ARTICLE AD BOX

The cryptocurrency industry faced a tumultuous June 2024, marked by staggering financial losses totalling nearly $200 million due to hacks, scams, and exploits. This unfortunate month ranks among the highest in terms of financial setbacks in crypto history, according to data from CertiK.

The Landscape of Losses

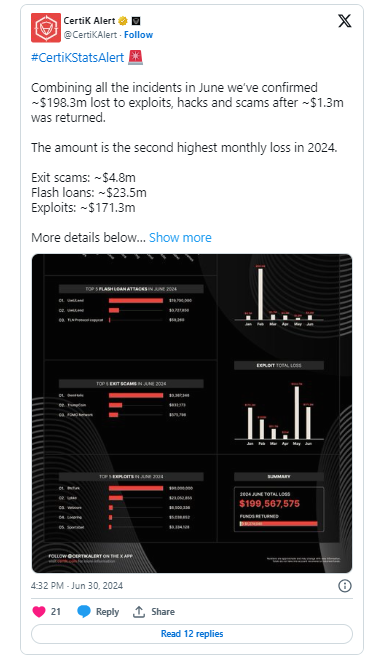

June 2024 saw various vulnerabilities and exploits across decentralized finance (DeFi) platforms, resulting in total losses amounting to approximately $198.3 million. This alarming figure underscores the persistent risks within the crypto ecosystem, highlighting the urgent need for enhanced security measures.

Exploits, Vulnerabilities, and Significant Losses

One of the most significant incidents involved BtcTurk, a Turkish cryptocurrency exchange, which fell victim to a devastating hacker attack that led to losses nearing $90 million. While efforts to recover some funds were made, this event underscores the vulnerabilities that exchanges continue to face.

Exploits alone contributed to around $171.3 million in losses, with DeFi applications proving to be prime targets. These platforms, designed to operate autonomously with minimal human intervention, became magnets for attackers exploiting weaknesses in their protocols.

Flash Loan Attacks: A Growing Threat

Flash loan attacks emerged as a prominent threat in June, causing losses estimated at $23.5 million. This tactic allows malicious actors to borrow large sums of cryptocurrency without collateral, manipulating markets and draining liquidity pools in a single transaction.

Rise of Exit Scams

Exit scams also plagued the crypto community, where project developers vanished with investors’ funds, resulting in losses of approximately $4.8 million. Such fraudulent schemes have exacerbated trust issues among investors and users alike.

Road to Recovery: Successes Amidst Losses

Despite the bleak financial landscape, efforts by security teams and blockchain analytics firms yielded some success. Approximately $1.3 million in stolen funds were recovered, showcasing the effectiveness of proactive security measures and rapid response strategies in mitigating losses.

Looking Ahead: Strengthening Crypto Defenses

June 2024 serves as a stark reminder of the vulnerabilities inherent in the cryptocurrency sector. As the industry continues to expand, so do the risks associated with cyber-attacks. Enhancing security protocols and fostering a culture of proactive risk management are crucial steps toward safeguarding against future threats.

In conclusion, while June brought substantial financial setbacks to the cryptocurrency market, the resilience displayed through recovery efforts and ongoing security enhancements provides optimism for a more secure future. Vigilance and preparedness will be key in navigating the evolving landscape of digital assets.

Also Read: April Marks Lowest Crypto Hack and Scam Losses Since 2021

.png)

4 months ago

5

4 months ago

5

English (US)

English (US)