ARTICLE AD BOX

The Reserve Bank of India (RBI) is enhancing the accessibility and usability of its central bank digital currency (CBDC), the e-rupee, with new features. This initiative starkly contrasts India’s stringent stance on the broader cryptocurrency industry.

The RBI’s plan to introduce offline transaction capabilities and programmability to the e-rupee marks a significant leap for the digital currency.

India Buffing E-Rupee CBDC Features

These features, aiming for a gradual rollout through pilot programs, are poised to revolutionize how retail users interact with the e-rupee.

The proposed programmability function, for instance, will enable government agencies to ensure precise disbursement of benefits and empower companies to streamline expenses like business travel.

Sharat Chandra, the co-founder of India Blockchain Forum, commented on features that may further boost adoption:

“Compensating employees using the CBDC is a good step. Other avenues such as toll tax collections can also be included to further encourage adoption.”

Meanwhile, the Indian crypto industry is on edge as the nation’s 2024 budget draws near. The past year has been challenging for crypto investors and exchange owners due to heavy taxation and regulatory uncertainties.

Read more: Digital Rupee (e-Rupee): A Comprehensive Guide to India’s CBDC

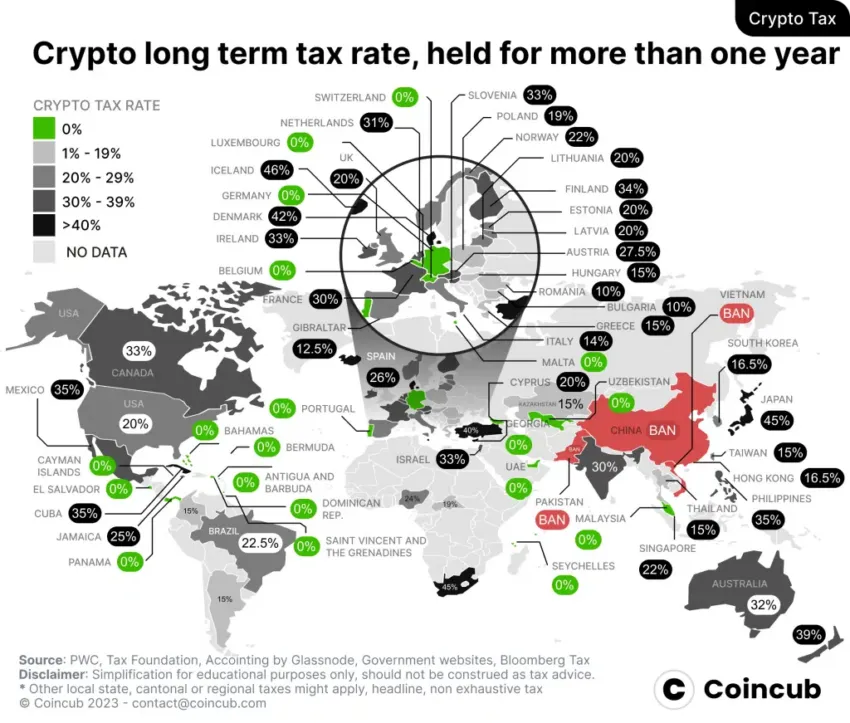

The industry is hoping for a reduction in the 30% tax rate on virtual assets. This stance has contributed to India being labeled as one of the world’s most heavily taxed crypto markets.

India’s crypto tax ranks as one of the world’s highest. Source: Coincub

India’s crypto tax ranks as one of the world’s highest. Source: CoincubAnd it’s not just taxes that are causing a headache. In December 2023, India’s Financial Intelligence Unit issued notices to nine major offshore crypto exchanges for non-compliance with AML laws. This led Apple to remove their respective apps from its App Store in India. This included well-known entities like Binance, Kraken, and Huobi.

This crackdown is part of a broader regulatory push requiring crypto exchanges to register under the Prevention of Money Laundering Act. The Act has significant implications for Indian consumers, advising them to move their assets to compliant Indian platforms.

Major Crypto Players Move to More Welcoming Climates

The situation has also prompted a shift among Indian crypto firms, many of which are relocating to the United Arab Emirates (UAE).

This move is fueled by the UAE’s more accommodating regulatory framework. It starkly contrasts India’s rigorous tax laws and uncertain legal environment surrounding digital currencies. The UAE, particularly Dubai, is quickly becoming a hub for crypto businesses. It offers low taxes, ease of business setup, and a dedicated regulatory framework for digital assets.

Read more: Digital Rupee Tutorial — How to Use India’s CBDC e-Rupee

The industry’s future hinges on the upcoming budget and the government’s subsequent actions.

Will the budget bring relief and foster a more vibrant digital asset ecosystem, or will it tighten the regulatory noose, pushing more firms towards favorable jurisdictions like Dubai?

Overall, this scenario underscores a broader trend in the global crypto sector, where regions like the Middle East and Africa are emerging as key players in the digital currency domain.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.

The post India Advances E-Rupee CBDC Features While Keeping Tight Grip on Crypto Sector appeared first on BeInCrypto.

.png)

9 months ago

2

9 months ago

2

English (US)

English (US)