ARTICLE AD BOX

The German government has drastically reduced its Bitcoin holdings, shedding significant amounts of the cryptocurrency in recent weeks. The country’s Bitcoin reserves have plummeted to just 9,094 BTC, a mere 18% of the original 49,857 BTC they held at the beginning of the sell-off.

Rapid Reduction in Bitcoin Holdings

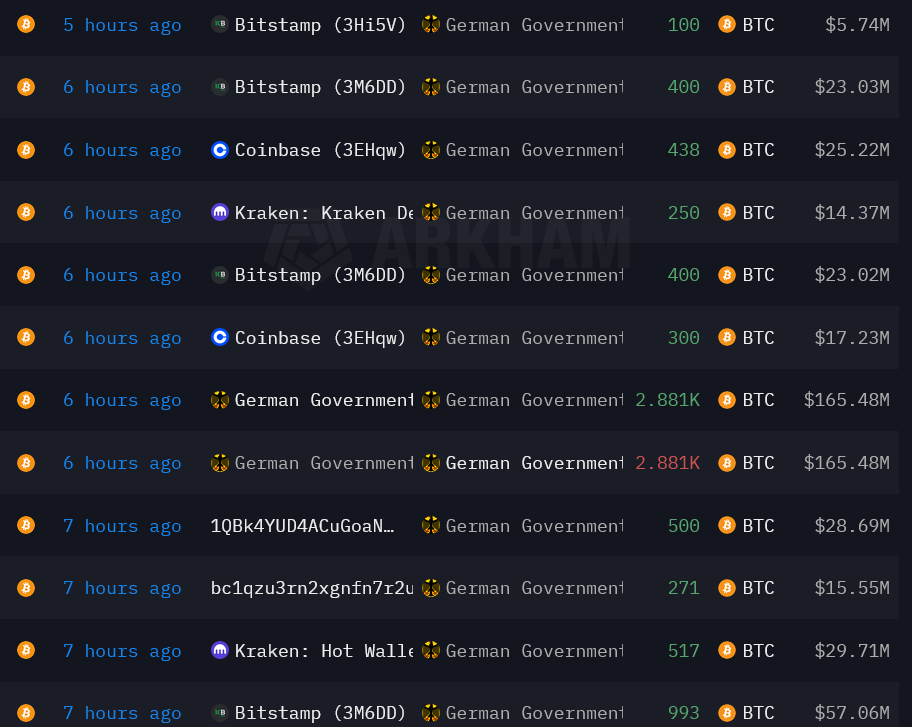

Germany’s Bitcoin wallet, initially filled with Bitcoin seized from a crackdown on the film piracy website Movie2k in January, has seen extensive activity since mid-June. On July 11, the wallet experienced a dramatic decrease, momentarily dipping below 5,000 BTC. This drop followed a massive transfer of 10,620 BTC, worth approximately $615 million, to various cryptocurrency exchanges including Coinbase, Bitstamp, Kraken, and Flow Traders, as well as two unidentified addresses.

Source: Arkham

Source: ArkhamBack-and-Forth Transfers

Shortly after the substantial transfer out, some of the Bitcoin was moved back into the government wallet, bringing the total holdings back up to over 9,000 BTC. The fluctuation has sparked curiosity and concern within the cryptocurrency community. Blockchain intelligence firm Arkham has suggested that the unidentified addresses may belong to institutional deposit or over-the-counter trading service providers, although this has not been confirmed.

Criticism and Market Impact

The aggressive sell-off strategy has faced criticism from various quarters. Joana Cotar, a German lawmaker and Bitcoin advocate, has argued that Bitcoin could have been used as a strategic reserve currency to mitigate risks associated with the traditional financial system. Her sentiments echo a broader frustration within the crypto community, as reflected by an inscription sent to the government’s wallet address stating, “Taxes are robbery.”

Also Read: German MP Urges Government to Halt Bitcoin Sales Amid Economic Uncertainty

The market has not remained untouched by these developments. The sell-off, coupled with fears that Mt. Gox may start distributing over $8 billion in Bitcoin to creditors, has contributed to a noticeable slump in Bitcoin’s price. The Crypto Fear & Greed Index has plunged into the “Extreme Fear” zone for the first time since January of the previous year, indicating heightened anxiety among investors.

Bitcoin’s price currently stands at $56,870, reflecting a 1.8% drop in the last 24 hours and a significant 15.1% decline over the past month.

.png)

4 months ago

1

4 months ago

1

English (US)

English (US)