ARTICLE AD BOX

- Metaplanet’s stock surged 3,600% after pivoting to a Bitcoin-first strategy, with plans to reach 21,000 BTC by 2026.

- Japan’s revamped NISA program boosts retail interest in Metaplanet, positioning it as a leading Bitcoin proxy in Asia.

Tokyo, Japan— Japanese investment firm Metaplanet Inc. has become the country’s fastest-growing stock, surging 3,600% over the past year after shifting to a Bitcoin-first strategy. The company, once a struggling hotel developer, has reinvented itself as Japan’s leading corporate Bitcoin holder, drawing comparisons to MicroStrategy in the U.S.

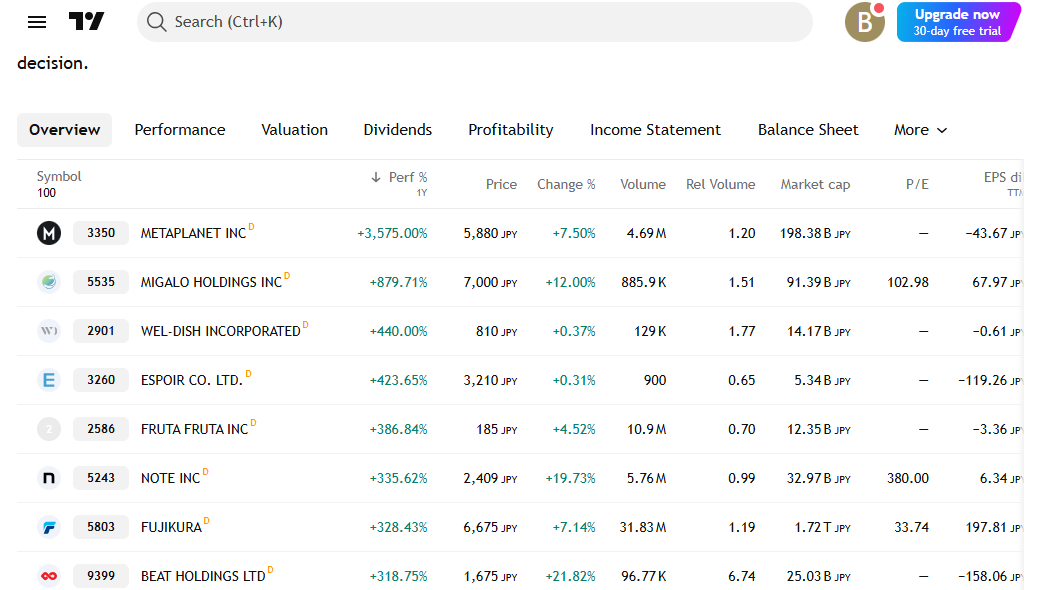

Best-performing Japanese stocks over the last 12 months Source: TradingView

Best-performing Japanese stocks over the last 12 months Source: TradingViewWith an ambitious plan to acquire 21,000 BTC by 2026, Metaplanet is positioning itself as Asia’s top Bitcoin proxy investment. Its stock rally reflects the rising demand for BTC exposure in Japan, fueled by a favorable tax program and a growing interest in digital assets.

Metaplanet’s Bitcoin Pivot Sparks Unprecedented Stock Surge

Metaplanet’s transformation began in early 2024 after pandemic-related struggles forced the company to shut down most of its hotel operations. Under the leadership of CEO Simon Gerovich, a former Goldman Sachs equity derivatives trader, the firm embraced Bitcoin as its core treasury asset.

The move has radically reshaped its financial outlook, attracting thousands of investors seeking an alternative to direct BTC purchases, which are subject to capital gains taxes of up to 55%. The company’s stock has now outperformed all other Japanese equities, as investors increasingly view it as Japan’s equivalent of MicroStrategy—the U.S. firm that holds over $45 billion in Bitcoin.

The surge comes amid a global Bitcoin boom, with the asset reaching an all-time high of $109,000 on January 20, the day of Donald Trump’s U.S. presidential inauguration. While Bitcoin has since pulled back to $97,000, Metaplanet’s stock has continued its meteoric rise, according to data from TradingView.

Metaplanet Aims for 21,000 BTC, Plans $750M Capital Raise

As of early 2025, Metaplanet holds 1,762 BTC, worth approximately $171 million. However, the firm has set an ambitious target—10,000 BTC by the end of 2025 and 21,000 BTC by 2026.

To achieve this goal, Metaplanet plans to issue 21 million new shares, aiming to raise nearly $750 million. This would be the largest Bitcoin-focused capital raise in Asia to date. The strategy has pushed the company into the top 20 largest corporate Bitcoin holders globally, and its planned acquisitions would solidify its position as one of the world’s biggest BTC treasuries.

Director Simon Gerovich emphasized that Metaplanet’s adoption of the Bitcoin Standard has fueled its rapid growth. “The market has recognized Metaplanet as Tokyo’s preeminent Bitcoin company,” he stated, adding that the firm is “seizing this momentum to lead Japan’s Bitcoin renaissance.”

Japan’s Tax Incentives and Retail Investors Drive Demand

Metaplanet’s success is partly driven by Japan’s revamped Nippon Individual Savings Account (NISA) program, launched in early 2024. This initiative allows citizens to invest in stocks tax-free, making Metaplanet a more attractive investment compared to direct Bitcoin purchases, which are taxed at some of the highest rates globally.

As reported by CNF, the company’s shareholder count skyrocketed by nearly 500% over the past year, reaching nearly 50,000 investors. While institutional players like Capital Group, which also hold shares in MicroStrategy, have taken positions, the majority of Metaplanet’s investors are retail traders. Many are new to crypto markets but see the firm as a regulated and tax-efficient way to gain Bitcoin exposure.

Metaplanet has also partnered with SBI Holdings, Japan’s leading financial services company, to secure its Bitcoin holdings and ensure regulatory compliance.

The Bitcoin Hotel and Future Expansion

Beyond Bitcoin accumulation, Metaplanet is integrating crypto into its hospitality business. Later this year, the company plans to rebrand its last remaining property, the Royal Oak Hotel in Tokyo’s Gotanda district, as “The Bitcoin Hotel.”

8/  Bitcoin Magazine and Bitcoin Hotel

Bitcoin Magazine and Bitcoin Hotel

In 2024, we secured the license for Bitcoin Magazine Japan (launching Q1 2025) and announced plans to renovate the Royal Oak Hotel into the Bitcoin Hotel (Q3 2025). These initiatives will serve as hubs for education, community, and… pic.twitter.com/oEOClykaQP

— Simon Gerovich (@gerovich) December 28, 2024

The hotel will serve as a hub for Bitcoin-related seminars, investor meetups, and blockchain education events, aligning with Metaplanet’s vision of leading Japan’s crypto economy. This move is expected to further solidify the company’s identity as a Bitcoin-first enterprise.

While Metaplanet’s rise has been impressive, analysts caution that the company’s fortunes are closely tied to Bitcoin’s price performance. With six consecutive years of losses, Metaplanet’s stock could face significant volatility if Bitcoin experiences a major downturn. However, the firm is expected to report a profit in its upcoming fourth-quarter earnings, which could further bolster investor confidence.

.png)

12 hours ago

2

12 hours ago

2

English (US)

English (US)