ARTICLE AD BOX

Spot crypto exchange-traded funds have recently debuted on the Hong Kong stock market, offering a potential avenue for mainland Chinese investors in the future.

Industry Optimism for Mainland Chinese Investment

Fund issuers and experts foresee the new ETFs as a catalyst for mainland Chinese participation in cryptocurrency investment.

Spot crypto exchange-traded funds (ETFs) have emerged on the Hong Kong stock market, signalling a significant development in the realm of cryptocurrency investment. Industry leaders and experts believe that this move could pave the way for a future influx of mainland Chinese investors into the crypto space.

Speaking to Bloomberg TV, Yimei Li, CEO of China Asset Management, expressed optimism about the potential of Hong Kong’s new crypto ETFs to attract mainland Chinese investors. Li highlighted that the launch of spot Bitcoin and Ethereum ETFs represents an opportunity for RMB holders to explore alternative investment avenues.

The debut of these ETFs on April 30 by three major issuers, including China Asset Management, Harvest Global Investments, and Bosera Asset Management, marks a crucial step in expanding crypto investment options in the region. However, it’s important to note that currently, these ETFs are accessible only to residents of Hong Kong.

Regulatory Oversight and Market Expansion

Regulators are closely monitoring the development of Hong Kong’s new ETFs, with an eye on managing potential risks while gradually opening up the market. Industry leaders like Harvest Global CEO Han Tongli emphasize the importance of regulatory comfort with the associated risks for further market expansion.

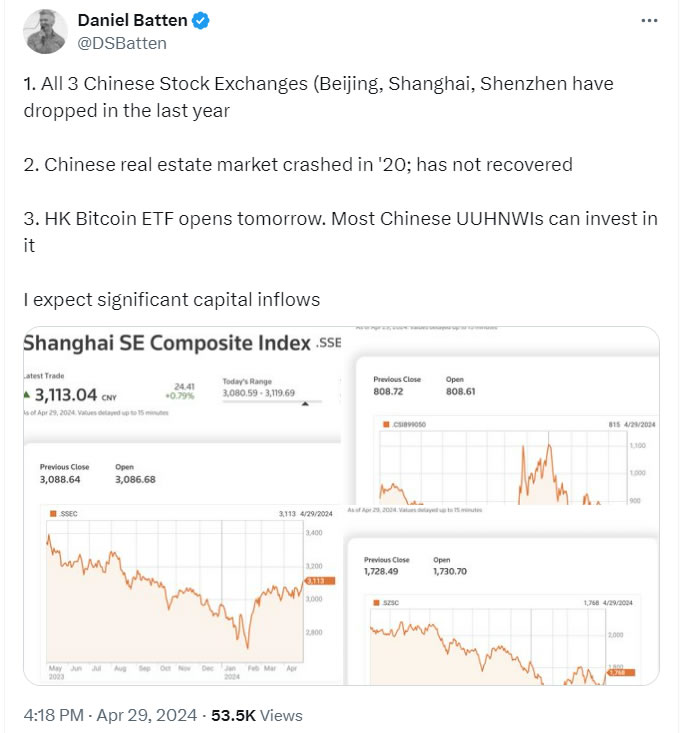

Potential for Market Growth and Capital Inflows

Industry insiders and cryptocurrency pioneers foresee significant growth potential for Hong Kong’s crypto ETFs. Samson Mow, CEO of Jan3 and a prominent figure in the Bitcoin community believes that the long-term implications of these ETFs are substantial, especially considering the limited investment options for Chinese investors at present.

While mainland Chinese investors are currently restricted from investing in these ETFs, there is optimism among fund issuers and investors that regulatory changes could facilitate mainland capital inflows in the future. Despite the current limitations, the introduction of crypto ETFs in Hong Kong represents a significant step towards broader market accessibility and potential expansion into mainland China.

.png)

6 months ago

2

6 months ago

2

English (US)

English (US)