ARTICLE AD BOX

Buying a home with family or friends becoming mainstream, according to a Zolo survey.

— Zolo 2024 Canada Housing Market Report

TORONTO, ONTARIO, CANADA, April 12, 2024 /EINPresswire.com/ — High inflation and interest rates have made buying a home more expensive, but North Americans aren’t letting high costs deter them from their homeownership dreams. Homebuyers are finding new ways to enter the housing market—whether by shopping around for the best rates, boosting down payments with money from relatives, or buying with friends or family.

A new report from Zolo highlights how dramatically home buying trends have changed in the last four years. Zolo asked 800 people who bought homes in 2023 about their buying experiences. The results, outlined in the 2024 Canada Housing Market Report, found:

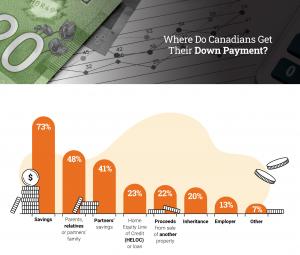

– 68% of respondents used money from family or an inheritance to boost their down payment

– 35% of respondents bought a home with family or friends

– 38% of buyers used a mortgage broker, making these professionals the fourth most-used real estate experts

35% of Homebuyers Bought Property With Family or Friends

North Americans are finding creative ways to afford a home, including purchasing with family or friends. The report found that 35% bought a home with a family member or friends versus the 38% that purchased a home as part of a couple.

By pursuing co-ownership, homebuyers can pool resources and enter markets they otherwise may not be able to afford.

Over a Third of Homebuyers Used a Mortgage Broker

Mortgage Brokers are currently the fourth most used real estate professionals, with 38% of homebuyers using these experts in real estate transactions. Mortgage brokers can help homebuyers secure the lowest possible interest rate and help those self-employed secure a mortgage. Saving even a few tenths of a percentage point on a mortgage rate can lead to a more affordable monthly payment and significant savings over the life of the mortgage.

Mortgage expert and author Angela Calla agrees, “Consumers are increasingly recognizing that banks may not always have their best interests at heart. Unlike banks, mortgage professionals are dedicated to providing unbiased advice and empowering clients with a range of options tailored to their individual needs and financial goals.”

About Zolo

Zolo is one of Canada’s most popular national real estate marketplaces. Each month, over 10 million home shoppers use Zolo to level up the way they buy, sell, rent, finance and learn about real estate.

Press Contact

Jordann Kaye, Content Marketing Manager and Spokesperson, jordann.kaye@zolo.ca

Ph: 902-401-0610

Jordann Kaye

Zolo

+1 902-401-0610

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Instagram

YouTube

TikTok

![]()

The content is by EIN Presswire. Headlines of Today Media is not responsible for the content provided or any links related to this content. Headlines of Today Media is not responsible for the correctness, topicality or the quality of the content.

The post Homebuyers Get Creative to Enter Real Estate Market Despite High Interest Rates appeared first on Headlines of Today.

.png)

1 year ago

4

1 year ago

4

,

,

English (US)

English (US)