ARTICLE AD BOX

Cashback reward programs have long been a staple in consumer loyalty strategies, offering incentives like coupons, air miles, and cashback in fiat currency. With the rise of digital currencies, cryptocurrency rewards are now capturing the attention of savvy consumers looking to earn in their favourite digital assets.

Traditional cashback programs typically involve users signing up for credit or debit cards, and earning points or cash based on their spending, which can then be used for discounts or other benefits. Similarly, cryptocurrency cashback programs offer rewards in digital currencies, targeting a niche audience familiar with and comfortable using crypto.

Popular Crypto Cashback Offerings: From Giants to Startups

From established financial giants to innovative fintech startups, many companies are now offering cryptocurrency cashback rewards. These programs often feature generous rewards to attract users and increase adoption.

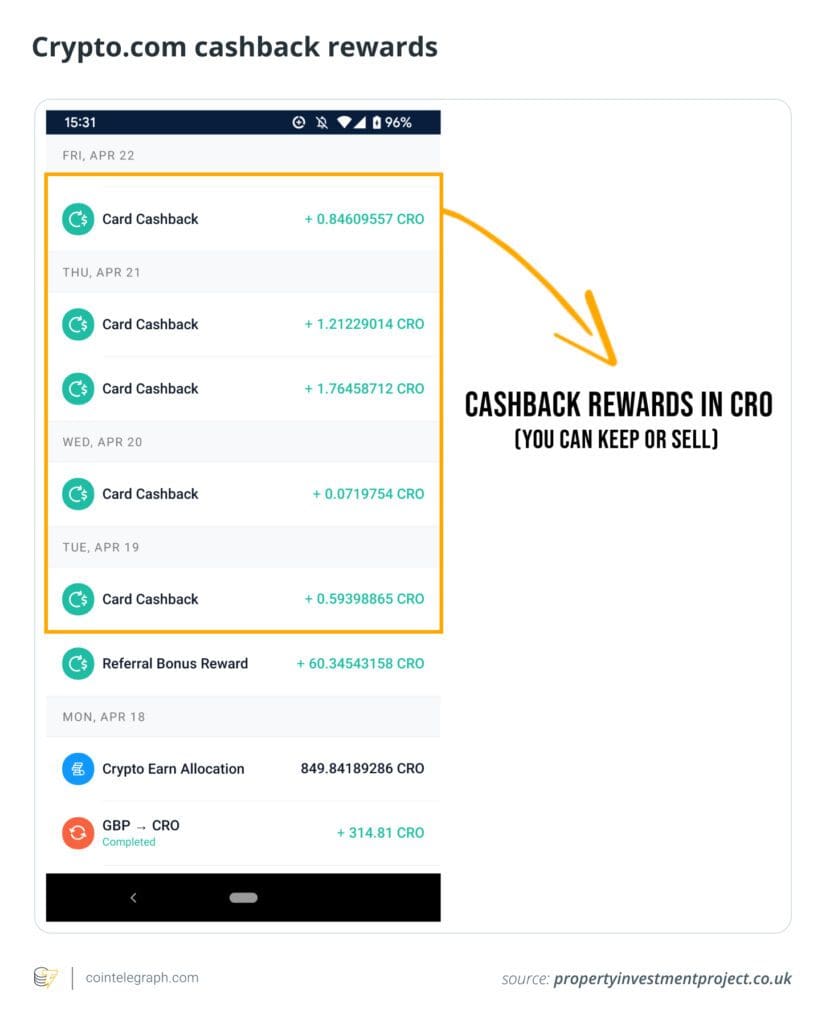

For example, Venmo, owned by PayPal, offers a credit card that converts cashback rewards into cryptocurrency. Paystand, focused on business-to-business payments, provides corporate expense cards that reward users in crypto. Crypto.com, Gemini, Coinbase, and Wirex also offer cards with cashback features, each with unique reward structures and requirements.

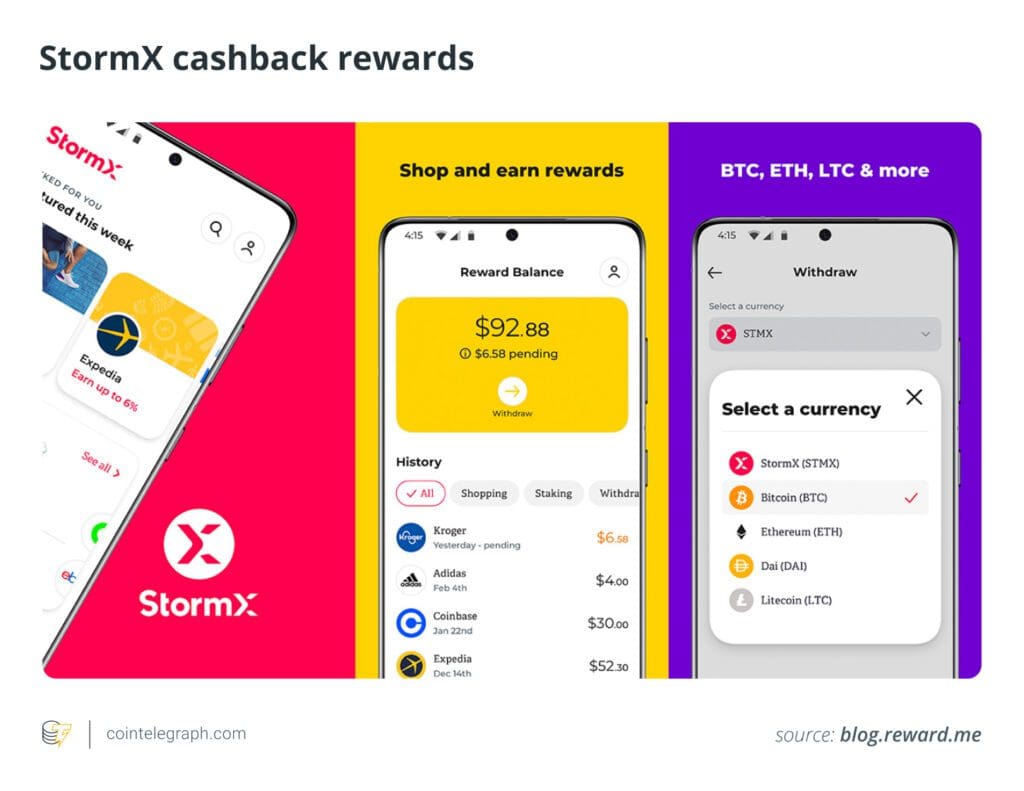

Crypto cashback sites and apps, such as StormX and CoinCorner, allow users to earn crypto rewards for shopping at various retailers. These platforms cover a wide range of categories, from lifestyle and fitness to travel and electronics, providing diverse earning opportunities.

Offbeat Cryptocurrency Rewards Programs: Moving Beyond Shopping

In addition to traditional shopping rewards, some niche programs offer crypto rewards for activities like fitness and gaming. Move-to-earn platforms, such as StepN and Sweatcoin, reward users with cryptocurrencies for physical activities like walking and running, tracked via dedicated apps.

Play-to-earn (P2E) games like Axie Infinity allow players to earn cryptocurrency rewards by engaging in online gaming. These programs provide unique opportunities for users to earn crypto while pursuing their hobbies and interests.

Tax Implications of Crypto Cashback Rewards: What You Need to Know

Earning cryptocurrency rewards brings various financial and tax reporting considerations. Users must be aware of the tax implications and ensure compliance with their jurisdiction’s tax laws.

Crypto rewards are generally considered taxable income, and any increase in value over time may incur capital gains tax when the cryptocurrency is sold or exchanged. The volatility of cryptocurrency adds complexity to tax calculations, as users are taxed based on the reward’s value at receipt, even if the value decreases later.

Accurate record-keeping is essential for tracking cashback rewards and transactions to facilitate proper tax reporting and compliance. Users should stay informed about changes in tax laws and seek professional advice to navigate the complexities of crypto taxation.

Also Read: Tax-Saving Tips for Expats: Strategies to Keep More of Your Money

Considerations Before Opting for Crypto Cashback Rewards

While cryptocurrency cashback rewards can be appealing, users must weigh the benefits against the potential costs and complexities. Tax compliance, conversion costs, and wallet security are critical factors to consider.

Users should assess the tax implications, ensure they can convert crypto rewards to fiat currency affordably, and implement robust security measures to protect their digital assets.

.png)

4 months ago

2

4 months ago

2

English (US)

English (US)