ARTICLE AD BOX

Landesbank Baden-Württemberg (LBBW), Germany’s largest federal bank, plans to offer cryptocurrency custody services.

This initiative, developed in partnership with the Bitpanda exchange, highlights the traditional banking industry’s increasing acceptance of digital assets. With about €333 billion (~$355 billion) in assets, LBBW’s entry into the crypto custody market is a landmark event.

Why German Banks Are Jumping Into Crypto Bandwagon

Starting in the second half of 2024, LBBW and Bitpanda aim to provide these services to their institutional and corporate clients. The announcement follows a rising demand for digital assets among such clients, as noted by Jürgen Harengel, managing director of corporate banking at LBBW.

“The demand from our corporate customers for digital assets is increasing,” Harengel said.

Moreover, this venture is part of a broader trend within the German financial ecosystem. Banks and asset managers across the country are actively developing custodial services and creating proprietary products for the crypto market.

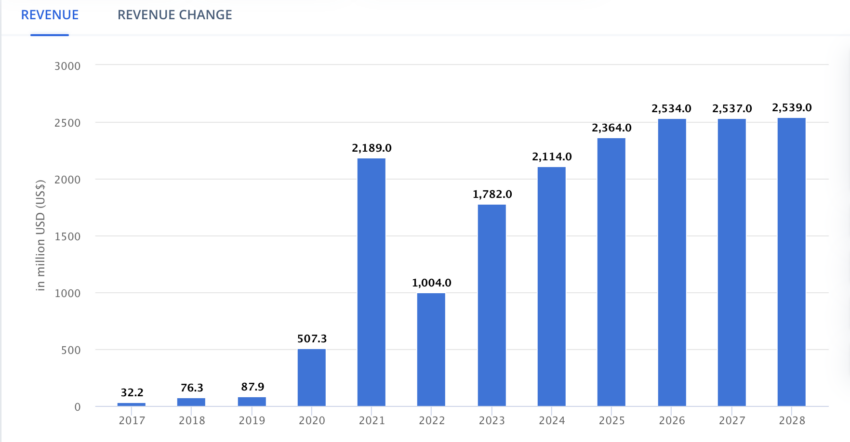

These efforts are largely in response to the forthcoming European Union’s crypto regulations, which are expected to bring clarity and stability to the handling of digital assets. Moreover, crypto revenue in Germany is expected to hit $2.5 billion by 2028.

Read more: What Is Markets in Crypto-Assets (MiCA)?

Germany Crypto Revenue. Source: Statista

Germany Crypto Revenue. Source: StatistaDeutsche Bank is also progressing in this domain with its digital-asset custody service. Additionally, its DWS unit is part of a consortium pioneering a euro-denominated stablecoin. Such initiatives reflect a widespread movement among financial institutions to integrate cryptocurrencies into their service offerings.

The commitment to crypto is also evident at Crypto Finance, a subsidiary of Deutsche Borse. Crypto Finance has secured four essential licenses from the German Federal Financial Supervisory Authority (BaFin).

These licenses enable Crypto Finance to provide comprehensive crypto trading, settlement, and custody services to institutional investors within Germany. Furthermore, regulatory approval in Switzerland has further bolstered Crypto Finance’s position in the European crypto market.

On another front, Commerzbank AG has received approval from BaFin to establish a crypto custody business. This approval illustrates BaFin’s support for well-established financial institutions exploring digital assets, provided they secure the requisite licenses.

Read more: TradFi Explained: Exploring Key Elements of Traditional Finance

Beyond Germany, global efforts to embrace cryptocurrencies continue to gain momentum. The Bank for International Settlements (BIS) and seven central banks have launched Project Agorá. This project seeks to integrate tokenized commercial and central bank funds on a single ledger platform. Consequently, it aims to address the inefficiencies plaguing cross-border payments and to enhance financial integrity controls.

The post German Banking Giant LBBW Jumps on the Crypto Bandwagon: Eyes Institutional Demand appeared first on BeInCrypto.

.png)

7 months ago

1

7 months ago

1

English (US)

English (US)