ARTICLE AD BOX

Hong Kong is swiftly advancing towards regulating stablecoins, drawing considerable attention from global investment powerhouses. The Hong Kong Monetary Authority (HKMA) is preparing to launch a stablecoin regulatory sandbox in the first quarter of this year, a decision that has piqued the interest of significant players in finance, including the international arm of Harvest Fund.

The sandbox initiative, a brainchild of HKMA and the Financial Services and the Treasury Bureau, signifies a major step in the city’s efforts to regulate the stablecoin market.

Hong Kong’s Big Stablecoin Push

This comes amid the sector’s growing size and influence, with stablecoins like Tether’s USDT and Circle’s USDC leading the market.

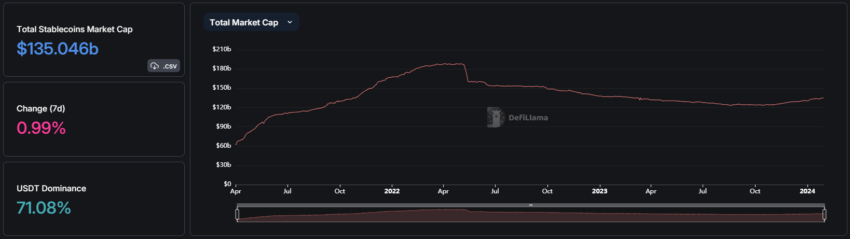

Stablecoins are often pegged 1-1 to fiat currencies and backed by cash or bond reserves. They comprise a substantial part of the $1.7 trillion digital asset market. The stablecoin market cap is currently over $135 billion across all chains.

Stablecoin market cap. Source: DeFiLlama

Stablecoin market cap. Source: DeFiLlamaThis regulatory push follows in the footsteps of jurisdictions such as the European Union, Japan, Singapore, and Dubai. All of these are currently striving to become digital asset hubs. The proposed rules would require licenses for marketing stablecoin products to retail investors. This would ensure a higher degree of consumer protection and market transparency.

Harvest Global Investments, fintech specialist RD Technologies, and Venture Smart Financial Holdings. are among the entities engaging in discussions with the HKMA. These talks are centered around the planned stablecoin trials. They reflect the keen interest of global financial players in the regulatory frameworks being developed in Hong Kong.

Read more: What Is a Stablecoin? A Beginner’s Guide

Challenges With Developing Stablecoin Regulations

Despite the potential challenges, such as compliance costs, this regulatory framework is seen as a significant step towards mitigating risks associated with digital assets. Christopher Hui, the Secretary for Financial Services and the Treasury, commented:

“With the implementation of the licensing regime for VA trading platforms from June this year, the legislative proposal to regulate FRS is another important measure facilitating Web3 ecosystem development in Hong Kong.”

The history of stablecoins, marked by instances of chaotic crashes and criticisms over reserve opacity, underscores the need for such regulations.

The initiative is not just about risk management; it’s also about innovation. Hong Kong’s approach to digital asset regulation aims to protect investors while fostering an environment conducive to financial innovation.

The sandbox model will offer a controlled setting for testing new products and services. This can provide valuable insights for both regulators and participants.

Overall, Hong Kong’s proactive and forward-thinking stance on stablecoin regulation is setting a new benchmark in digital finance. This move, expected to boost investor confidence and market stability, positions the city as a potential leader in the global race to regulate digital assets.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.

The post Hong Kong’s Race to Regulate Stablecoins Attracts Global Investment Heavyweights appeared first on BeInCrypto.

.png)

9 months ago

1

9 months ago

1

English (US)

English (US)