ARTICLE AD BOX

- FTX CEO Sam Bankman-Fried filed a 102-page appeal requesting a new trial, claiming the judge overseeing his fraud and conspiracy case showed bias that compromised his defense.

- The appeal contends that FTX was not insolvent during its collapse but rather faced a liquidity crisis, with billions in illiquid assets with possible reimbursements to customers.

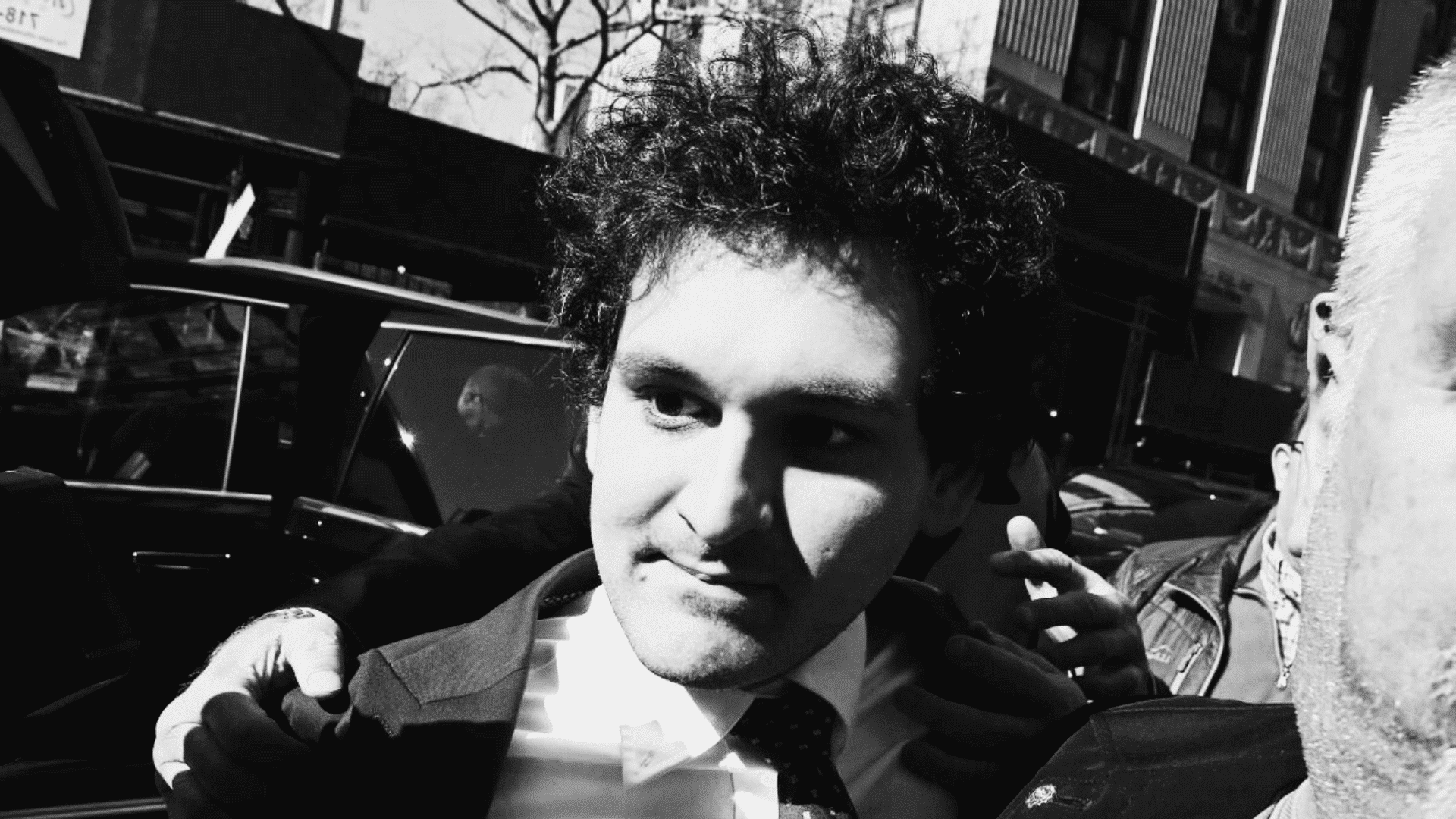

Sam Bankman-Fried (SBF), the former CEO of the collapsed FTX digital asset exchange, has filed an appeal. In the filing, he is requesting a new trial following his conviction for fraud and conspiracy in November 2023. Moreover, his legal team claims that Bankman-Fried did not receive a fair trial as the presiding judge, Lewis Kaplan, allegedly displayed bias throughout the proceedings.

Details of Sam Bankman-Fried’s Appeal

SBF’s attorneys filed a 102-page appeal filed in the United States Court of Appeals for the Second Circuit on September 13. The attorneys, namely, Alexandra A.E. Sapiro, Theodore Sampsell-Jones, and Jason A. Driscoll argued that their client was “presumed guilty before he was even charged.”

The filing further emphasized, “He was presumed guilty by the media, by the FTX debtor estate and its lawyers, by federal prosecutors eager for quick headlines, and by the judge who presided over his trial.”

Bankman-Fried’s defense team specifically accused Judge Kaplan of making inappropriate comments during the trial that undermined the defense’s case in front of the jury. According to the filing, the judge’s behavior was biased and damaging. In addition, Kaplan was allegedly seen “deriding” Bankman-Fried’s testimony and making “biting comments” that harmed the defense’s credibility.

At the heart of the appeal, the legal team argued that FTX was not insolvent at the time of its collapse in November 2022. Instead, they claimed that the exchange faced a liquidity crisis. Also, the appeal highlighted that SBF had billions of dollars in assets tied up in illiquid investments that could have been used to reimburse customers, per reported Crypto News Flash.

These investments included a $500 million stake in the artificial intelligence company Anthropic and a massive investment in Solana. The defense maintained that Bankman-Fried’s investments were not “risky or stupid.” They also argued, “He had not lost or stolen all the money.”

Crucial Evidence Embargo

The appeal further emphasized that the court didn’t permit Sam Bankman-Fried to present crucial evidence during the trial that could have rebutted the prosecution’s narrative. “All this could have been proven at trial if the judge had allowed the defense evidence,” the filing stated.

According to his attorneys, the prosecution’s case was “objectively false.” However, they were unable to counter it via evidence due to restrictions placed by Judge Kaplan. In addition, the appeal also targeted the relationship between the U.S. Department of Justice (DOJ) and the legal counsel for FTX bankruptcy estate.

The defense alleged that the FTX estate’s lawyers acted as “an arm of the prosecution.” Moreover, they allegedly provided information to federal authorities in a way that went beyond standard cooperation, per the CNF report.

Hence, Bankman-Fried’s legal team is seeking a new trial with a different judge to counter the FTX founder’s 25-year prison sentence. “Over and over, Judge Kaplan expressed a firm belief in Bankman-Fried’s guilt,” they wrote. This bias, they argued, created an uneven playing field that unfairly favored the government’s case.

.png)

2 months ago

6

2 months ago

6

English (US)

English (US)