ARTICLE AD BOX

Bitcoin (BTC) has experienced an approximately 19% drop since hitting its all-time high (ATH) on March 14, 2024. This condition raises concerns about the current bull market’s longevity.

However, despite the recent correction, many analysts believe this represents a healthy consolidation within the ongoing bull market, not its end.

Bitcoin Correction Signals Market Health, Not End of Bull Run

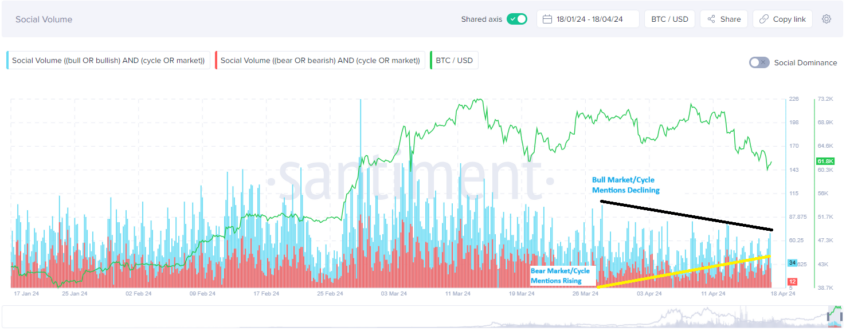

On-chain data platform Santiment reports a shift in market sentiment. According to Santiment data, the “bull market/cycle” mentions have risen since late March. Moreover, Santiment observes a decline in FOMO (fear of missing out) sentiment and a rise in FUD (fear, uncertainty, and doubt).

Santiment further suggests that prices have historically moved contrary to the prevailing sentiment of the masses. Therefore, there is a potential for a recovery before or shortly after the approaching Bitcoin halving.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

Comparison of Bull Market/Cycle and Bear Market/Cycle Mentions. Source: Santiment

Comparison of Bull Market/Cycle and Bear Market/Cycle Mentions. Source: SantimentThe increase in the “bull market/cycle” mentions aligned with Bitcoin’s current price performance. Bitcoin is trading at $61,988 at the time of writing.

Interestingly, Bitcoin’s price decline contradicts the typical narrative surrounding Bitcoin halving. The quadrennial event has a history of being associated with BTC price surges. The approaching Bitcoin halving is scheduled for a block height 840,000, approximately on April 20, 2024.

Many experts believe this year’s Bitcoin halving could potentially alter BTC’s typical price surge. This prediction is notably due to the recent approval of the US spot Bitcoin ETFs.

Nonetheless, analysts see the current correction as a healthy movement. Crypto analyst CryptoCon emphasized the need for corrections, even within a bull market. He identifies the 20-week EMA at $55,600 as a key support level for Bitcoin.

“As long as Bitcoin continues to retest this moving average, we can see a nice smooth curve like 2017 to the top,” he explained.

Renowned analyst PlanB also maintains a bullish long-term outlook for Bitcoin.

“[In my opinion], this Bitcoin halving will not be different … BTC top will be above $300,000 in 2025,” PlanB said.

Echoing Plan B and CryptoCon, Hannah Phung, Lead Data Analyst at Spot On Chain, stated that price increases tend to occur around 6 to 12 months post-halving.

The experts’ opinion aligns with Bitcoin’s historical data. After the first halving in November 2012, the price rose from around $12 to over $1,000 by late 2013. Similarly, the second halving in July 2016 saw the price of Bitcoin surging from around $650 to nearly $20,000 by December 2017. The third halving in May 2020 resulted in a price increase from around $8,000 to $69,000 by November 2021.

Read more: Bitcoin Halving Countdown

Bitcoin Halving Countdown. Source: BeInCrypto

Bitcoin Halving Countdown. Source: BeInCryptoDespite the positive outlook for Bitcoin’s price in the long term, Bitcoin halving might remain a concern for miners. This year’s halving cuts the reward for mining a Bitcoin block from 6.25 to 3.125 BTC, significantly impacting miner profitability. As a result, miners face pressure to innovate and find ways to reduce costs while maintaining or increasing their Bitcoin output.

While this event can potentially impact miner profitability, a January 2024 study by CoinShares reveals that some miners can survive. CoinShares notes that miners with substantial Bitcoin holdings and better capitalization tend to fare better in bullish markets.

However, those with limited cash reserves and high operational costs per BTC are more vulnerable to Bitcoin’s price declines.

The recent correction, the approaching halving, and the newly approved US spot ETFs create a complex environment for Bitcoin price predictions. But overall, long-term bullish sentiment remains strong among most industry experts.

The post Is the Bitcoin, Crypto Bull Market Over? Analysts Weigh In appeared first on BeInCrypto.

.png)

7 months ago

7

7 months ago

7

English (US)

English (US)