ARTICLE AD BOX

- Solana price drops below $160 amid market concerns over the FTX unlocking event, increasing supply risks.

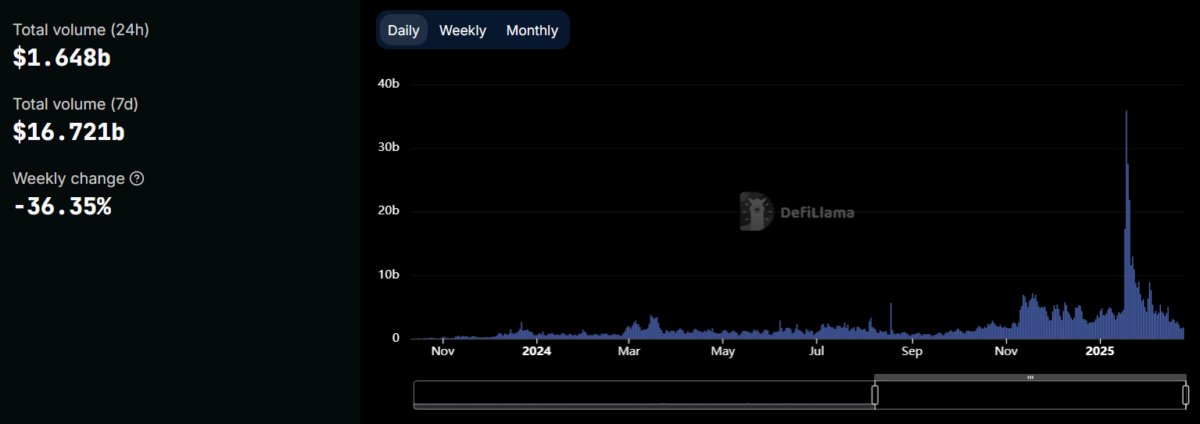

- Weekly decentralized exchange (DEX) volume on Solana fell by 36.35%, reflecting broader market cooling.

Solana has taken a sharp fall, slipping under the $160 mark as market jitters intensify over the upcoming FTX unlocking event. With 11.2 million SOL—worth about $1.77 billion—set for release on March 1, traders fear increased supply could drive further losses.

On February 24, Solana hit a low of $158, marking a steep 6.55% drop for the day. This level had not been breached since October 20, 2024, when the token closed at $159. Despite minor fluctuations, Solana has failed to reclaim $160, hovering around $158.50 at press time.

Market data shows Solana has slumped nearly 14.60% in the past week and over 36.60% in the past month. The downward trend signals continued pressure on the token as uncertainty looms. Solana’s market cap now stands at $77.84 billion, while its fully diluted valuation has shrunk to $94.29 billion.

Solana Faces Potential Downward Pressure on FTX Token Unlocks

The anticipated release of millions of SOL tokens has raised alarms in the market. Historically, large token unlocks tend to flood supply, weighing down prices. If demand does not match the incoming volume, Solana could face another downward spiral.

Despite this, some investors see an opportunity. A price dip could allow for strategic accumulation, particularly if demand holds steady or rebounds. However, the scale of the FTX unlocks means traders remain on edge, bracing for heightened volatility.

Solana’s decentralized exchange (DEX) volume has also suffered a significant blow. Data from DeFiLlama reveals that weekly DEX volume has declined by 36.35%, currently standing at $16.72 billion. The daily volume remains at $1.64 billion, reflecting a broader cooldown in market activity.

Source: DeFiLlama

Source: DeFiLlamaDerivatives Market Sees Heavy Put Option Activity

A notable trend in Solana’s derivatives market suggests major investors are hedging against further losses. According to Amberdata, Solana block trades on Deribit accounted for nearly 25% of all SOL options activity last week, totaling $32.39 million out of a broader $130.74 million market.

Nearly 80% of these transactions were concentrated in put contracts, indicating that large investors expect more downside. Put options allow traders to sell at a predetermined price, offering a layer of protection against sharp declines. Instead of executing market sell orders, whales appear to be positioning themselves defensively through these contracts.

Typically, during steep price drops, institutional players prefer over-the-counter (OTC) put options rather than direct exchange orders. This approach minimizes immediate price disruption while ensuring downside protection. The increasing put volume suggests a cautious market, with traders preparing for further instability.

Solana has also witnessed significant capital outflows, adding to the overall bearish sentiment, according to CoinGlass. On February 24, net outflows reached $63.94 million, indicating intense selling pressure. This continues a broader trend observed in recent months, where capital movements have swung between positive and negative flows.

Source: CoinGlass

Source: CoinGlassDecember saw multiple days of net outflows exceeding $100 million, underscoring the token’s struggle to maintain bullish momentum. Solana’s price currently sits well below its November highs of over $270, with recent inflows failing to counteract selling pressure.

.png)

2 hours ago

1

2 hours ago

1

English (US)

English (US)