ARTICLE AD BOX

The Aave community has voted to include PayPal’s PYUSD stablecoin in its Ethereum-based pool. The December proposal has reached a 99.9% quorum and is soliciting further feedback before being finalized later today.

The original proposer, Trident, said liquidity providers will add around 15 million PYUSD to the pool within the first two days of launch. Among the contributors to the pool will be the Paxos Trust, the issuer of the PYUSD stablecoin.

PYUSD Gets DeFi Boost After TradFi Flop

The new proposal follows the inclusion of PYUSD on the decentralized stablecoin application Curve. Trident is offering high-interest rates for PYUSD on Curve. This offering will fuel demand for PYUSD borrowing on Aave.

Read more: What Is a Stablecoin? A Beginner’s Guide

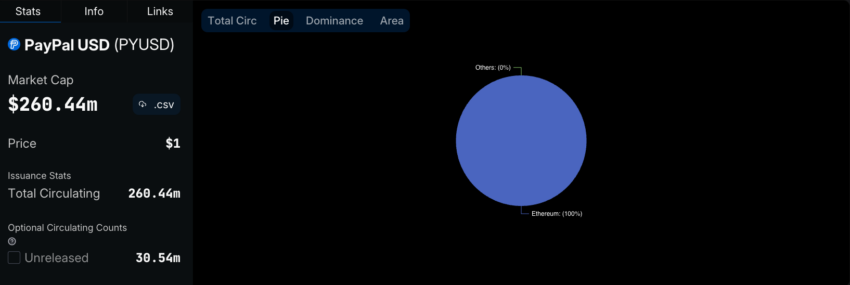

The move comes as PayPal’s stablecoin has struggled to keep up with older rivals. In September, PayPal tapped the exchange Crypto.com to boost PYUSD adoption after the stablecoin was ranked 61 in terms of overall market cap compared to rivals. PYUSD has a circulating supply of around 260 million, according to DeFiLlama.

Read more: 10 Platforms That Provide the Best Interest Rate on Stablecoins

PayPal’s PYUSD Circulating Supply | Source: DeFiLlama

PayPal’s PYUSD Circulating Supply | Source: DeFiLlamaPYUSD was deemed a bellwether of crypto’s mainstream acceptance when it dropped in August 2023. Amid an ongoing crypto bear market and high levels of regulatory hostility, it came out of nowhere to revive hope of crypto becoming mainstream. Former Binance US CEO Brian Brooks said the asset could help restore US dollar dominance as China and India considered moving away from the currency for trade.

PYUSD Needs Aave to Combat Lacklustre Debut

The environment of high US interest rates could also be a boon for adoption. The issuer of PYUSD’s rival USDC, Circle, has benefited much from interest rates that have boosted the value of the assets used to back its stablecoin. However, high-interest rates could bolster confidence that PYUSD users would be able to exchange their holdings for fiat at any time.

In decentralized finance, the Curve and Aave pools will add greater incentives for people to use the stablecoin. The coin’s higher liquidity on-chain could cause it to gain favor as a settlement layer. Already, EU laws have moved USDC issuer Circle and Societe Generale to launch euro-based stablecoins.

Furthermore, Solana also unveiled a team that will help make the financial rails in Brazil more efficient through a local stablecoin. Circle recently floated a cross-chain feature to transfer its USDC assets between blockchains seamlessly.

Do you have something to say about the Aave PYUSD proposal or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

The post Exploring the Impact of Aave’s PayPal Integration on Stablecoin Adoption appeared first on BeInCrypto.

.png)

10 months ago

4

10 months ago

4

English (US)

English (US)