ARTICLE AD BOX

- JPMorgan reports Bitcoin is more correlated with small-cap tech stocks in the Russell 2000 Index than precious metals.

- Bitcoin’s relationship with equities fluctuates, correlating strongly with tech stocks during both market surges and downturns.

Bitcoin has long been compared to gold, but fresh analysis suggests its closest financial twin lies elsewhere. According to JPMorgan, the cryptocurrency’s strongest link isn’t with precious metals but with small-cap tech stocks, particularly those in the Russell 2000 Index.

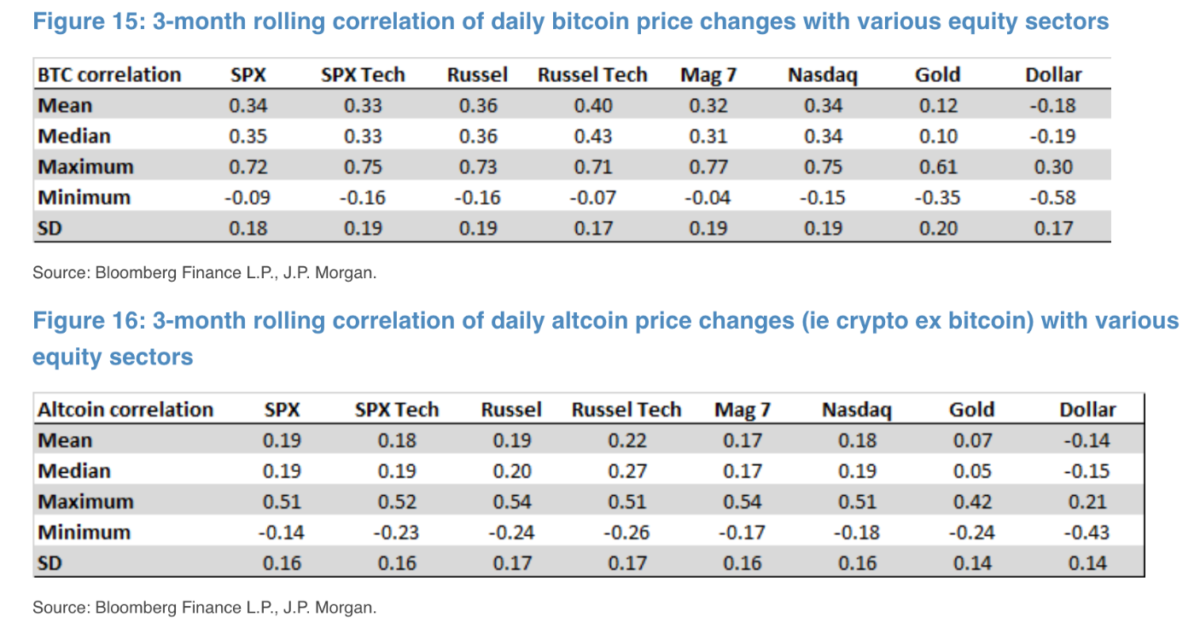

JPMorgan analysts, led by Managing Director Nikolaos Panigirtzoglou, determined that Bitcoin exhibits a higher correlation with the Russell 2000 tech sector than with larger technology firms. Both Bitcoin and altcoins (crypto excluding Bitcoin) follow this pattern, though the correlation remains more pronounced for Bitcoin.

“This is true with both bitcoin and altcoins (i.e., crypto ex-bitcoin), although the correlation is on average higher with the former,” the report stated.

The study pointed out that Bitcoin’s connection to smaller tech firms makes sense, given the sector’s reliance on venture capital and its focus on blockchain and crypto innovation.

The Russell 2000 Index, tracking 2,000 of the smallest publicly traded companies within the Russell 3000, serves as a key benchmark for small-cap firms. Bitcoin’s market behavior aligns more closely with these emerging businesses than with established tech industry leaders.

Crypto-Equity Link Isn’t Breaking—JPMorgan’s Take

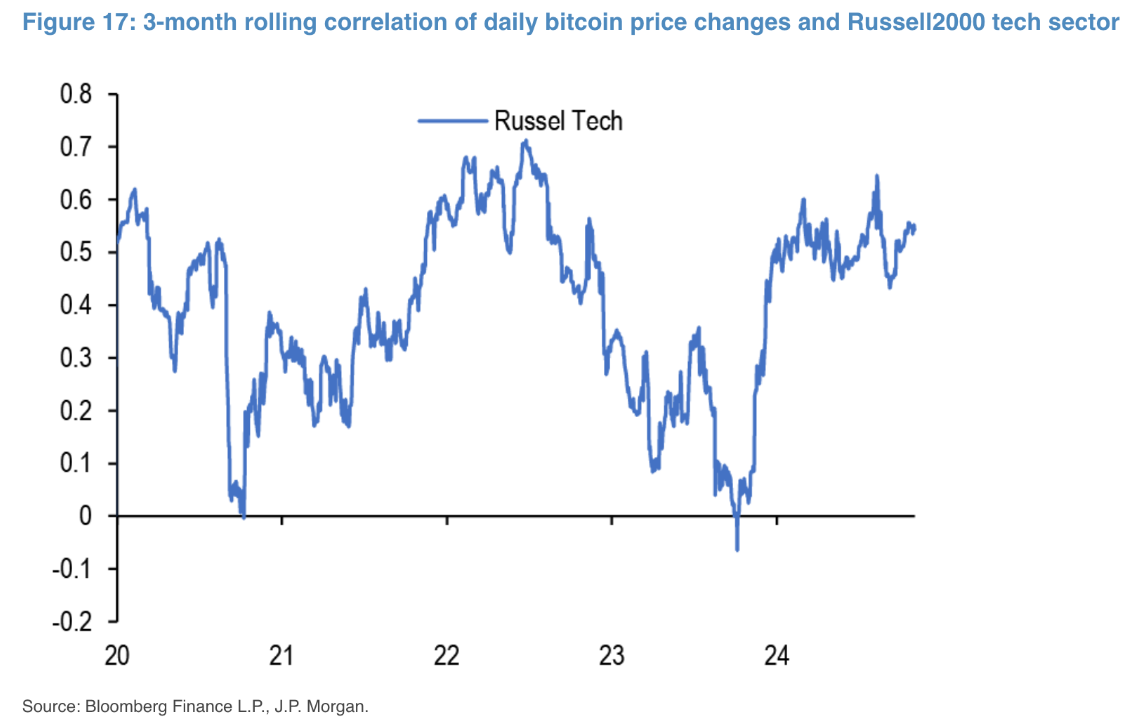

JPMorgan revisited its crypto-equity market research following a sharp correction in both U.S. tech stocks and cryptocurrencies earlier in the week. The analysts noted that the correlation has remained structurally positive since the pandemic, largely due to two key factors: the influence of retail investors who leverage both markets and the tech-driven nature of both industries.

Source: JPMorgan

Source: JPMorganThe research found that Bitcoin’s relationship with equities isn’t static—it fluctuates depending on market conditions. When tech stocks surge, as seen in 2020 and 2024, Bitcoin’s correlation with equities strengthens. The same trend occurs during downturns, such as the sharp sell-offs of 2022.

Source: JPMorgan

Source: JPMorgan“This pattern supports the idea that crypto is fundamentally linked to tech and when the tech sector is subjected to a more significant reassessment by equity investors,” JPMorgan’s analysts noted.

Bitcoin’s Correlation with Equities

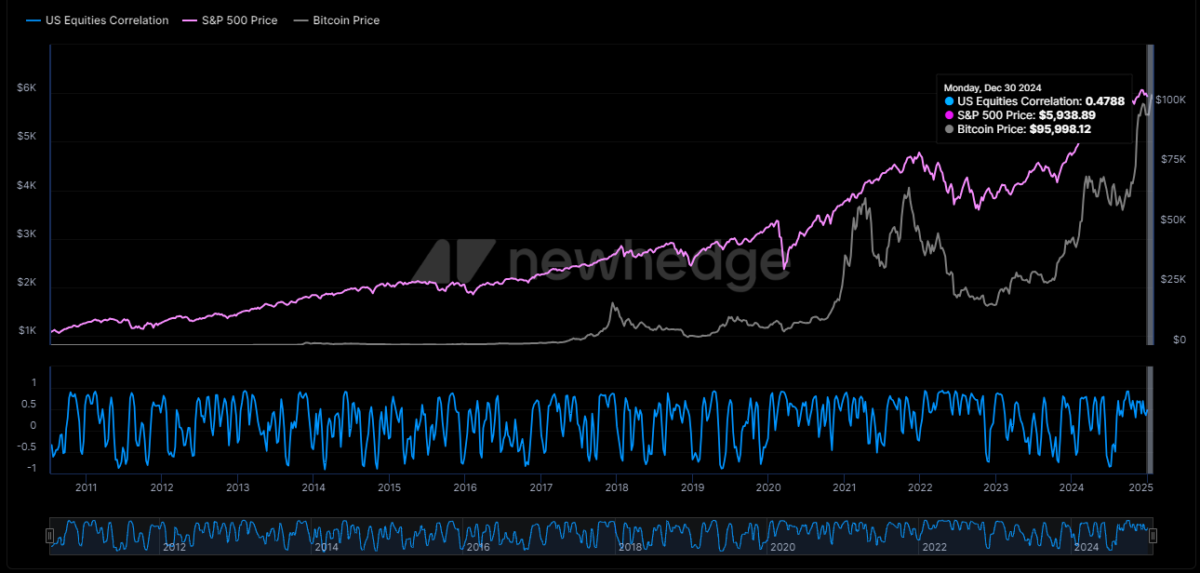

Over the years, Bitcoin’s price journey has been volatile yet upward-trending, soaring from below $1,000 in 2017 to its near-$100K valuation today. In contrast, the S&P 500 has followed a steadier climb from $1,000 in 2010 to its current levels. Newhedge data shows that Bitcoin’s correlation with equities fluctuates between -1 and 1, highlighting its evolving role within traditional finance.

Source: Newhedge

Source: NewhedgeWith a 0.4788 correlation between Bitcoin and equities, the lines between cryptocurrency and traditional markets continue to blur. This rising synchronization suggests that Bitcoin’s presence in institutional portfolios may only grow stronger in the coming years.

Despite Bitcoin’s deepening ties with equities, some market experts emphasize its distinct nature from gold. Mike Maharrey, a market analyst at MoneyMetals.com, argues that gold operates as a true safe-haven asset, whereas Bitcoin remains largely speculative.

.png)

2 hours ago

3

2 hours ago

3

English (US)

English (US)