ARTICLE AD BOX

Franklin Templeton, a renowned asset management firm ventures into the world of spot Ethereum exchange-traded funds, joining the competition to offer Ethereum-based investment products to investors.

Staking Integration: A New Dimension in ETFs

In a notable move, Franklin Templeton expressed its intention to incorporate staking into its proposed Ether ETF, presenting shareholders with the opportunity to earn additional income. This innovative approach aligns with the evolving landscape of cryptocurrency investment strategies.

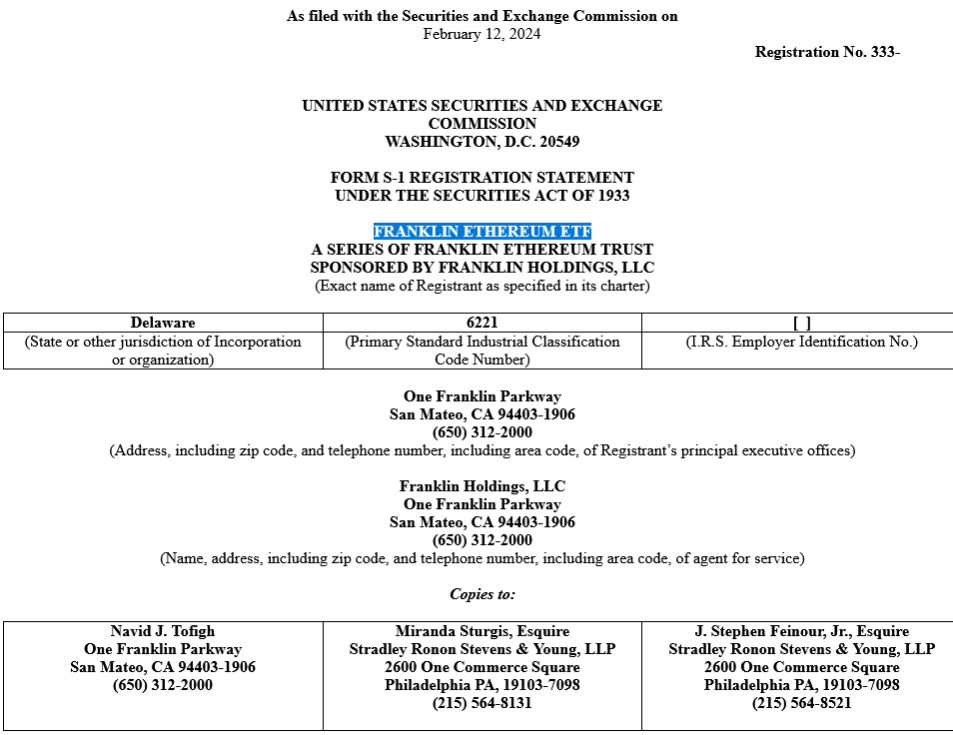

Franklin Templeton officially filed an S-1 application with the United States Securities Exchange Commission on February 12, signalling its ambition to introduce the “Franklin Ethereum ETF” on the Chicago Board Options Exchange, should regulatory approval be granted.

Source: SEC

Source: SECThe firm outlined plans to stake a portion of the ETF’s Ether holdings through trusted providers, potentially including its affiliates. This staking mechanism is designed to generate staking rewards, which would be treated as supplementary income for the trust.

Competitive Landscape and Regulatory Outlook

Franklin Templeton’s foray into the spot Ether ETF market intensifies the competition among industry giants seeking SEC approval for similar offerings. Competitors include BlackRock, VanEck, Fidelity, Invesco Galaxy, Grayscale, and Hashdex, all vying for a slice of the burgeoning Ethereum ETF market.

Here’s the most recent table of other filers that I have pic.twitter.com/xCRRMwK76r

— James Seyffart (@JSeyff) February 12, 2024

The SEC faces a series of deadlines for evaluating the pending applications, with decisions expected by specific dates throughout the year. Analysts predict that a comprehensive verdict on all applicants may be reached by May 23, drawing parallels to the regulatory process for spot Bitcoin ETFs earlier this year.

Also Read: Ethereum Could Hit $4K with Pending ETF Approval

Market Speculation and Investment Prospects

Despite the increasing interest in spot Ether ETFs, market analysts have tempered expectations regarding regulatory approval timelines. Bloomberg ETF analysts have adjusted the odds of approval downward, reflecting a degree of uncertainty surrounding the regulatory landscape.

Franklin Templeton’s venture into Ethereum ETFs follows its recent acknowledgement of the robust fundamentals underpinning blockchain networks like Ethereum and Solana. This positive sentiment suggests a potential expansion beyond Bitcoin-based investment products in the future.

We are excited about ETH and its ecosystem. Despite the midlife crisis it's recently experienced, we see a bright future with many strong tailwinds to push the Ethereum ecosystem forward

-EIP 4844

-Alt DA

-Community Revitalization

-Restaking

— Franklin Templeton (@FTI_US) January 17, 2024

As the race for spot Ether ETF approval heats up, investors await regulatory decisions that could shape the trajectory of cryptocurrency investment offerings in the United States.

.png)

9 months ago

6

9 months ago

6

English (US)

English (US)