ARTICLE AD BOX

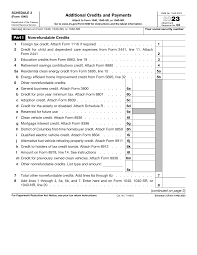

Schedule 3 Tax Form

IRS Tax Form Instructions

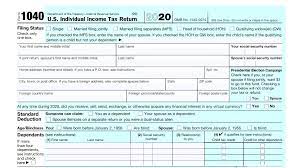

Printable IRS 1040 Tax Forms

The Internal Revenue Service (IRS) has released the Schedule 3 tax form and instructions for the years 2023 and 2024.

TRAVERSE CITY, MI, US, January 13, 2024 /EINPresswire.com/ — The Internal Revenue Service (IRS) has released the Schedule 3 tax form and instructions for the years 2023 and 2024.

This form is used by taxpayers to report nonrefundable credits, such as the child tax credit and the credit for other dependents.

The Schedule 3 tax form is part of the 1040 tax return. Taxpayers who are eligible to claim nonrefundable credits must complete Schedule 3 and attach it to their 1040 return. Nonrefundable credits cannot be used to receive a refund if the credit amount is greater than the taxpayer’s tax liability.

The IRS has updated the Schedule 3 tax form and instructions for the years 2023 and 2024, with a focus on making it easier for taxpayers to understand and complete the form. The updated form includes new lines for reporting certain credits, such as the credit for electric vehicles and the credit for residential energy-efficient property.

Taxpayers who are eligible for the child tax credit and the credit for other dependents will find the updated Schedule 3 tax form and instructions helpful. The new instructions provide clear guidance on how to calculate the credit amount and how to claim it on the tax return.

In addition to the new credits and instructions, the IRS has also made changes to the Schedule 3 tax form for reporting certain deductions. Taxpayers who are eligible to claim the educator expense deduction, the student loan interest deduction, and the tuition and fees deduction will find the updated form and instructions useful.

Completing the Schedule 3 tax form accurately is important to avoid any penalties or delays in processing the tax return. Taxpayers are encouraged to review the instructions carefully and seek professional advice if they have any questions or concerns.

The IRS Schedule 3 tax form and instructions for the years 2023 and 2024 are now available on the IRS website. Taxpayers can download the form and instructions or obtain a hard copy from their local IRS office.

For more information on the Schedule 3 tax form and other tax-related topics, visit https://filemytaxesonline.org/printable-irs-tax-forms-instructions/

Frank Ellis

Harbor Financial

email us here

Visit us on social media:

LinkedIn

![]()

Source link

The content is by EIN Presswire. Headlines of Today Media is not responsible for the content provided or any links related to this content. Headlines of Today Media is not responsible for the correctness, topicality or the quality of the content.

.png)

10 months ago

4

10 months ago

4

,

,

English (US)

English (US)