ARTICLE AD BOX

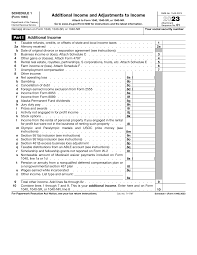

The Internal Revenue Service (IRS) has recently released the updated Schedule 1 tax form and instructions for the years 2023 and 2024.

TRAVERSE CITY, MI, US, January 13, 2024 /EINPresswire.com/ — The Internal Revenue Service (IRS) has recently released the updated Schedule 1 tax form and instructions for the years 2023 and 2024.

The new form and instructions are designed to simplify the tax filing process for individuals and businesses and ensure accurate reporting of taxable income.

The Schedule 1 form is used to report additional income or adjustments to income that are not listed on the standard Form 1040. It includes sections for reporting income from rental real estate, partnerships, S corporations, and other sources, as well as deductions for self-employment tax, student loan interest, and health savings account contributions.

One of the key highlights of the updated Schedule 1 form is the addition of a new line for reporting cryptocurrency transactions. Taxpayers must report any gains or losses from the sale or exchange of virtual currency, as well as any income earned from mining or staking activities.

The instructions for completing the Schedule 1 form have also been updated to provide more detailed guidance on reporting cryptocurrency transactions and other types of income and deductions. Taxpayers are advised to carefully review the instructions before completing the form to ensure that all income and deductions are accurately reported.

In addition to the updated Schedule 1 form and instructions, the IRS has also released a new publication, Publication 5349, which provides guidance on the tax treatment of virtual currency transactions.

The publication explains the tax implications of various types of transactions involving virtual currency, including buying, selling, and exchanging virtual currency, as well as using virtual currency to pay for goods and services.

The IRS is encouraging taxpayers to use tax preparation software to complete and file their tax returns electronically. Electronic filing is faster, more accurate, and more secure than paper filing, and it can help taxpayers avoid common errors that can delay their refunds or result in penalties.

Overall, the updated Schedule 1 form and instructions, along with the new guidance on virtual currency transactions, are designed to help taxpayers accurately report their income and deductions and ensure compliance with tax laws.

Taxpayers are encouraged to review the updated form and instructions carefully at, https://filemytaxesonline.org/printable-irs-tax-forms-instructions/

To

Frank Ellis

Harbor Financial

email us here

Visit us on social media:

LinkedIn

![]()

Source link

The content is by EIN Presswire. Headlines of Today Media is not responsible for the content provided or any links related to this content. Headlines of Today Media is not responsible for the correctness, topicality or the quality of the content.

.png)

10 months ago

6

10 months ago

6

,

,

English (US)

English (US)