ARTICLE AD BOX

The post Gold Price Hit All-Time High of $3,300 While Bitcoin Price Drops to $83K appeared first on Coinpedia Fintech News

According To Google Finance Today, gold has surged past the crucial $3,300 all-time high, marking a significant milestone in its ongoing rally. The sharp upward movement has energized investors, especially gold enthusiasts.

Notably, outspoken gold advocate Peter Schiff has seized this moment to question the future of Bitcoin. He has even urged investors to sell all their Bitcoin holdings, fueling speculation about whether Bitcoin could be in serious trouble.

Bitcoin Price Struggles While Gold Price Hit ATH

At the beginning of this month, the price of gold was $3,114.040. Though on the second day of the month, it grew to $3,132.63 from $3,144.040, between April 3 and April 7, the price slipped from $3,131.085 to $2,980.780. The correction coincided with the global market uncertainty created by the implementation of an aggressive tariff policy by US President Donald Trump and its subsequent 90-day pause offered to non-retaliating countries.

On April 8, the market witnessed a tough fight between buyers and sellers, creating a long-legged Doji candlestick pattern on the daily chart of gold.

The trend shifted on April 9. Since then, the market has steadily climbed. Between April 9 and 11 alone, the market surged by over 8.52%.

Currently, the gold market looks bullish. At the start of today, the gold price was $3,230.255. At present, it sits at $3,296.745. The trend indicates that the market will witness a bullish rally today.

Meanwhile, the Bitcoin price has dropped below the market of $83,380. In the last 24 hours alone, the BTC market has declined by over 2.6%.

Right now, the price of BTC sits at least 5.87% below the peak of the month, and over 23.53% below its all-time high of $109K.

In the first quarter of this year, the Bitcoin market recorded a drop of no fewer than 11.7% – in the previous year, during the same quarter, the market reported a rise of 68.7%.

Peter Schiff’s Bold Call: Ditch Bitcoin, Buy Gold Mining Stocks

Acclaimed gold advocate Peter Schiff, known for his skepticism against the future of Bitcoin, has advised investors to sell all their Bitcoin holdings.

Unsurprisingly, he has recommended investors to buy gold mining stocks.

According to Yahoo Finance companies, engaged in gold exploration, mining, processing, extraction, and smelting, have experienced an average surge of 16.69% in the last 30 days. The sector’s YTD return stands at +47.16%. The one-year return of the sector is +60.29%, and the 3-year return and 5-year return are +26.77% and +73.77%, respectively.

The YTD change of Newmont Corporation sits at +46.64%, AngloGold Ashanti plc at +89.90%, Royal Gold Inc at 40.31%, Coeur Mining Inc at +6.64%, Seabridge Gold Inc at +9.20%, Caledonia Mining Corporation Plc at +44%, and Idaho Strategic Resources Inc at +78.41%.

Schiff Mocks MicroStrategy and Saylor’s Bitcoin Bet

In December 2024, at a time when Bitcoin was in its best moment, Strategy co-founder Michael J Saylor advised top US tech companies, including Microsoft, to adopt its aggressive BTC accumulation strategy.

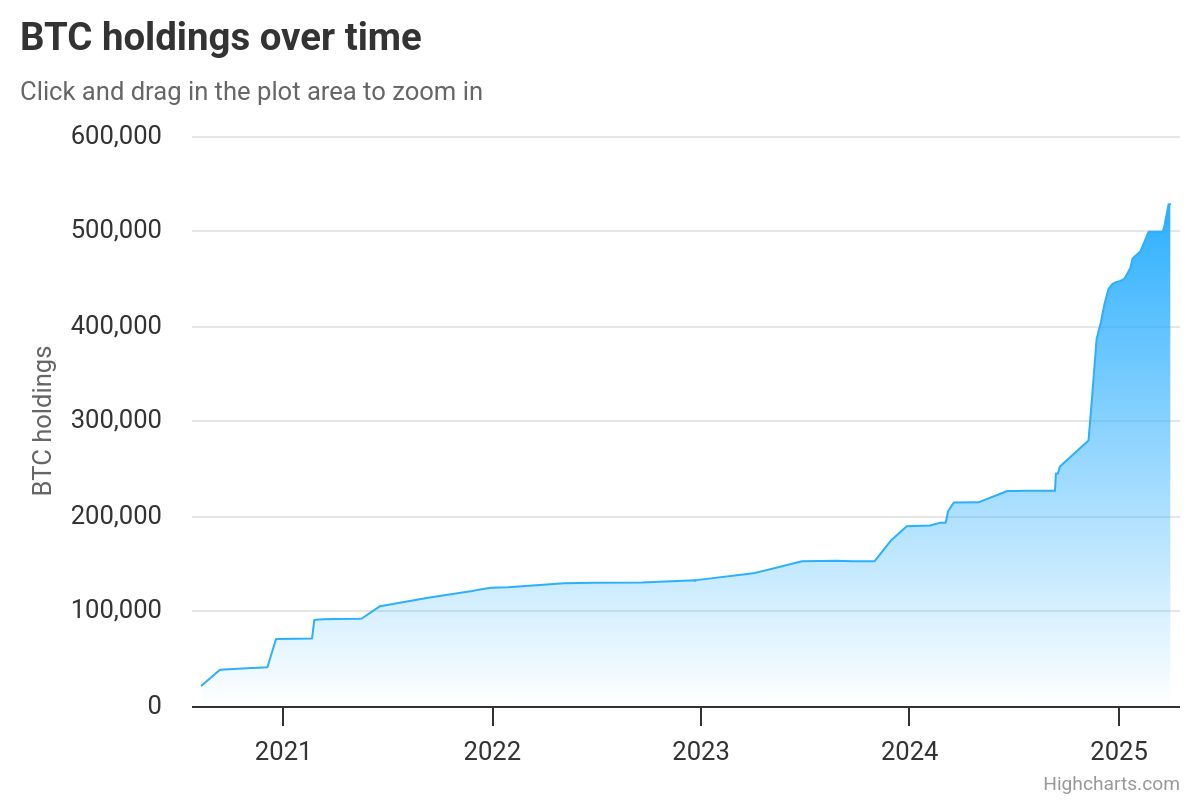

Strategy, with 528,185 BTC tokens worth $44,050,903,656, is the public company, which owns the highest number of BTC tokens.

Schiff has denounced Strategy’s BTC accumulation strategy.

Earlier, Schiff even predicted that BTC could drop as low as $10,000.

Strategy Outperforms Tech Stocks in 2025

Renowned crypto analyst Eric Balchunas recently highlighted that Strategy has significantly outperformed U.S. tech stocks in 2025.

Over the past year, Strategy’s stock has surged by 147.78%, with a year-to-date (YTD) growth of 7.29%. In the last 30 days alone, it has climbed 5.59%.In contrast, according to data from Yahoo Finance, the broader U.S. tech sector has gained just 6.82% over the past year and recorded a YTD decline of -14.56%.

.png)

1 day ago

3

1 day ago

3

English (US)

English (US)