ARTICLE AD BOX

- Filecoin’s Q4 2024 inflows surged 21% QoQ to $99M, reflecting increased investor confidence and a growing demand for FIL-backed loans.

- Prioritizing enterprise adoption, Filecoin’s storage capacity shrank 13% QoQ, while client growth rose 10%, driven by key partnerships.

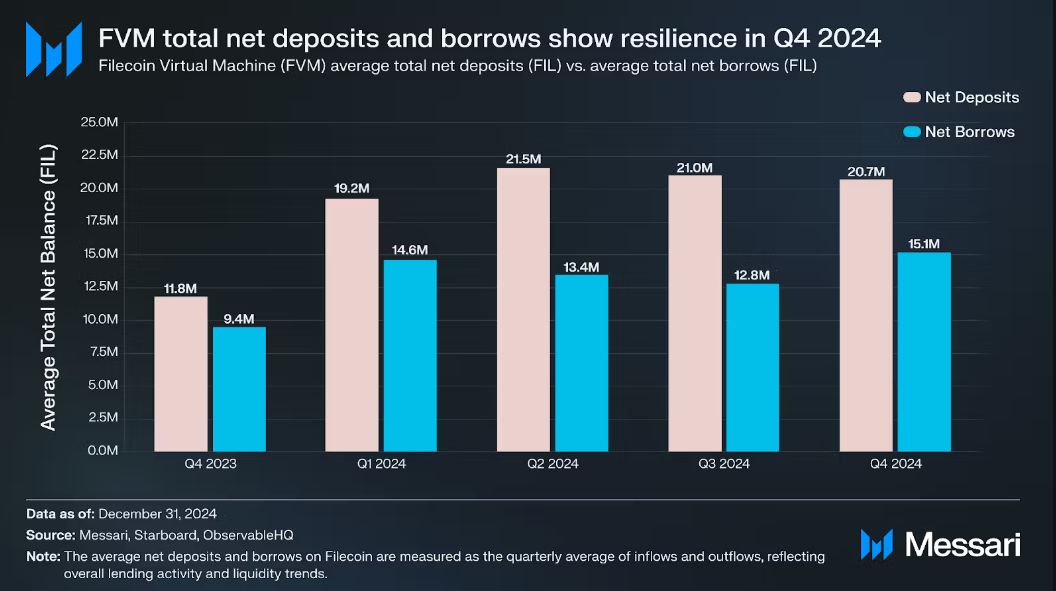

According to the “State of Filecoin Q4 2024” report by Messari, Filecoin recorded a $99 million inflow in Q4 2024, reflecting a 21% rise from Q3’s $82 million. A sharp increase in deposits indicates stronger investor confidence and greater demand for liquidity, likely driven by network incentives and a growing preference for FIL-backed loans. Meanwhile, outflows surged 50% quarter-over-quarter to $75 million from $50 million.

Source: Messari

Source: MessariCompared to Q4 2023, inflows skyrocketed 87% from $53 million, highlighting substantial expansion in Filecoin’s lending sector. Despite this growth, inflows remained below the Q1 2024 peak of $146 million. Outflows, which reached $43 million in Q4 2023, rose 73% year-over-year but remained lower than the Q1 2024 peak of $108 million.

FIL-denominated inflows of 21 million FIL and outflows of 15 million FIL remained steady, suggesting that price appreciation of 30% quarter-over-quarter influenced USD fluctuations more than shifts in lending activity. Filecoin’s circulating market capitalization expanded 36% quarter-over-quarter to $3.0 billion, with FIL’s price climbing to $4.9 from $3.8 in Q3 2024.

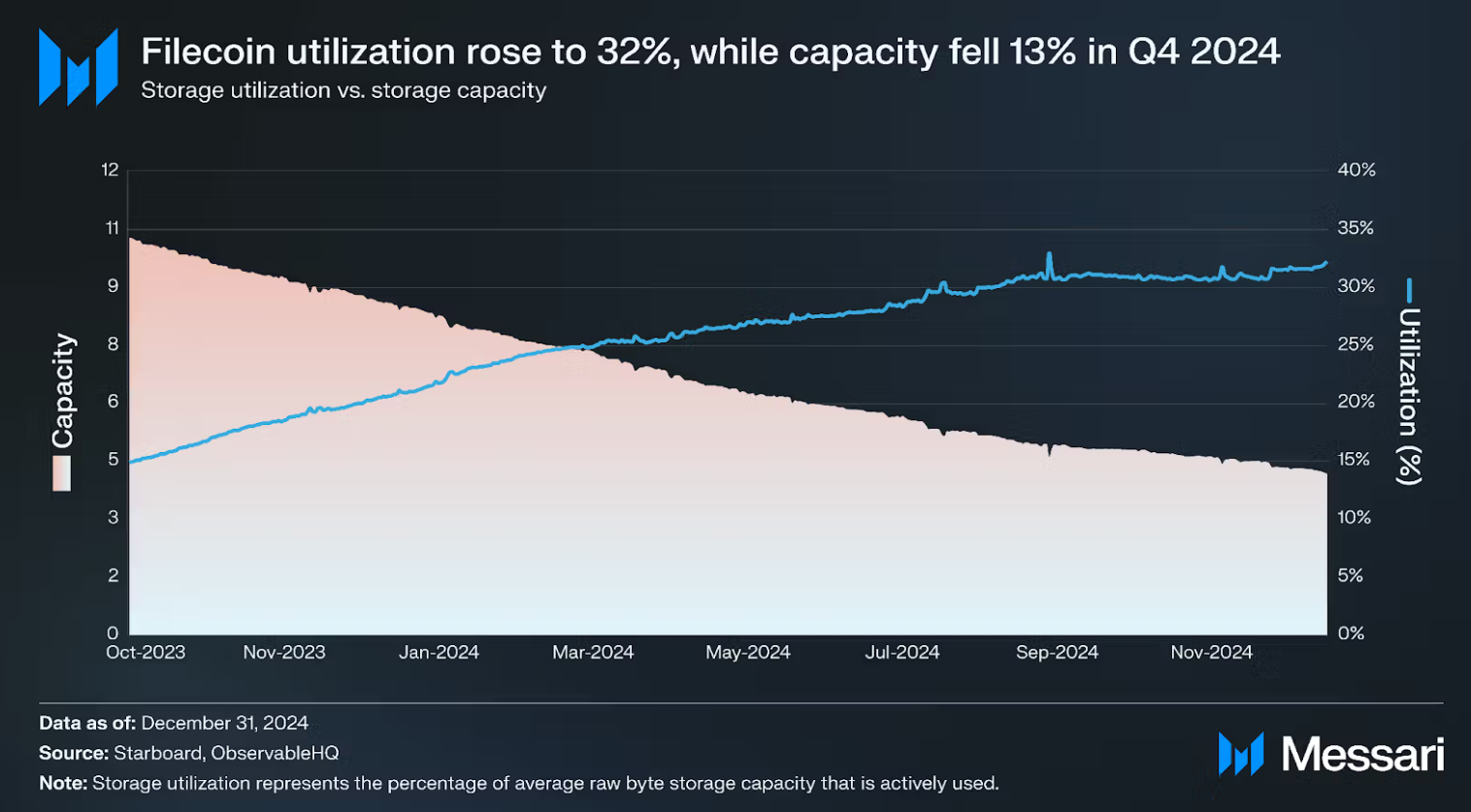

Filecoin’s Storage Shrinks by 13%—But That’s by Design

In a notable shift, Filecoin deprioritized sheer storage growth, favoring enterprise adoption and compliance-ready storage. Raw byte storage capacity fell 13% QoQ, declining from 4.8 EiB to 4.2 EiB, as Filecoin focused on onboarding high-value storage clients. Since Q3 2022’s peak of 17 EiB, changing economic incentives led smaller providers to exit, reducing active storage providers to 1,900 in Q4 2024, down from 4,100 in Q3 2022.

Source: Messari

Source: MessariDespite this, storage utilization improved, rising to 32% in Q4 2024 from 31% in Q3. The network’s strategic pivot prioritizes AI-driven storage, data privacy, and long-term archiving over raw volume, refining how incentives and deals are structured.

Filecoin now emphasizes enterprise storage integrations, partnering with DeStor, Seal, Aethir, and Filecoin Web Services to provide secure, scalable, and AI-ready storage solutions. These efforts ensure that the network remains competitive in the decentralized storage sector. In May 2024, Filecoin also launched Basin, which marks the world’s first data Layer 2 solution, as previously reported.

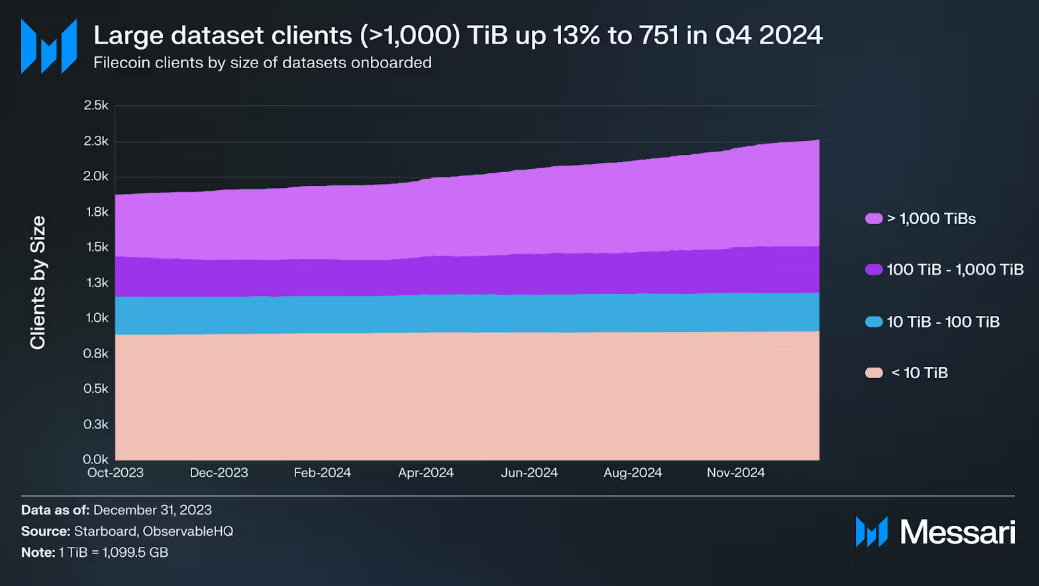

Filecoin’s Client Base Saw 10% Growth in Q4 2024

By the end of Q4 2024, Filecoin onboarded 2,263 clients, a 10% QoQ jump from 2,060 in Q3. Notably, 751 clients onboarded large datasets exceeding 1,000 TiB, signaling a growing need for enterprise-scale decentralized storage.

Source: Messari

Source: MessariThis growth was fueled by FIP-0092, introduced in Q3 2024 through the Waffle upgrade, which lowered entry barriers for new storage providers. The update implemented Non-Interactive Proof of Replication (NI-PoRep), improving proving efficiency, reducing computational costs, and making storage expansion more accessible.

Expanding enterprise partnerships also contributed to this rise. DeStor, a key Filecoin service provider, partnered with Qamcom DDS to enhance security and scalability. Clients such as YayPal (a Web3 gaming studio with over 500,000 users) and Fieldstream (an AI-driven marketing analytics firm) have been onboarded onto Filecoin’s ecosystem.

.png)

5 hours ago

2

5 hours ago

2

English (US)

English (US)