ARTICLE AD BOX

Cryptocurrency hackers have seized the opportunity presented by the recent market downturn to acquire Ethereum at a steep discount. This strategy involves leveraging stolen funds from past cybercrimes to make substantial investments in digital assets.

Hackers Exploit Ethereum’s Market Decline

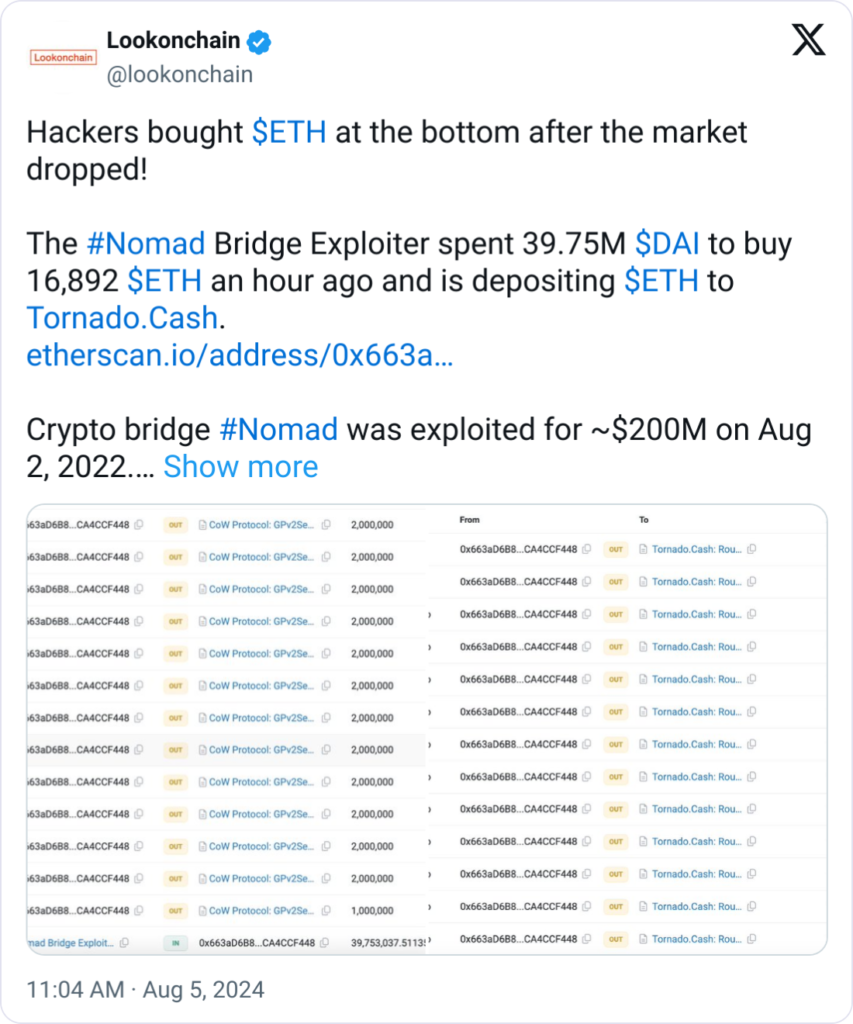

On August 5, hackers used funds stolen from the 2022 Nomad bridge hack to purchase 16,892 ETH. The transaction occurred during a significant drop in Ethereum’s value, which plummeted from approximately $2,760 to $2,172 in less than 12 hours. This dramatic decline in value provided an opportune moment for these illicit actors to buy Ethereum at a discounted price.

Source: TradingView

Source: TradingViewStolen Funds Routed Through Crypto Mixer

According to blockchain analytics firm Lookonchain, the Nomad bridge hacker utilized 39.75 million DAI, a stablecoin, to acquire the 16,892 ETH. Following the purchase, the stolen funds were routed through Tornado Cash, a crypto mixer used to obscure the trail of on-chain transactions. This process helps the hackers avoid detection and makes it difficult for authorities to trace the stolen assets.

Source: Look On Chain

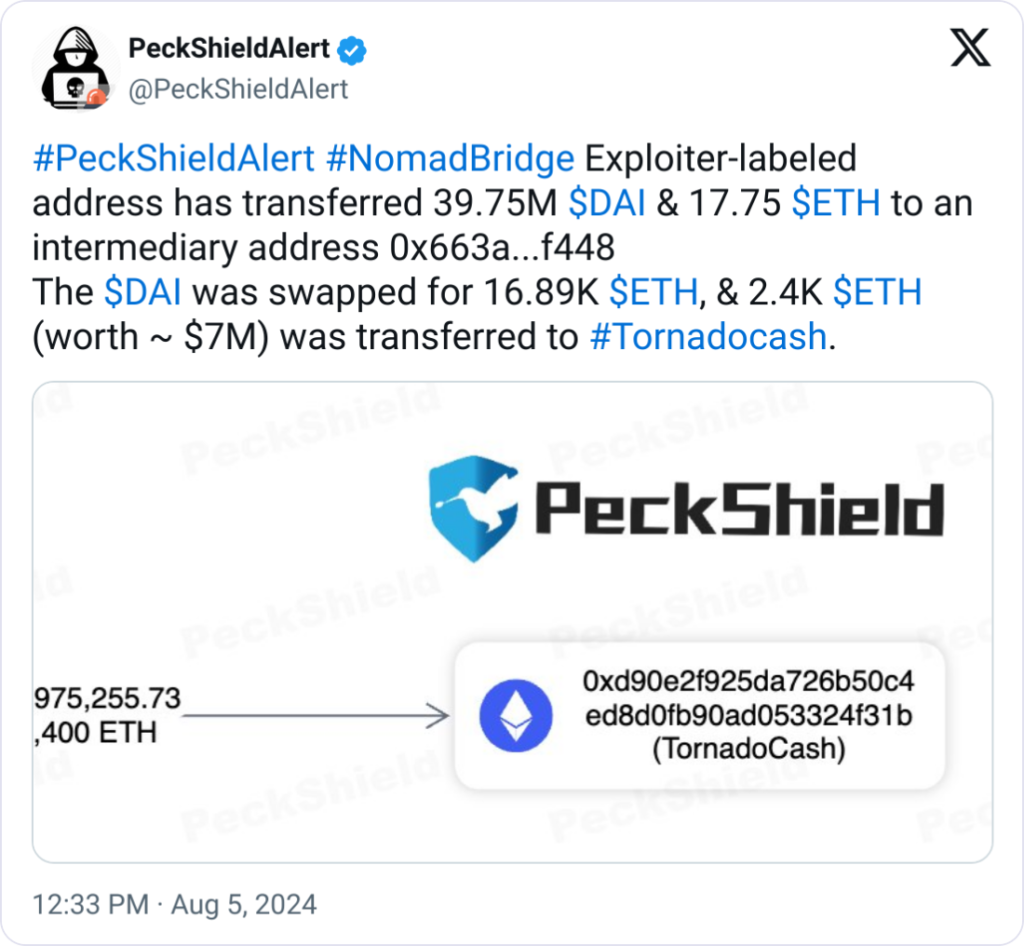

Source: Look On ChainBlockchain investigation firm PeckShield corroborates these findings, noting that the hacker also transferred 17.75 ETH to an intermediary Ethereum address and has since moved approximately 2,400 ETH (worth $7 million) to Tornado Cash. This method of fund movement is typical of hackers seeking to launder their stolen assets.

Source: PeckShield

Source: PeckShieldAdditional Hacks and Market Manipulation

The current market uncertainty has also prompted other hackers to move stolen funds. For instance, the hacker involved in the Pancake Bunny exploit from three years ago has also been active. This individual exchanged stolen DAI tokens for ETH, although a portion of the transaction was mistakenly sent to an unsupported address.

Pancake Bunny, a decentralized finance protocol on the BNB Smart Chain, suffered a flash loan attack in 2021. The hacker involved in this incident recently used Tornado Cash to siphon $2.9 million worth of Ether.

.png)

3 months ago

4

3 months ago

4

English (US)

English (US)