ARTICLE AD BOX

The post Key US Economic Events This Week: How They Could Impact Crypto Markets appeared first on Coinpedia Fintech News

This week, the US market is expected to witness several important economic events. These events are very crucial because they can influence the course of the cryptocurrency market. The below given are the key economic events this week. Read on!

Prime US Economic Events This Week

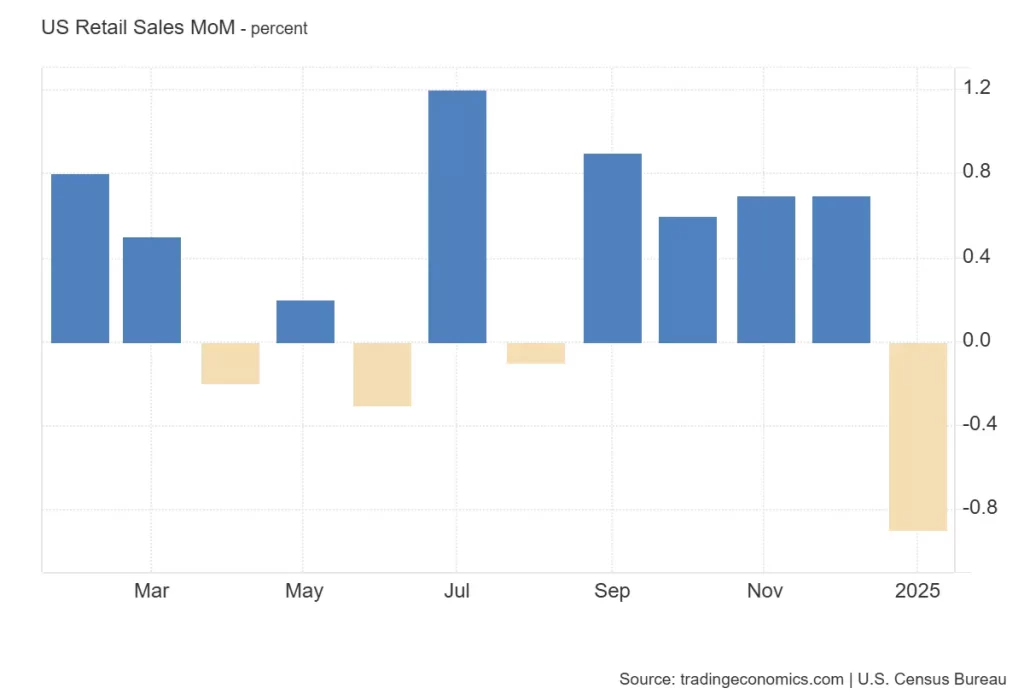

US Retail Sales Index

The US Retail Sales index will be released on Monday. The sales index provides aggregated measures of sales of retail goods and services over a period of month.

In January, it dropped from 0.7% to -0.9%. The consensus expects that it would rise from -0.9% to 0.7%. According to TEForecast, the index would climb to 0.5%.

A rise in the US retail Sales index can signal a strong economy, increasing investor risk appetite. This may lead to more capital flowing into volatile assets like cryptos. Conversely, it can also influence the Fed’s decision regarding interest rates, which can then have an adverse effect on the crypto market.

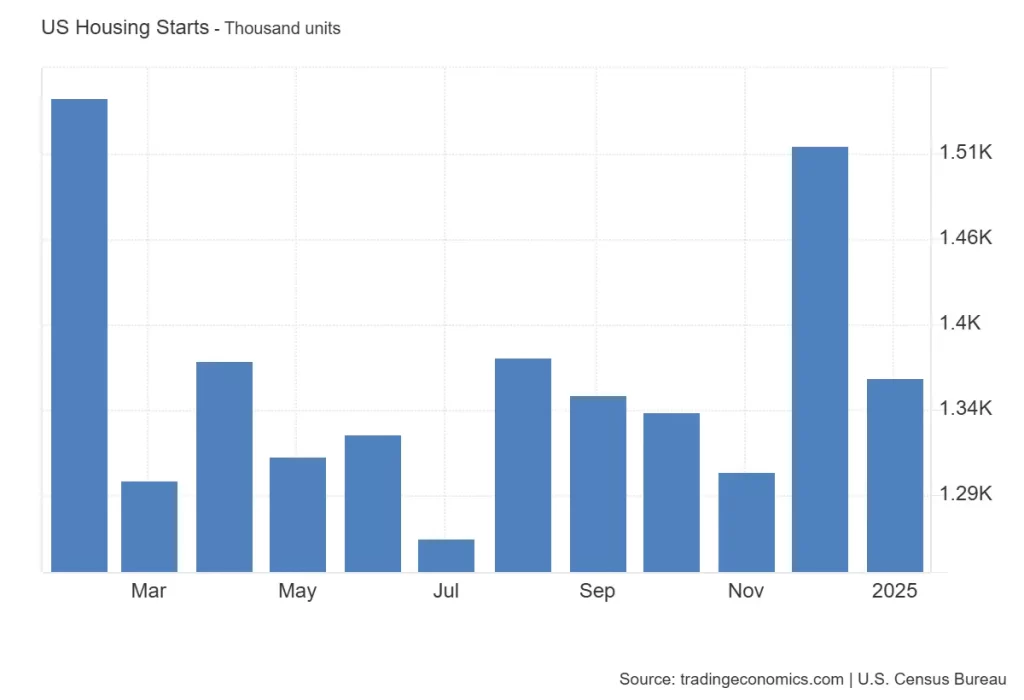

US Housing Starts Index

The US Housing Starts index will be released on Tuesday. The index showcases the number of new residential construction projects that have begun during any particular month.

In January, the index declined from 1.515 million to 1.366 million. The consensus expects that the index would slightly rise from 1.366 million to 1.375 million, Meanwhile, according to TEForecast, it would decline from 1.366 million to 1.34 million.

A rising US Housing starts index indicates economic strength. This could boost investor confidence. However, it may also lead to higher interest rates, impacting crypto negatively.

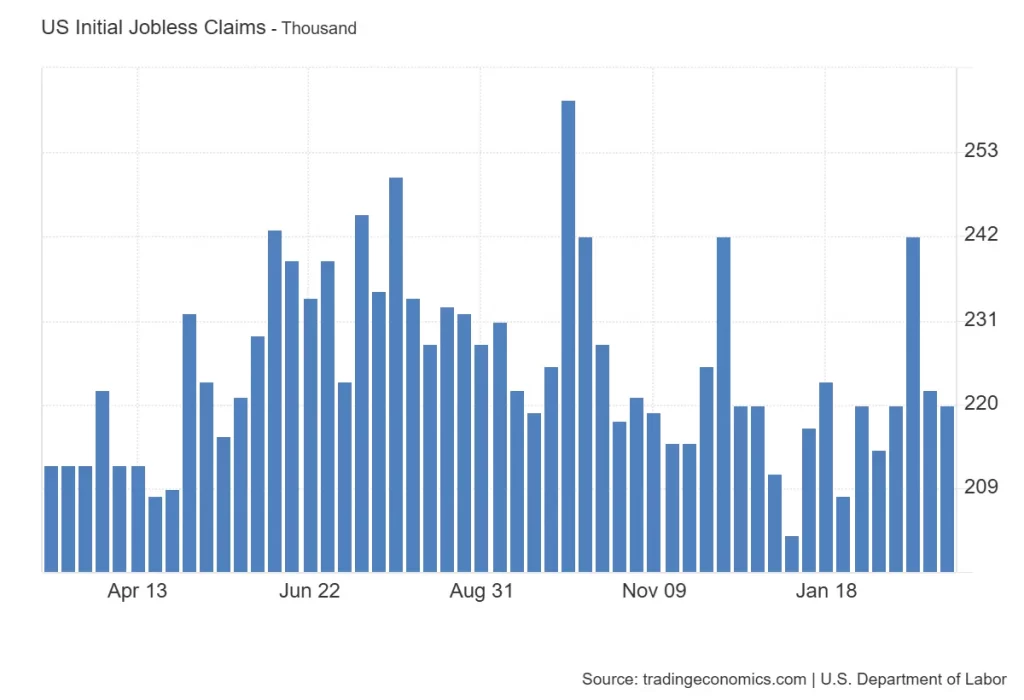

US Initial Jobless Claims Index

The initial jobless claims index will be released on Thursday. The index shows the number of people who have filed for unemployment benefits with their state’s unemployment agency for the first time during a specific reporting period.

In the second week of March, it slipped from 222K to 220K. The consensus estimates that it would grow sharply from 220K to 224K. As per TEForecasts, it would reach as high as 225K.

A rise in US initial jobless claims suggests economic weakness. This could decrease investor confidence. However, it might also delay interest rate hikes.

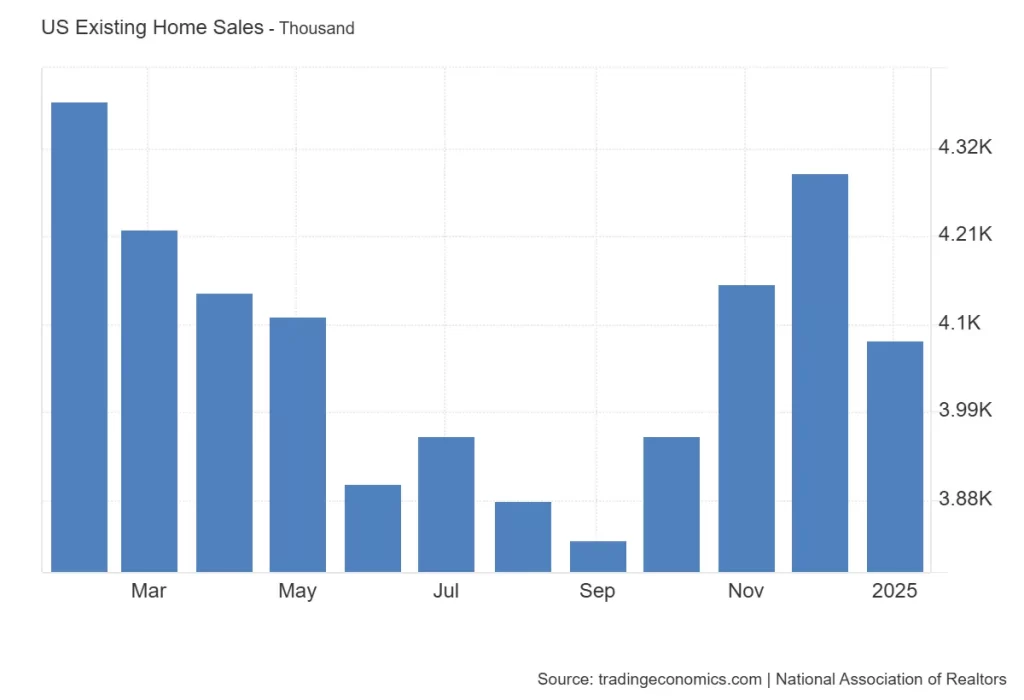

US Existing Home Sales Index

The US Existing Home Sales index is also scheduled to be released on Thursday. In the US, a house sale occurs when its mortgage is closed.

In January, the index decreased from 4.29 million to 4.08 million. The consensus expects that the index would drop to 3.92 million from 4.08 million.

A drop in US existing home sales signals economic slowdown. It may also suggest lower consumer spending. This could affect crypto market sentiment adversely.

US Fed Manufacturing Index

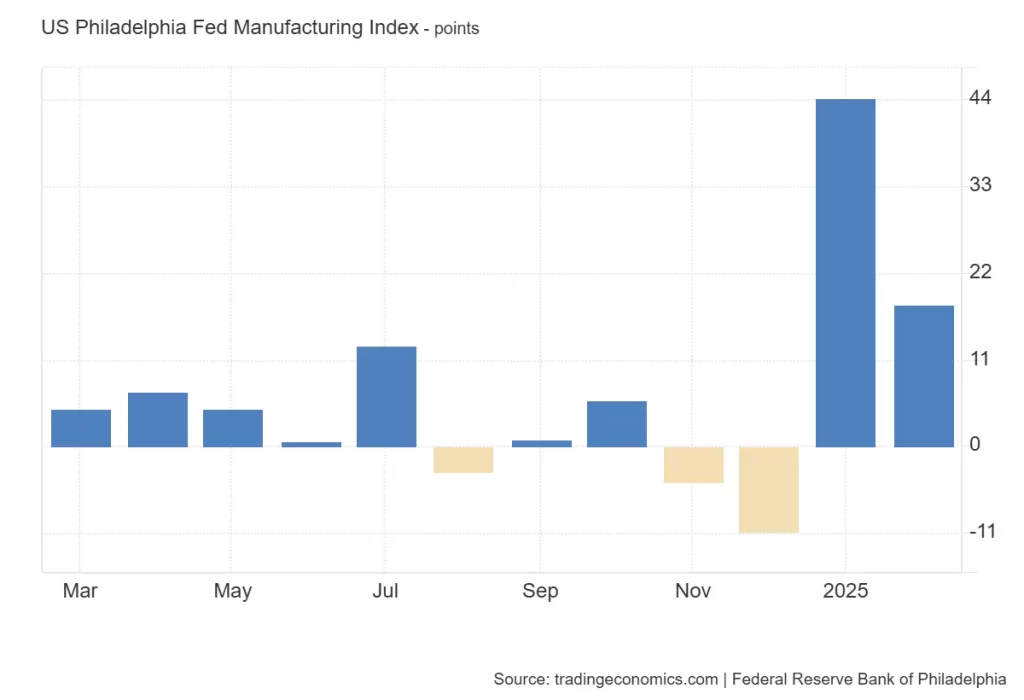

The Philadelphia Fed Manufacturing index is also expected to be released on Thursday. The index is based on The Business Outlook Survey of manufacturers in the Third Federal Reserve District.

In February, it declined from 44.3 points to 18.1 points. The consensus expects that it would drop from 18.1 points to 12.1 points. According to TEForcast, it would decline to 11 points.

A drop in the index signals economic contraction. It also suggests potential economic slowdown. This could impact broader market sentiment and crypto investment.

US Fed Interest Rate Decision

The Federal Open Market Committee is scheduled to meet on Tuesday. They will announce their decision on interest rates on Wednesday.

Experts believe that the US Federal Reserve will leave its interest rates unchanged when its policy committee meets this week.

In a recent speech, Fed Chairman Jerome Powelll hinted that his organisation is taking a wait-and-see approach to interest rates since so many economic policies are up in the air.

.png)

4 hours ago

2

4 hours ago

2

English (US)

English (US)