ARTICLE AD BOX

- Litecoin shows strong potential for a $150 breakout, backed by increased open interest and bullish trader sentiment.

- Enhanced on-chain activity and growing futures data indicate rising institutional and whale interest in Litecoin.

Litecoin (LTC) continues to show signs of revival as the crypto market try to turns green. In an X post, well-known crypto analyst World of Charts has published his analysis indicating that the altcoin has breakout from its range on short time frame. He stated:

“Seems like Litecoin finally getting ready for 150$ one more time.”

Source: World of Charts on X

Source: World of Charts on XDerivatives Market Shows Increased Activity for Litecoin Futures

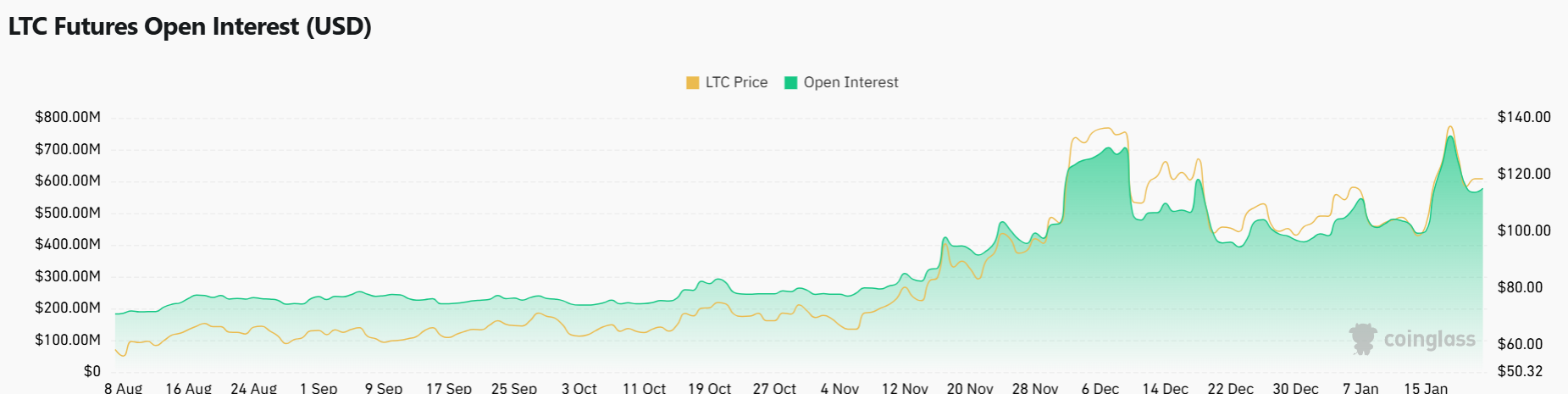

Data from CoinGlass indicates from a derivatives market standpoint that Open Interest (OI) for LTC futures has increased significantly starting in August 2024. Since November 2024, this spike has grown more noticeable and LTC OI rises by 1.64% over the last 24 hours, coming to $574.66 million.

Source: CoinGlass

Source: CoinGlassOn the Binance exchange, the LTC/USDT pair has a long/short ratio of 3,095, suggesting that most traders are speculating on more high price movement.

The trading volume of Litecoin also captures the market’s antusiast. With an LTC transaction volume of $440.83 million, Binance emerged as the platform with the highest volume in last 24 hours, followed by OKEx with $172.27 million and Bybit with $147.98 million.

Meanwhile, LTC at the time of writing this post was swapped hands at about $116.68, with a 13.62% increase over the last 7 days.

[mcrypto id=”435419″]Whale Activity and ETF Prospects Boost Market Confidence

Rising whale activity was mostly responsible for this surge, as on-chain data shows a 7% rise in significant Litecoin daily transaction volume.

Furthermore, most LTC holders are in a profitable state right now, so honing the coin’s bullish momentum. One of the main reasons Litecoin might pass the psychological level of $150.

The possibility of Litecoin ETF approval in the United States is another element encouraging favorable opinion of the cryptocurrency. As we previously reported, Senior ETF analyst Eric Balchunas of Bloomberg said that Litecoin spot ETF has a significant likelihood of receiving the next clearance in the US market.

Based on its performance over 2024, Litecoin’s network activity has increased noticeably. Up from 366,000 in 2023, the daily average of active addresses came up at 401,000. Furthermore, from 66.95 million in 2023 to 92.76 million in 2024, the yearly transaction volume grew 38.55%.

.png)

2 hours ago

4

2 hours ago

4

English (US)

English (US)