ARTICLE AD BOX

The post From Ripple to Coinbase: Deaton’s Legal Insights into 2024’s Biggest Crypto Cases appeared first on Coinpedia Fintech News

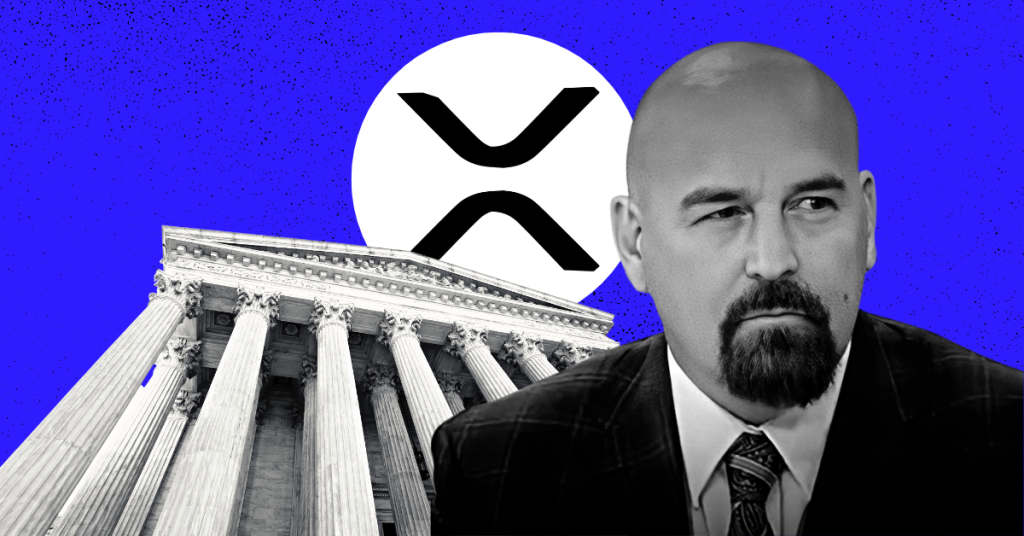

In a year-end interview with Fox journalist Eleanor Terrett, Deaton conveyed an intriguing perspective regarding Judge Analisa Torres’s potential approach to Ripple’s Settlement next year. He highlighted the likelihood of the judge not intending to penalize the company severely, especially considering the non-fraudulent sales made to institutional investors. This insight brings a nuanced view of the legal ramifications Ripple might face ahead.

In 2024, Deaton anticipated a decision on the suitable penalty Ripple might face for its XRP token sales to institutional investors. Notably, he emphasized the legality of these sales outside the U.S. and the role of On-Demand Liquidity (ODL) in potentially reducing Ripple’s potential disgorgement of $770 million, which may be settled on $20 Million.

But wait, there’s more coming up in 2024!

Deaton Take Charge of Coinbase Case

After supporting his 75000 XRP army to win the Ripple vs SEC case, John Deaton has hinted to favor Coinbase in their legal battle with the SEC. The winning lawyer in the ongoing lawsuit on SEC vs Coinbase appears to be grounded in his strategy to safeguard the interests of individual token holders. His anticipation of filing an amicus brief in the Coinbase lawsuit if the exchange loses its motion to dismiss reflects a stance that advocates for direct representation and protection of the rights of Coinbase customers and token holders.

Deaton’s inclination arises from his belief that the asset sales were executed through an intermediary, Coinbase, rather than directly by the issuer. This viewpoint leads him to anticipate a partial victory for Coinbase in the dismissal motion, emphasizing the intermediary’s pivotal role in these transactions.

Here’s the Twist!

The imminent possibility of an amicus brief in the Coinbase lawsuit adds an intriguing twist. Deaton intended to file this brief on behalf of Coinbase customers if the exchange’s motion to dismiss fails. He aims to advocate that individuals and token holders should have a say in their representation rather than solely relying on the U.S. SEC and Coinbase to protect their interests.

Moreover, Deaton’s prediction of a partial victory in the motion to dismiss centers on the argument that the asset sales occurred through an intermediary (exchange), not directly from the issuer. This aligns with Coinbase’s stance that the SEC’s references to older laws necessitate clearer guidance for crypto companies, an aspect the agency has yet to address following a rulemaking petition submitted on June 14, 2023.

.png)

1 year ago

4

1 year ago

4

English (US)

English (US)