ARTICLE AD BOX

Ethena Labs’ recent launch of the USDe stablecoin has sparked widespread debate. Investors are notably apprehensive about its 27.6% annual yield.

With the mainnet launch on February 19, the Ethereum-based USDe offers a return far exceeding the norm. This has drawn comparisons to Terra’s UST, which collapsed after promising around 20% yield.

Novel Stablecoin Project Faces Community Skepticism

The crux of investor worry lies in the potential for yield inversion. In such scenarios, the costs surpass earnings, leading to losses. This concern, voiced by 0xngmi from DefiLlama, recalls the failure of similar ventures.

While enticing, the high yield of USDe may mask deeper sustainability issues.

“I dont get why so many people are focused on Ethena’s high yield (its a basis trade) instead of the fact that there’s been 2 projects that tried this before and both gave up because they lost money due to yields inverting. When yields invert you start losing money, and the bigger the stablecoin is the more money it loses. But i’ll just close the shorts when yield is negative. Previous projects tried to do the same but opening/closing positions has a cost and that ate into all yield,” 0xngmi said.

Read more: A Guide to the Best Stablecoins in 2024

Moreover, Duo Nine, a pseudonymous crypto analyst, enumerates the risks linked to USDe. These include negative funding rates and liquidity constraints. He believes that in a bear market, these risks could converge, possibly causing stETH to depeg from Ethereum. Eventually, such an event would leave investors with a devalued asset.

“If that happens, the mint/redeem option stops. You can’t swap USDe for ETH and back, you’re stuck with a stable that can fall under $1. The next bear market will be spicy. A Russian roulette to find out what will trigger the next crash,” Nine explained.

In response, Ethena Labs has offered reassurances. Conor Ryder, the firm’s head of research, underscores the thorough risk assessments undertaken. He argues that USDe introduces a novel risk profile unlinked to traditional banking risks. By leveraging stETH and an insurance fund, Ethena aims to cushion against negative funding impacts. Notably, negative funding was a concern on only 11% of days over the last three years.

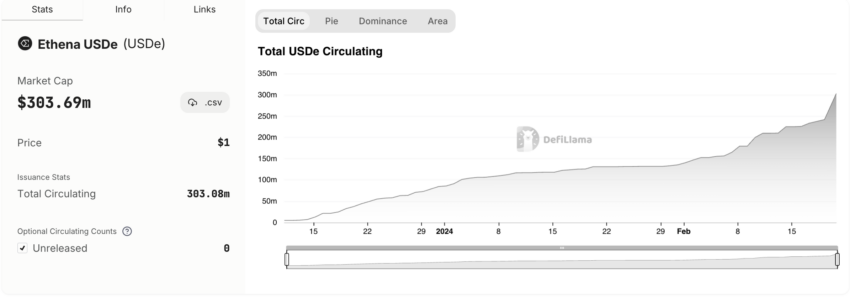

Total Ethena USDe Circulating. Source: DefiLlama

Total Ethena USDe Circulating. Source: DefiLlamaDespite these risks, USDe’s adoption is swiftly growing, with circulation exceeding $300 million shortly after its launch. This surge follows a $14 million funding round, boosting Ethena Labs’ valuation to $300 million. The round drew heavyweight backers like Dragonfly, Brevan Howard Digital, and Arthur Hayes’ family office, Maelstrom.

The project has also attracted investments from PayPal Ventures, Franklin Templeton, and Fidelity through Avon Ventures. Support from leading crypto exchanges, including Binance, Deribit, Gemini, and Kraken, further bolsters USDe’s credibility.

Read more: How To Fund Innovation: A Guide to Web3 Grants.

This wide-ranging support underscores the community’s optimistic stance on Ethena’s innovation. Drawing inspiration from Arthur Hayes, Ethena aspires to disrupt Tether’s dominance with USDe. This stablecoin is designed to be independent of traditional financial systems, relying on a delta-neutral strategy.

The post Imminent Collapse? Ethena Labs’ 27.6% Annual Yield Sparks Debate appeared first on BeInCrypto.

.png)

8 months ago

7

8 months ago

7

English (US)

English (US)