ARTICLE AD BOX

The cryptocurrency market is witnessing a profound resurgence, as evidenced by Bybit’s 2024 Institutional Industry Report, developed in partnership with Treehouse.

This analysis highlights the escalating global crypto adoption and its dynamics with traditional finance (TradFi). Over the six-month period ending in March 2024, the crypto market cap surged from just over $1 trillion to a remarkable $2.5 trillion, driven by renewed institutional interest and substantial capital inflows.

Investor Sentiment High for BTC and ETH as Derivatives Show Bullish Trends

The report delineates a notable bullish trend in the derivatives market and active investment movements in on-chain metrics for BTC and ETH. As these primary cryptocurrencies show increasing call premiums despite market fluctuations, investor sentiment remains robust, particularly with the impending bitcoin halving and prospective bull run in 2024.

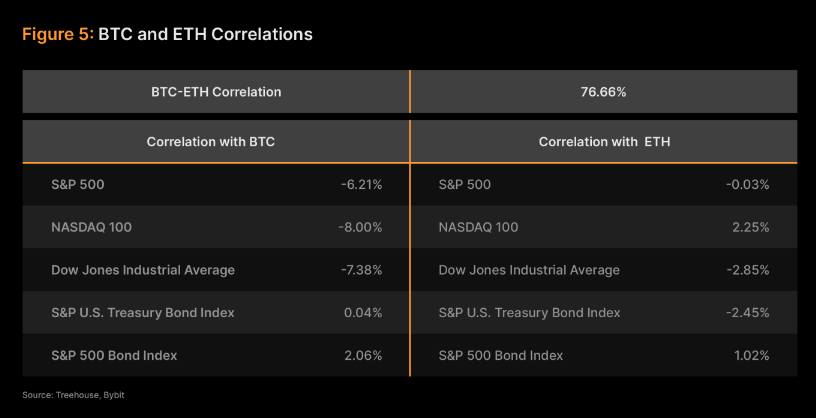

Furthermore, BTC is gaining traction as a strategic hedge against TradFi, exhibiting minimal correlation with major equity indices. Incorporating a modest allocation of 5% each into BTC and ETH can enhance the Sharpe ratio of an S&P 500 portfolio by 43.6%, underscoring the potential of cryptocurrencies as diversification tools within investment portfolios.

BTC-ETH TradFi Hedge Comparison. Source: ByBit

BTC-ETH TradFi Hedge Comparison. Source: ByBitVenture capital (VC) investment in the sector is also experiencing a significant uptick. By early 2024, disclosed funding in crypto-related ventures reached $1.94 billion across 243 deals. Correlating to a 36% increase from the previous quarter. This revival of VC interest is particularly concentrated on infrastructure projects crucial to the blockchain ecosystem’s foundational development.

Read More: What Happened at the Last Bitcoin Halving? Predictions for 2024

These projects include advancements in hardware wallets and blockchain data services, vital for addressing industry challenges and fostering innovation.

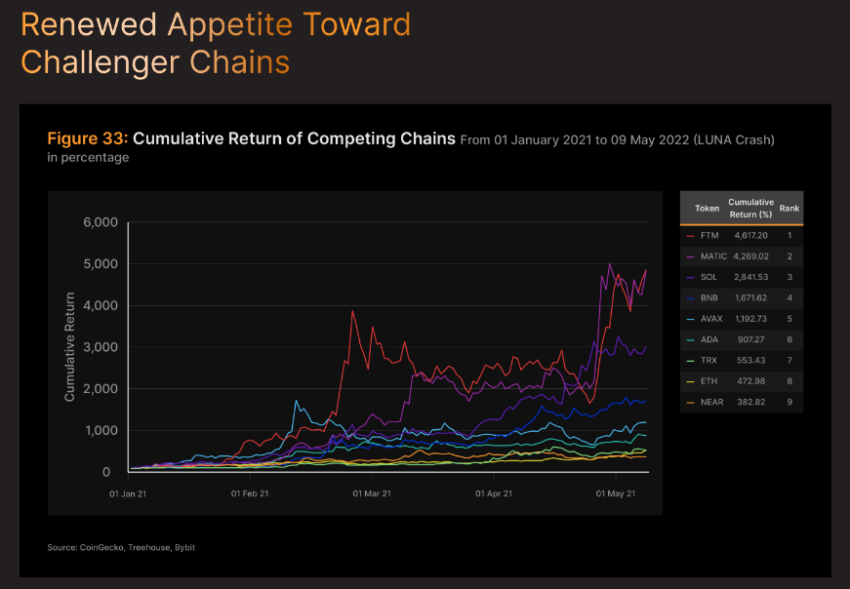

Challenger chains like Solana (SOL) are also drawing attention, with their tokens outperforming established players like ETH. Which is reminiscent of their rise in 2021. This shift indicates a broadening interest and confidence in alternative blockchain technologies that promise enhanced transaction capabilities and decentralized applications. This comes especially in the gaming and AI sectors.

Cumulative Returns of Competing Chains. Source: ByBit

Cumulative Returns of Competing Chains. Source: ByBitAs traditional markets continue to integrate with cryptocurrency frameworks, the complexities for TradFi participants and newcomers escalate. Staying informed and agile is essential in navigating this rapidly evolving landscape, with institutions and investors increasingly poised to capitalize on the burgeoning opportunities within the crypto sector.

The post Institutions Bullish on Challenger Chains as VC Funding Spikes in Tech Sectors – Report appeared first on BeInCrypto.

.png)

7 months ago

3

7 months ago

3

English (US)

English (US)