ARTICLE AD BOX

Martin Mizrahi, CEO of a Las Vegas internet service provider, faces a potential 127-year prison term. Convicted on charges of wire fraud, money laundering, and identity theft, his case underscores the harsh realities of engaging in crypto crimes.

As Mizrahi’s downfall captivates, a global crackdown on similar illicit activities is gaining momentum.

How Mizrahi Conducted Bitcoin Scams

Mizrahi, 53, was found guilty after a 12-day trial in Manhattan federal court. Prosecutors revealed his operation, which used Bitcoin for laundering over $4 million. This sum included $3 million from a New York nonprofit and funds from a Mexican cartel. Furthermore, he executed a credit card fraud scheme, running nearly $8 million in fraudulent charges through his company.

Mizrahi’s scheme, active from February to June 2021, involved sophisticated tactics like email phishing to defraud banks and credit card companies. He claimed ignorance of the funds’ illicit origins, a defense not uncommon in cryptocurrency crime cases. However, the jury found the evidence against him compelling.

Read more: Crypto Social Media Scams: How to Stay Safe

US Attorney Damian Williams emphasized the verdict as a deterrent, highlighting the misuse of Mizrahi’s company for laundering millions.

“The jury’s unanimous verdict sends a resounding message that individuals who steal and introduce illicit funds into the US financial system will be held accountable,” Williams said.

Law Enforcement Cracks Down on Crypto Money Laundering

Concurrently, international efforts to combat cryptocurrency fraud are intensifying. In India, the Enforcement Directorate charged 299 entities, including people of Chinese origin, with deceiving investors under the guise of cryptocurrency mining. This action, originating from an FIR by Kohima Police’s Cyber Crimes Unit, parallels Mizrahi’s deceptive practices.

The narrative of OneCoin adds another layer to this complex issue. Mark Scott, implicated in laundering $400 million from OneCoin, received a decade-long prison sentence in January. Ruta Ignatova and Karl Sebastian Greenwood led the scheme. The authorities sentenced them to 20 years, exemplifying the global challenge of regulating digital finances. Ignatova’s brother was also recently released from a 34-month prison stint for his role in the crime.

These cases unfold against a backdrop of increasing scrutiny on cryptocurrency’s role in financial crimes. They are a part of a broader narrative where digital currencies are scrutinized for their potential misuse.

Read more: 15 Most Common Crypto Scams To Look Out For

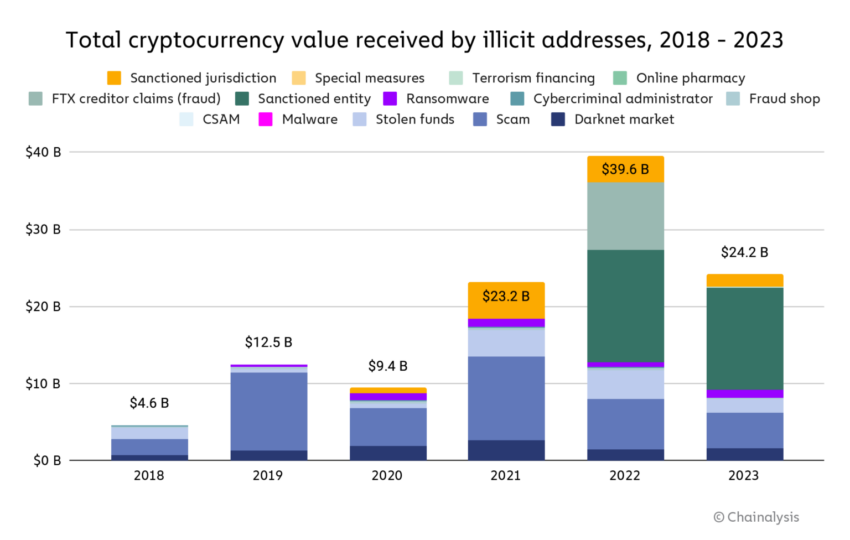

Cryptocurrency Received by Illicit Addresses. Source: Chainalysis

Cryptocurrency Received by Illicit Addresses. Source: ChainalysisInterestingly, despite concerns, studies and reports from entities like the US Treasury Department suggest that traditional cash transactions remain the preferred method for money laundering among criminal organizations due to their anonymity and stability compared to traceable blockchain transactions.

“Criminals use cash-based money laundering strategies in significant part because cash offers anonymity. They commonly use US currency due to its wide acceptance and stability,” the US Treasury said.

The post Las Vegas CEO Faces 127-Year Sentence for $4M Bitcoin Drug Cartel Laundering appeared first on BeInCrypto.

.png)

8 months ago

4

8 months ago

4

English (US)

English (US)