ARTICLE AD BOX

As the presidential election nears, industry leaders are closely observing how the candidates, Joe Biden and Donald Trump, may impact Bitcoin and the broader crypto market.

The stakes are heightened by their upcoming historic debate on CNN, which could significantly set the stage for what comes next.

SEC’s Regulatory Agenda

Ripple CEO Brad Garlinghouse has criticized SEC Chairman Gary Gensler’s aggressive stance on crypto regulation. He argues that Gensler’s failure to address issues like FTX and Binance undermines his credibility.

“Absolute nonsense coming from Gary Gensler today. And this slander about ‘all crypto execs going to jail’ from the man who completely missed FTX (and actually cozied up to SBF), and wasn’t even invited to the DOJ announcement about Binance,” Garlinghouse said.

Garlinghouse also criticized Gensler for misrepresenting the American people’s interests. Therefore, the SEC Chair should have have been removed from his position long ago. He went even further to suggest that Gensler’s actions could jeopardize Biden’s chances in the upcoming election.

Mark Cuban shares a similar sentiment, emphasizing that regulatory challenges in the US are stifling the crypto industry. He contrasts this with more favorable environments like Singapore and Japan.

Like Garlinghouse, Cuban believes Gensler’s actions could alienate younger voters heavily invested in crypto.

“If he has a political career in mind, he’s done, and he literally could cost Joe Biden the election because there are a whole lot of Gen Z, Gen X, millennials that own a whole lot of crypto, and by not making it easy to register, it makes it easier for all the scam coins to exist,” Cuban emphasized.

Who’s Better for Bitcoin?

Despite the sentiment that Gensler’s regulatory approach to the crypto market has generated, choosing between Trump and Biden for Bitcoin involves evaluating their policies. Trump has always been known for his enthusiastic support of Bitcoin and the blockchain space. Meanwhile, Biden’s stricter regulations ensure market stability and security, but may stifle innovation.

Niel Roarty, analyst at Stocklytics, told BeInCrypto the general consensus in the industry leans more towards Trump due to his vocal support for Bitcoin.

“The consensus among the crypto community seems to be that a Trump victory would be favorable for the industry. Aside from the vocal support he’s given, Bitcoin has tended to perform well during periods of political and economic uncertainty, and a second Trump presidency will likely see more of both,” Roarty noted.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

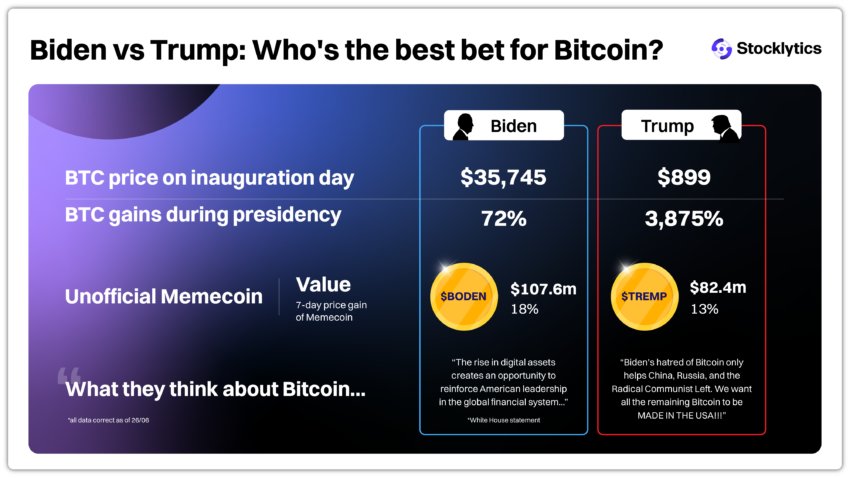

Biden vs Trump for Bitcoin. Source: Stocklytics

Biden vs Trump for Bitcoin. Source: StocklyticsOn the other hand, Max Jones, Founder of Memepad, told BeInCrypto about the influence of presidential meme coins in the election. He believes that meme coins reflect public sentiment towards political figures and demonstrate how cryptocurrency is intertwining with politics.

“Trump-based memecoins like MAGA, MAGA Hat, Doland Tremp, Super Trump, MAGA VP, and Trump Mania are leading the trend. Over the past 24 hours, these tokens have soared by over 19% each. The high posturing to Trump might take precedence in his crypto-focused campaign… President Joe Biden also has dedicated meme coin projects that are tied to him. Of the Biden-themed tokens, Jeo Boden, with a 5.1% surge to $0.1549 in 24 hours, is the most valuable,” Jones added.

As the campaign heats up, Jones believes these meme coins could act as a measure of popularity for the candidates. Their volatility is influenced by the hype surrounding the politicians they represent, but their growth also reflects broader market trends.

While it is uncertain which meme coins will endure, they currently provide an unusual gauge for Trump and Biden. Roarty maintains that the upcoming presidential debate between Biden and Trump may impact these meme coins.

“Biden does hold the edge when it comes to presidential meme coins, however, which are created and traded by crypto enthusiasts although not endorsed by the candidates themselves. The BODEN coin, modelled after the president, currently holds a market capitalization of $107 million, compared to the $82 million of TREMP,” Roarty shared.

In a related discussion, Anthony Pompliano recently talked about how stablecoins could help address the US debt crisis by providing steady demand for treasuries. This perspective ties into the broader debate on crypto policies between Biden and Trump.

Trump’s pro-Bitcoin stance suggests a favorable environment for stablecoins to aid in debt management. On the other hand, Biden’s regulatory approach and exploration of a CBDC could impact stablecoin utilization.

The upcoming presidential election could play a crucial role in shaping the future regulatory environment for cryptocurrencies in the US. Indeed, the outcome will greatly affect the industry’s growth and stability.

The post Industry Leaders Debate Who’s Better for Bitcoin: Joe Biden or Donald Trump appeared first on BeInCrypto.

.png)

4 months ago

2

4 months ago

2

English (US)

English (US)