ARTICLE AD BOX

The world’s largest crypto asset manager is not done selling shares of its Grayscale Bitcoin Trust (GBTC) and the underlying asset. This follows weeks of outflows in the wake of the launch of competing spot Bitcoin exchange-traded funds.

Grayscale’s GBTC selling has slowed down, much to the joy of industry observers and Bitcoin advocates, but there are more outflows on the horizon.

Grayscale GBTC Exodus

On February 13, Swan senior analyst Sam Callahan reminded industry observers that another bankruptcy estate is planning to sell billions of dollars worth of GBTC soon.

FTX has sold almost $1 billion in GBTC shares since it was converted into an ETF in January. This has taken the embattled crypto company’s Grayscale stake down to zero.

However, there is more to come from bankrupt crypto lender Genesis. The firm recently asked the courts to approve the sale of around 36 million shares of GBTC worth roughly $1.5 billion.

Moreover, 4.7 million of these shares were obtained from the defunct crypto hedge fund Three Arrows Capital.

The remaining 31 million GBTC shares Genesis wants to sell were used as collateral for the Gemini Earn program, said Callahan, citing court documents.

Gemini Earn was the program that resulted in the SEC charging both Genesis and Gemini for allegedly offering and selling unregistered securities in early 2023.

Read more: What Is a Bitcoin ETF?

That may not be the end of the Grayscale selloff, however.

“There are also an additional 31 million GBTC shares worth $1.3 billion that could be sold soon.”

Moreover, Grayscale parent company, DCG, agreed to send these shares to Gemini. It noted that this was “for the benefit of Gemini lenders” around the time FTX collapsed. Genesis won the dispute over ownership of these shares, meaning that it could be sold soon to repay creditors.

In total, Genesis could be selling as many as 67 million shares of GBTC worth nearly $3 billion soon. However, Genesis creditors will be paid in BTC, which reduces the direct selling pressure.

“Expect the GBTC outflows to increase again when this happens, but remember, this is a one-time selling event.”

Latest on Bitcoin ETF Flows

Grayscale selling slowed down towards the end of last week. However, the selloff has ramped up again.

According to Farside, the firm saw an outflow of $95 million on February 12 and $72.8 million on February 13. The company has now liquidated $6.5 billion worth of Bitcoin since its spot ETF conversion.

Nevertheless, BlackRock and Fidelity are still buying way more than Grayscale is selling. On February 13, there was a whopping net inflow of $631 million despite the GBTC outflows.

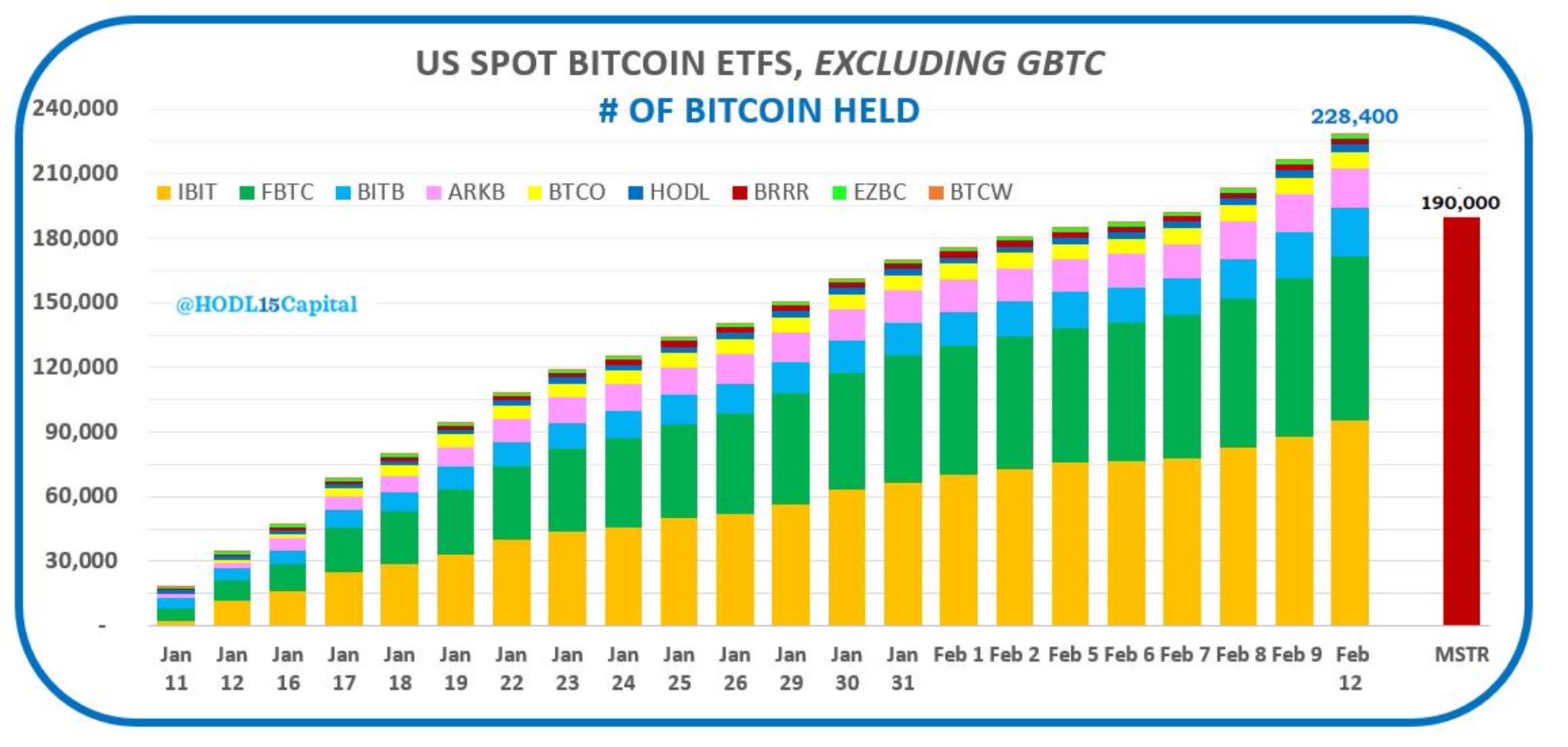

Spot ETF BTC holdings, excluding Grayscale. Source: X/@HODL15Capital

Spot ETF BTC holdings, excluding Grayscale. Source: X/@HODL15CapitalWith Genesis creditors being paid in BTC and new ETF funds absorbing way more coins than are being mined every day, the Grayscale selloff isn’t as bad as it sounds.

The post Grayscale’s GBTC Liquidation: More Than Meets the Eye appeared first on BeInCrypto.

.png)

9 months ago

7

9 months ago

7

English (US)

English (US)