ARTICLE AD BOX

- Litecoin (LTC) has undergone significant price volatility recently, initially surging by 40% but then experiencing an equivalent correction within a week.

- Declines in both active addresses and transactions suggest a waning interest in the Litecoin network.

- This critical juncture sees Litecoin potentially entering a period of price adjustment before stabilization.

Litecoin (LTC), the popular cryptocurrency often referred to as the “silver to Bitcoin’s gold,” has recently experienced a rollercoaster ride in terms of price action.

After witnessing a remarkable 40% increase, LTC quickly encountered an equal correction over a week, leaving investors and analysts questioning the future trends of the digital asset.

The decrease in active addresses and transactions indicates a declining interest in the Litecoin network, while bearish signals from the Exponential Moving Average (EMA) crosslines hint at a possible upcoming downtrend.

These developments have brought Litecoin to a critical juncture, as the cryptocurrency might be entering a price adjustment period before stabilizing. Investors are closely monitoring the situation to determine whether LTC can overcome these bearish trends or if it will face further corrections in the near future.

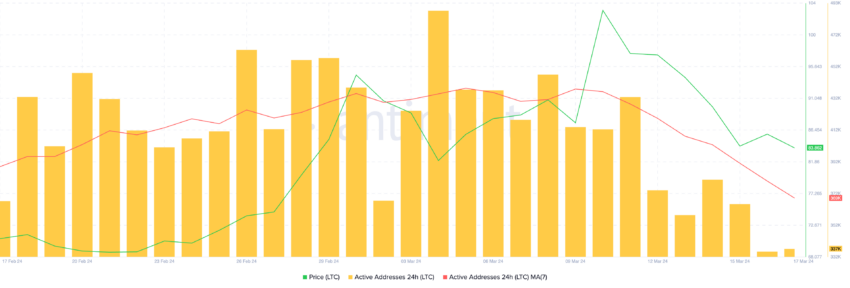

Litecoin Active Addresses Heavily Decreasing

Active addresses serve as a crucial metric for gauging users’ interest in a given network. During January 2024, Litecoin consistently maintained over 1 million daily active addresses, showcasing a strong level of engagement. Interestingly, this heightened activity did not translate into significant price growth, as LTC prices remained relatively stable throughout that period.

However, the following months saw a dramatic shift in Litecoin’s price trajectory. From February 5 to March 10, LTC surged from $72 to $104, marking a substantial increase. Intriguingly, the number of active addresses began to decline sharply since the price peak on March 10, falling from 413,000 to 335,000 within a single week.

In addition to active addresses, the number of transactions serves as another vital on-chain indicator. Litecoin’s transaction history mirrors the trend observed in active addresses.

During the period from December 2023 to January 2024, Litecoin consistently logged over 400,000 daily transactions, occasionally exceeding the 1 million mark on certain days. Despite this substantial network activity, the price of LTC remained stable throughout this timeframe.

A closer examination of LTC’s 4-hour price chart reveals a current support level at $83. If this support fails to hold, Litecoin could potentially face a new correction, with a possible 12% decrease to $72.

.png)

9 months ago

5

9 months ago

5

English (US)

English (US)