ARTICLE AD BOX

The Hong Kong Monetary Authority (HKMA) recently issued a new critical circular regarding crypto custody platforms. This directive, aimed at authorized institutions (AIs), encapsulates a comprehensive framework for providing custodial services for digital assets.

Consequently, as the crypto sector catches its stride in Hong Kong, interest in digital asset trading and custodial service platforms has reached new heights.

Hong Kong Circular Targets Crypto Custody

The HKMA’s circular is a pivotal step towards ensuring robust protection and proficient management of client digital assets, establishing a set of standards and guidelines that AIs are mandated to follow.

Key to this new directive is the requirement for AIs to conduct thorough risk assessments and formulate policies and controls to mitigate risks associated with digital asset custody.

The circular stresses the importance of maintaining distinct governance structures, operational arrangements, and effective risk management practices. A critical aspect of these guidelines is the segregation of client digital assets from the AI’s own assets, providing a safeguard in the event of insolvency.

“To ensure that such client digital assets held by AIs in custody are adequately safeguarded and that the risks involved are properly managed, the HKMA considers it necessary to provide guidance on AIs’ provision of digital asset custodial services,” the circular notes.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

This move towards enhanced security is further bolstered by the HKMA’s insistence on AIs adopting industry best practices and international security standards, particularly in managing and safeguarding seeds and private keys of digital assets.

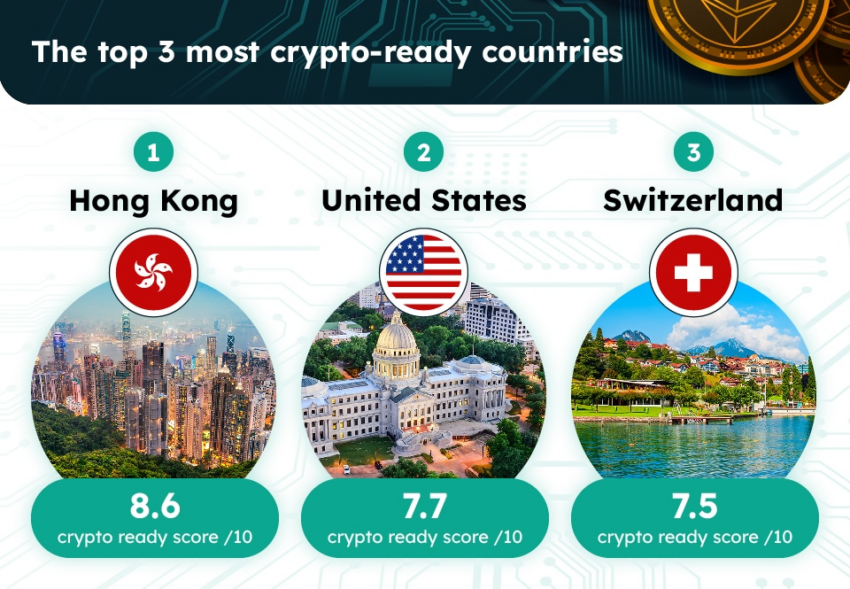

Top 3 most crypto-ready countries. Source: Forex Suggest

Top 3 most crypto-ready countries. Source: Forex SuggestIn parallel, the Securities and Futures Commission (SFC) has been proactive in shaping the regulatory environment for virtual asset trading platforms (VATPs) in Hong Kong. By February 29, all crypto exchanges operating within Hong Kong’s jurisdiction must obtain or apply for a VATP license.

This development is crucial in establishing a regulated and secure environment for virtual asset investors. The SFC’s directive underscores the necessity of trading through licensed exchanges and highlights the risks associated with unlicensed platforms. This could potentially lead to account closures if investors fail to comply by the set deadlines.

Vying for Crypto Hub Status

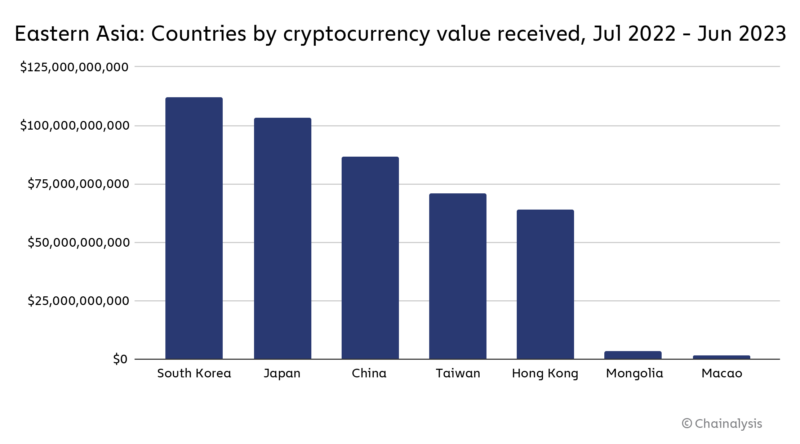

Hong Kong’s crypto market is not just thriving in a regulated environment; it’s also booming in terms of transaction volume. The region transacted an estimated $64.0 billion in crypto received between July 2022 and June 2023. The active over-the-counter (OTC) market significantly drives this market activity.

East Asian countries by crypto value received July 2022 – June 2023. Source: Chainalysis

East Asian countries by crypto value received July 2022 – June 2023. Source: ChainalysisSpecifically, these OTC desks are instrumental in facilitating large transactions for institutional investors and high-net-worth individuals, thereby playing a crucial role in the city’s crypto economy.

These regulatory strides by the HKMA and SFC represent Hong Kong’s commitment to creating a balanced ecosystem. They aim to foster innovation while ensuring stringent investor protection.

Ultimately, these developments position Hong Kong as a digital asset hub, impacting traders and aligning with global security standards.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.

The post Hong Kong Revises Crypto Custody Rules: Impact on Traders & Compliance? appeared first on BeInCrypto.

.png)

8 months ago

2

8 months ago

2

English (US)

English (US)