ARTICLE AD BOX

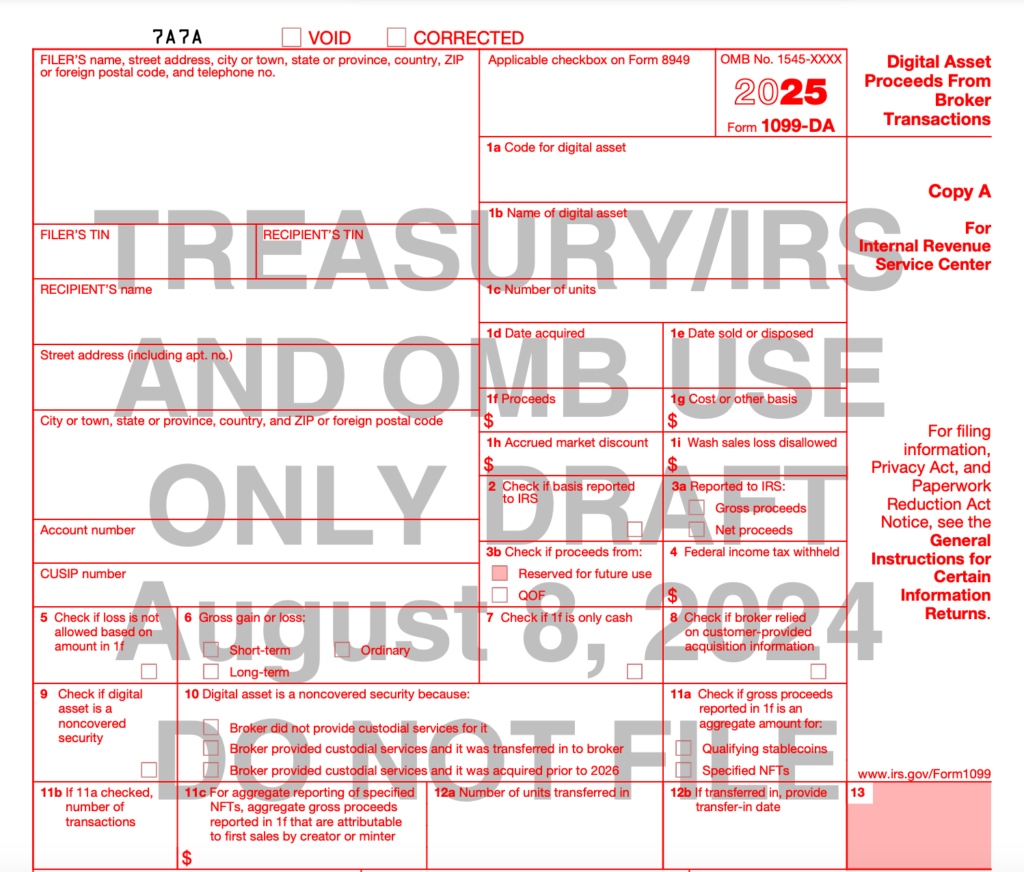

The U.S. Internal Revenue Service (IRS) is making significant strides in clarifying and simplifying the process for taxpayers to report their digital asset transactions. In a move aimed at improving transparency and ease of use, the IRS has released an updated draft of Form 1099-DA, which is set to become the standard reporting tool for cryptocurrency transactions starting in 2026.

A Simpler Approach to Crypto Tax Reporting

On August 8, the IRS unveiled the latest iteration of Form 1099-DA, titled “Digital Asset Proceeds From Broker Transactions.” This form, if approved, will become a key tool for taxpayers to report digital asset transactions from 2025 onward, with the first filings due by April 2026.

The most notable changes in this updated draft include the removal of requirements that many in the industry had criticized as overly burdensome. The earlier version of the form asked taxpayers to specify the exact time of day when a transaction occurred, as well as to identify the type of broker involved in the transaction. These requirements have now been eliminated, reflecting the IRS’s effort to reduce the complexity of crypto tax reporting.

Source: IRS

Source: IRS

Additionally, the latest draft no longer asks for wallet addresses and transaction IDs, which were previously required. These revisions have been widely welcomed by industry experts, who view them as a step toward more practical and less intrusive reporting standards.

Industry Reaction: Positive Feedback on the New Draft

IRS Commissioner Danny Werfel commented on the updated form, stating that it would offer “more clarity for taxpayers and give them another tool to help them accurately report their digital assets transactions.” His sentiments were echoed by legal experts and industry advocates.

Drew Hinkes, an attorney at K&L Gates, took to social media platform X (formerly known as Twitter) to praise the revisions, calling the new version “massively improved,” “less burdensome,” and requiring “considerably less” data reporting. Similarly, Ji Kim, Chief Legal and Policy Officer for the Crypto Council for Innovation (CCI), noted that the changes align with the feedback provided by industry stakeholders.

These adjustments come after a period of intense scrutiny and criticism of the initial draft released in April. Many in the crypto community had expressed concerns that the original form’s stringent requirements could discourage compliance and stifle innovation in the rapidly evolving digital asset market.

IRS Seeks Further Feedback as Deadline Approaches

The IRS has opened a 30-day comment period, inviting further input from taxpayers and industry professionals on the draft form. This continued engagement is part of the agency’s broader effort to refine its approach to cryptocurrency tax reporting, which has become an increasingly important issue as the use of digital assets continues to grow.

In addition to the updates to Form 1099-DA, the IRS has been working on broader crypto broker reporting requirements. In June, the agency released a final draft of these requirements, clarifying that decentralized exchanges and self-custody wallets would not be subject to the new rules. This clarification was aimed at closing the tax gap by ensuring that taxable income from digital assets is properly reported, without imposing unnecessary burdens on decentralized finance (DeFi) participants.

As the IRS moves forward with these changes, taxpayers and industry observers alike will be watching closely to see how the final version of Form 1099-DA and related regulations take shape.

Also Read: South Korea’s Crypto Tax: Potential Delay to 2028 by Ruling Party

.png)

4 months ago

3

4 months ago

3

English (US)

English (US)