ARTICLE AD BOX

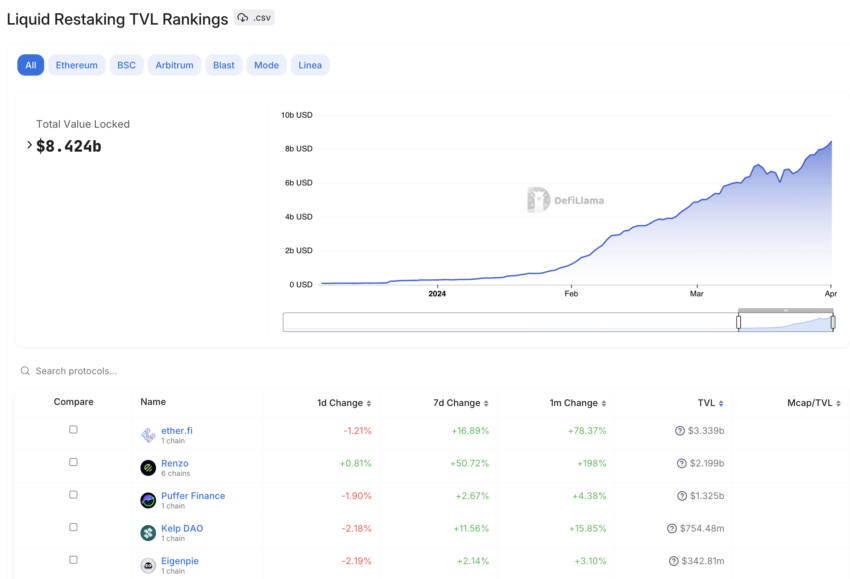

The decentralized finance (DeFi) sector is witnessing a transformative trend, with liquid restaking tokens (LRTs) reaching a staggering total value locked (TVL) of nearly $8.5 billion.

This surge highlights a broader narrative within the DeFi ecosystem, suggesting a shift in investment dynamics.

Which Liquid Restaking Protocols Are Contributing to TVL Growth?

Leading this charge is EtherFi, which alone commands a TVL exceeding $3.3 billion. Consequently, protocols like Renzo, Kelp, and Puffer are also experiencing unprecedented growth.

Etherfi’s dominance, followed closely by Renzo with $2.2 billion and Puffer at $1.3 billion, signifies a robust market appetite for liquid restaking. Moreover, Kelp and EigenPie contribute significantly, with TVL of over $750 million and $342 million, respectively.

“Liquid restaking protocols now control almost 5% of staked Ethereum, most of which was staked in 2024,” pseudonymous DeFi researcher Hildobby said.

Read more: Ethereum Restaking: What Is It And How Does It Work?

Liquid Restaking TVL Rankings. Source: DefiLlama

Liquid Restaking TVL Rankings. Source: DefiLlamaImportantly, the adoption of EigenLayer is central to this trend. It facilitates restaking, allowing users to maintain access to their funds, which boosts the TVL in these protocols.

Furthermore, EigenLayer has become a pivotal element in this ecosystem, with its TVL now surpassing $12.4 billion. The protocol’s strategy to leverage these funds for enhancing network security is noteworthy.

Specifically, since February 2024, EigenLayer and other restaking platforms started attracting community attention. A report by BeInCrypto highlighted a remarkable 171% increase in EigenLayer’s TVL in just one week in February, underscoring the market’s enthusiasm for liquid restaking.

Despite a temporary halt in restaking deposits on EigenLayer, the interest in LRTs remains high. Protocols like EtherFi, Renzo, and Kelp continue to attract ether deposits for restaking, promising additional rewards through Eigen. This move has maintained momentum and bolstered the growth of liquid restaking.

The allure of an EigenLayer airdrop has further invigorated the DeFi community. Many are depositing staked Ethereum into EigenLayer to improve their airdrop prospects. This strategy is indicative of the evolving tactics within the DeFi sector aimed at maximizing returns.

Read more: What Is EigenLayer?

The consistent increase in TVL and strategic restaking practices indeed highlights the emerging potential of liquid restaking as a pivotal narrative in the DeFi space.

“Liquid restaking is the main narrative for the next decade,” DeFi analyst Chrome said.

The post Liquid Restaking Total Value Locked Surpasses $8.4 Billion: Next Big Narrative? appeared first on BeInCrypto.

.png)

7 months ago

4

7 months ago

4

English (US)

English (US)