ARTICLE AD BOX

With spot Bitcoin exchange-traded funds dominating crypto narratives and market sentiment at the moment, Ethereum is getting left behind. However, those narratives could soon switch to the world’s second-largest digital asset if BTC funds are approved.

Crypto markets have surged to a 21-month high of $1.8 trillion total capitalization driven by spot Bitcoin ETF hype. Bitcoin is leading them as expected, and some of the altcoins are gaining double digits—but not Ethereum.

Insanely Undervalued Ethereum

On January 9, crypto investor “DCInvestor” told his 235,000 X followers that Ethereum “will do better and retain more value after this cycle than the vast majority of assets.”

“IMO it’s insanely undervalued at the moment,”

The claim comes from the premise that after Bitcoin ETFs are approved, and billions of dollars flow into them, Ethereum will be the next logical asset for a spot ETP.

He added that Ethereum already has futures-based ETFs, so a spot fund will be approved next in the United States.

“It [ETH] becomes the ‘silver to Bitcoin’s gold’ which moves harder and faster in a crypto bull market.”

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

Crypto YouTuber ‘Crypto Rover’ echoed the sentiment to his 635,000 X followers. “An Ethereum spot ETF is going to be the next big narrative,” he said before adding:

“After the Bitcoin Spot ETF is accepted, things will settle down, and the next hype will transfer to ETH.”

The analyst said that little attention is being paid to Ethereum due to the current Solana pump. SOL prices have pumped 360% over the past 90 days, whereas underperforming ETH has managed just 48% in the same period.

Crypto trader ‘RamenPanda’ said the same thing, stating that funds will be flowing to the Ethereum ecosystem soon. An Ethereum ETF will come after Bitcoin ETFs are approved, he added.

Last week, Bloomberg ETF analyst James Seyffart said that the SEC has approved Ethereum futures, and the CFTC has labeled ETH a commodity. “I think we could see potential Ethereum ETFs approved this year as well,” the analyst noted.

ETH Price Outlook

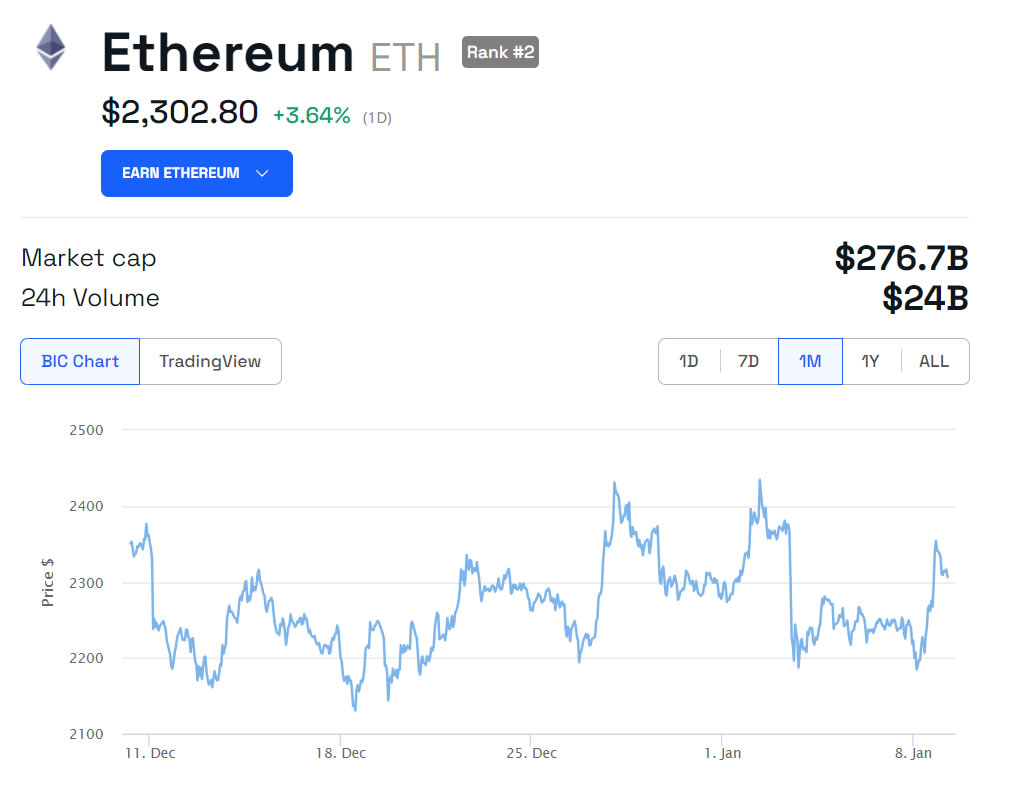

Ethereum prices have gained 3.6% on the day to trade just above $2,300 at the time of writing.

However, the asset has been range-bound, bouncing between $2,150 and $2,400 since the beginning of December.

ETH/USD 1 month. Source: BeInCrypto

ETH/USD 1 month. Source: BeInCryptoMeanwhile, alternative layer-1 tokens such as SOL and AVAX have pumped 13% and 11% on the day, respectively.

Other altcoins outperforming ETH today include Cardano (ADA), Polkadot (DOT), Polygon (MATIC), and Internet Computer (ICP).

Top crypto platforms in the US | January 2024

The post How ‘Undervalued’ Ethereum Could Become the Next Spot ETF Hype Wave appeared first on BeInCrypto.

.png)

10 months ago

3

10 months ago

3

English (US)

English (US)