ARTICLE AD BOX

- Seasonal patterns, macroeconomic factors, and increasing global liquidity could lead to a Q4 bull run in crypto markets.

- FTX’s repayment of $16B to creditors could inject liquidity into the market, fueling further growth potential.

According to crypto analyst Miles Deutscher, the next fourth quarter (Q4) of 2024 has the potential to ignite a bull run in the crypto market, driven by a range of variables. These variables vary from seasonal trends and macroeconomic conditions to cryptocurrency-specific dynamics, which Deutscher believes will determine the market’s trajectory in the coming months.

The crypto market is about to catch A LOT of investors off guard.

Don't let that be you.

With Q4 right around the corner, there are some critical factors you NEED to know.

🧵: Here are 10 reasons why Q4 could spark a MONUMENTAL market shift.👇

— Miles Deutscher (@milesdeutscher) September 14, 2024

Seasonality: The Key to Crypto Strong Q4 Performance

One of the most convincing grounds for optimism, according to Deutscher, is the concept of seasonality. While market moves may look random, research suggests that they follow a cyclical pattern, particularly in the cryptocurrency market.

Historically, the fourth quarter has been the strongest for both equities and crypto. Since 1945, the S&P 500 has gained an average of 3.8% in the fourth quarter, advancing 77% of the time. The similar pattern applies to Bitcoin, which has continuously performed strongly during this time span.

Source: CoinGlass

Source: CoinGlassIn reality, BTC returned an average of +88.84% in Q4, with notably impressive performances during past halving years like 2016 and 2020, when Bitcoin gained 58.17% and 168.02%, respectively.

This strengthens the notion that Q3, historically a weaker period for Bitcoin, functions as an accumulation phase, laying the groundwork for a potential bull run in the coming months.

According to historical data, Bitcoin’s returns from May to September have shown a cumulative increase of 619.5%. However, the period from October to April has been significantly more profitable, with returns reaching an astonishing 13,656,203%.

This suggests that the months of May to September typically serve as an accumulation season, while the period from October to April is often referred to as the bull season.

Source: Jeff Park on X

Source: Jeff Park on XMacro Factors: Election Impact and Federal Reserve Policies

In addition to seasonality, Deutscher identifies macro factors that are likely to influence the market. The upcoming U.S. federal election stands out as a watershed moment, with Deutscher predicting that a Trump presidency might be especially beneficial to the cryptocurrency industry.

Trump has openly supported Bitcoin, particularly after his recent remarks at the Bitcoin 2024 conference. According to Deutscher, a Trump victory could prompt a favorable market reaction because the cryptocurrency ecosystem has not yet fully factored in this eventuality.

While a victory for Kamala Harris may provide regulatory issues, Deutscher believes it would not be a disastrous blow to the business.

Inflation Control and Potential Rate Cuts: A Boost for Bitcoin?

Another key macroeconomic aspect is the slowing of inflation and the possibility of Federal Reserve rate decreases. The most recent Consumer Price Index (CPI) measurement was the lowest since February 2021, indicating that inflation is being kept under control.

Federal Reserve Chair Jerome Powell has signaled that a policy shift may be on the horizon, potentially leading to lower interest rates. While others claim that rate cuts are bearish, Deutscher believes that this is only true during recessions.

During non-recessionary periods, the initial rate cut is typically positive, providing support for risky assets such as shares and crypto. Furthermore, a Federal Reserve rate drop would weaken the US currency, potentially benefiting Bitcoin, which is highly sensitive to global liquidity.

In terms of liquidity, Deutscher reports that global liquidity is already expanding and is likely to continue to do so through 2025.

Global liquidity is the most closely connected factor influencing Bitcoin, surpassing even equities and gold. This surge in liquidity may bolster Bitcoin’s upward momentum, creating a favorable atmosphere for the market to expand.

Low Retail Involvement and FTX Repayments: A Catalyst for Market Growth?

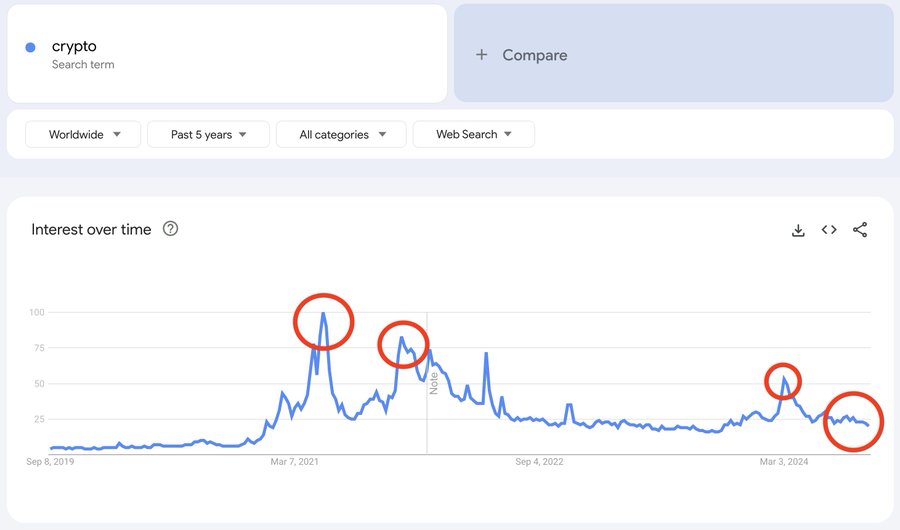

Deutscher emphasizes that retail participation in cryptocurrency is currently at an all-time low. According to metrics such as Google Trends, social media activity, and YouTube views, 90% of retail investors have left the market.

This dynamic, according to Deutscher, provides a chance for more aggressive market expansion, as periods of limited retail involvement frequently precede major bull runs.

Source: Miles Deutscher on X

Source: Miles Deutscher on XFinally, Deutscher examines the implications of FTX returning $16 billion to creditors. Unlike the large losses generated by the Mt. Gox and German sales, the FTX repayments are cash injections rather than cash extractions.

According to CNF, with $12 billion scheduled to be paid out in cash, many users are expected to put the funds back into the market, increasing liquidity and stoking the possibility of a market turnaround.

.png)

2 months ago

8

2 months ago

8

English (US)

English (US)