ARTICLE AD BOX

- Hedera (HBAR) has been tipped for a massive surge as Open Interest (OI) rises by $144 million to reach $344 million.

- Analysts believe that this expected run could be triggered by the potential spot HBAR ETF approval in 2025.

Hedera (HBAR) has remained stagnant for multiple weeks now after declining from its yearly high of $0.38 to $0.29. However, the asset appears to be rebounding as it surged by 13.6% in the last seven days and 1.9% in the last 24 hours, pushing its price to $0.31. This underscores the high level of optimism amidst the recent period of consolidation.

[mcrypto id=”435433″]Delving into the market metrics, we observed that the Open Interest (OI) of HBAR has increased by $144 million in the last seven days. Fascinatingly, this brings the total OI to $344 million. From this data, it can be concluded that traders are returning to active engagement. Meanwhile, the surge in OI is also supported by the positive funding rate. According to the data, most of the futures positions are long, confirming the growing confidence.

Source: Coinglass

Source: Coinglass

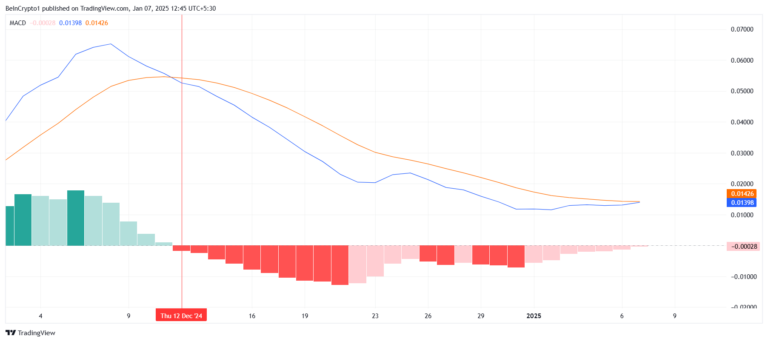

Taking a further look at the Moving Average Convergence Divergence (MACD), we observed that the bearish phase has likely ended as the line nears the crossover with the signal line. Per our analyst interpretation, this indicates a possible bullish run.

Source: TradingView

Source: TradingView

Meanwhile, HBAR has, over the last month, traded in a consolidation phase between $0.33 and $0.25. Fortunately, the above-featured metric shows a possible breakout from this range. A successful move could see HBAR securing the $0.39 and proceeding to the 2024 high of $0.40. Beyond this range, HBAR could hit $5, as we earlier reported. Currently, the next immediate support is found at $0.33.

The Potential HBAR ETF Approval and the Price

Analysts have argued that an explosive run for HBAR largely depends on the potential approval of its spot Exchange Traded Fund (ETF). In November, asset management firm Canary Capital filed the first-ever ETF based on HBAR to provide direct exposure to investors. According to Bloomberg analysts Eric Balchunas and James Seyffart, the US Securities and Exchange Commission (SEC) could approve multiple ETFs this year.

Elaborating on the potential launch, the analysts pointed out that Solana and XRP ETFs could be delayed as they are currently involved in an ongoing legal battle regarding their securities status. As we earlier highlighted in a CNF report, Seyffart believes that the Solana and the XRP ETFs could be put on hold until the new administration commences work. However, he expects Litecoin and HBAR ETFs to get approval in a short time.

According to him, Litecoin was forked from Bitcoin, making it a commodity. HBAR has also been excluded from multiple lists of cryptos classified as securities by the SEC. Meanwhile, only a few issuers have filed for HBAR ETF, raising concerns about the investors’ demand around it.

In addition to the ETF sentiment, the recent launch of Hedera Hashgraph via Elon Musk’s SpaceX, as discussed by CNF, is expected to be another tailwind for the price appreciation.

.png)

3 months ago

9

3 months ago

9

English (US)

English (US)