ARTICLE AD BOX

The post Grayscale CEO Calls for SEC to Greenlight Listed Options for Spot Bitcoin ETF appeared first on Coinpedia Fintech News

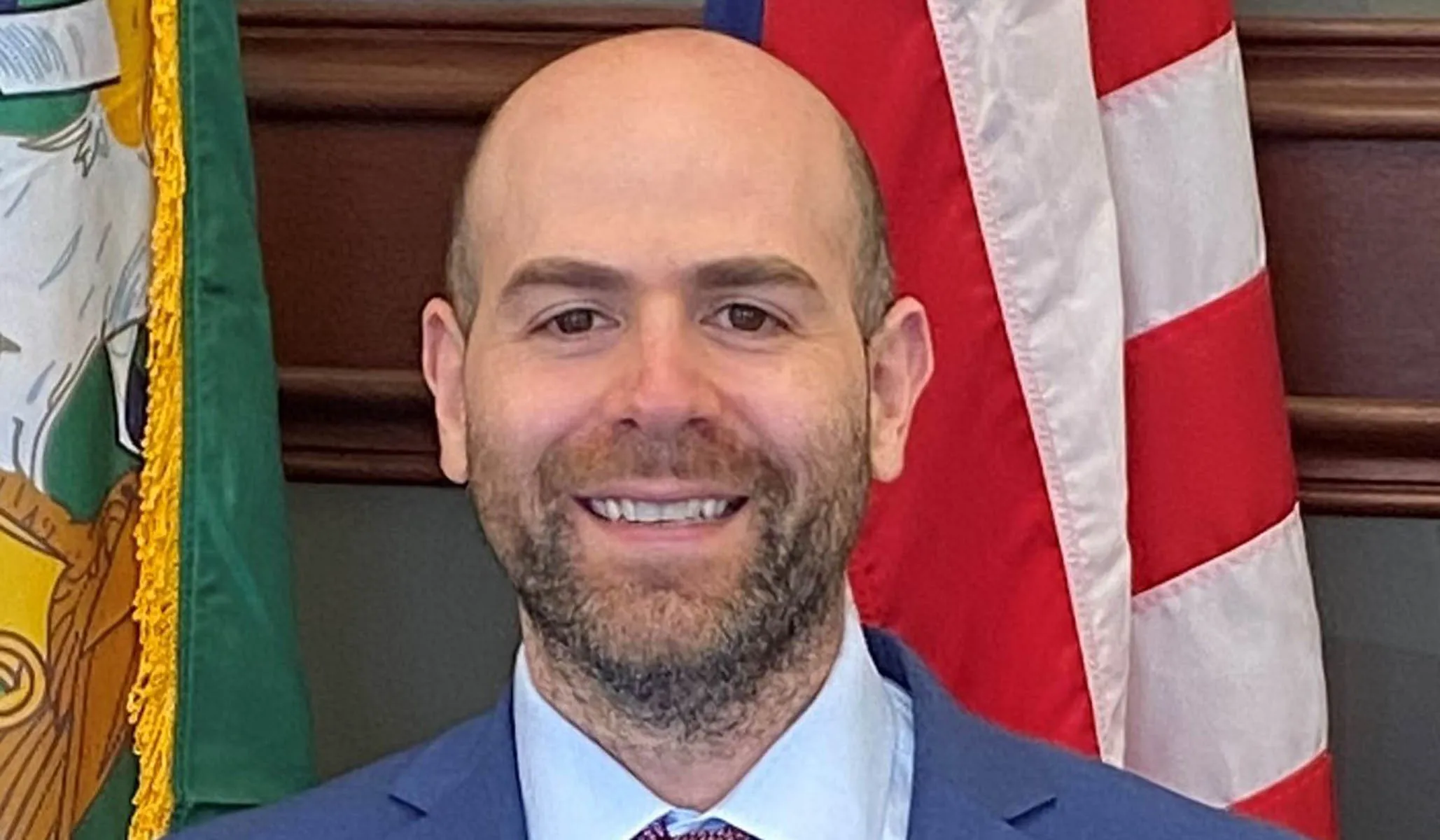

Grayscale’s CEO, Michael Sonnenshein, is leading the charge for regulators to approve options tied to spot Bitcoin exchange-traded funds (ETFs). In his recent X post he said that these options would greatly benefit investors by providing them with additional tools to understand market dynamics, discover fair prices, and deal with complexities and invest more effectively.

Excited to know about the why the bulls are calling for Options after ETF’s, Let’s delve in.

Grayscale CEO Urges SEC for Equal Treatment for Range of Crypto Assets

However, Options, as Sonnenshein explains, are financial contracts that give investors the right, but not the obligation, to buy or sell a specified amount of an asset at a predetermined price within a specified time frame. They are an important aspect of financial markets, allowing investors to manage risk, hedge positions, and potentially generate income.

Option trading is well-established in traditional financial markets and regulated by the CFTC and SEC, although it is not yet commonly available for spot Bitcoin ETFs. Sonnenshein believes this gap must be bridged for market fairness.

He further pointed out that while futures-based ETFs had options accessible almost immediately following SEC approval, commodity-based ETFs like spot Bitcoin ETFs did not. This regulatory disparity highlights the need for clear standards and equitable opportunity for diverse ETFs.

SEC’s is Closer to Decide on Options

Hence, to allow options trading on commodity-based ETFs, including spot Bitcoin ETFs, national exchanges are actively seeking regulatory amendments. The submission of Forms 19b-4 is part of these initiatives to increase investment options and bitcoin innovation.

As the SEC reviews proposals for options on spot Bitcoin ETFs and may consider BlackRock’s proposal with Cboe. Overall, Sonnenshein remains optimistic about the potential impact of these products. He believes that options would not only improve the market and liquidity but also make investing in Bitcoin more accessible and understandable for naive investors. Bloomberg’s Eric Balchunas thinks the SEC might decide by Feb. 15 or by September 2024.

In the meanwhile, GBTC dominated the spot Bitcoin ETF market with a trading volume of $338 million, led by Sonnenshein. BlackRock is closely trailing behind, intensifying the competition in the cut-throat trillion dolar industry.

What you think will be the options future after failed ETFs, will it help them revive the lost momentum?

.png)

10 months ago

1

10 months ago

1

English (US)

English (US)