ARTICLE AD BOX

US Treasury Secretary Janet Yellen calls upon lawmakers to intensify the regulatory framework governing crypto and stablecoins.

Yellen will testify before the US House Committee on Financial Services today. She will highlight the urgent need for laws to address risks in the crypto industry.

Janet Yellen Urges For Crypto Regulation

Yellen’s testimony arrives at a key time for the crypto industry. This sector has faced turbulence and regulatory challenges recently. She will inform Congress that the Treasury is focusing on digital assets. This includes risks like destabilizing runs on platforms and price volatility.

The Treasury has noted many crypto platforms do not comply with regulations. Hence, Janet Yellen seeks to fix this with new laws.

“The Council is focused on digital assets and related risks such as from runs on crypto-asset platforms and stablecoins, potential vulnerabilities from crypto-asset price volatility, and the proliferation of platforms acting outside of or out of compliance with applicable laws and regulations. Applicable rules and regulations should be enforced, and Congress should pass legislation to provide for the regulation of stablecoins and of the spot market for crypto-assets that are not securities,” Yellen stated.

Yellen’s advocacy for a more stringent regulatory environment is not without precedent. The collapse of the crypto exchange FTX in November 2022 served as a strong reminder of the vulnerabilities within the crypto sector. In the aftermath, Yellen was vocal about the necessity for “more effective oversight of cryptocurrency markets,” emphasizing the urgency of closing regulatory gaps to avert future crises akin to the FTX fallout.

Yellen’s support for regulatory agencies, particularly the Securities and Exchange Commission (SEC) under Gary Gensler’s leadership, further reinforces her rigorous approach to overseeing the industry. Despite Yellen’s strict stance against crypto, the efforts for regulations are crucial. She aims to protect the financial system’s stability and integrity.

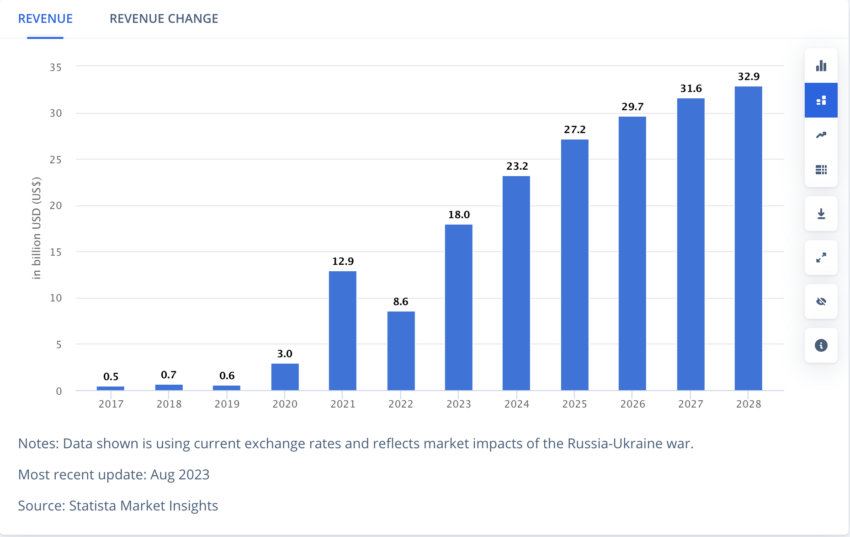

Crypto regulation is particularly pertinent given the anticipation of the US cryptocurrency sector’s revenue growth. With an expected Compound Annual Growth Rate (CAGR) of 9.10% from 2024 to 2028, the industry is projected to reach a total revenue of $32.9 billion by 2028.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Crypto Revenue Growth in the US. Source: Statista

Crypto Revenue Growth in the US. Source: StatistaHowever, on the positive side, the US Treasury Secretary does not advocate outright banning crypto assets. Last year, at the G20 Summit in India, she supported creating a “strong regulatory framework.” Her approach calls for working with other countries. This highlights the global nature of crypto regulation.

The post Janet Yellen Calls for Stronger Crypto Regulation in Congressional Testimony appeared first on BeInCrypto.

.png)

9 months ago

2

9 months ago

2

English (US)

English (US)