ARTICLE AD BOX

JPMorgan Chase & Co., the largest bank in the United States, has revealed its substantial Bitcoin exchange-traded fund (ETF) holdings.

The disclosure includes a variety of investments in different Bitcoin ETFs, showcasing the bank’s significant involvement in the cryptocurrency market.

JPMorgan Chase Reveals Bitcoin ETF Holdings

The report highlights 25,021 shares of Bitcoin Depot Inc., valued at $47,415. JPMorgan also holds 6,475 shares of the Bitwise Bitcoin ETF, worth $250,647, alongside a smaller stake of 55 shares valued at $2,129. The Fidelity Wise Origin Bitcoin ETF accounts for 16 shares, valued at $1,043. Additionally, the bank holds 40 shares of the Grayscale Bitcoin Trust, valued at just $2.

In the iShares Bitcoin Trust, JPMorgan owns 11,000 shares worth $445,170, and an additional 797 shares valued at $32,255. The ProShares Bitcoin Strategy ETF also forms part of the bank’s portfolio, with 14 shares valued at $452, and 831 shares worth $26,841.

The disclosure highlights JPMorgan’s strategic approach to cryptocurrency investment, leveraging a diversified portfolio across various Bitcoin ETFs. This move aligns with the growing institutional interest in digital assets despite recent market volatility.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

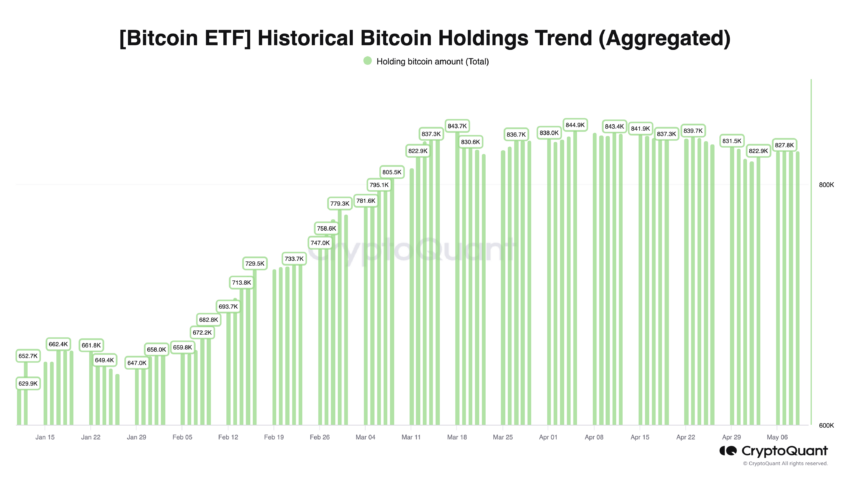

Historical Bitcoin ETF Holdings. Source: CryptoQuant

Historical Bitcoin ETF Holdings. Source: CryptoQuantDespite the recent news, Bitcoin’s price experienced a 4.75% decline. Despite this, the Open Interest only saw a 3.91% decrease of $647 million, with liquidations totaling $167 million over 24 hours. This indicates that the market has not yet fully deleveraged, reflecting ongoing uncertainty.

The post JPMorgan Chase Discloses Bitcoin ETF Holdings appeared first on BeInCrypto.

.png)

6 months ago

3

6 months ago

3

English (US)

English (US)