ARTICLE AD BOX

- Jim Cramer emphasized Bitcoin’s value in portfolios but refrained from elaborating on his stance against MicroStrategy.

- MicroStrategy, the world’s largest Bitcoin holder, owns over 417,107 BTC worth over $48 billion.

During CNBC’s Mad Money show on Monday night, former hedge fund manager Jim Cramer called investors to own Bitcoin (BTC)instead of MicroStrategy (MSTR). Throughout 2024, the Bitcoin proxy bet MSTR, which is up 560% on the yearly chart, outperformed BTC, which is up by 147% during the same period.

Own Bitcoin, But Not MicroStrategy – Jim Cramer

While responding to a caller during the Mad Money show, Cramer said: “If you want to own Bitcoin, (you) own Bitcoin. I own Bitcoin, you should own Bitcoin. Bitcoin is a great thing to have in your portfolio. But not MicroStrategy,” he ended without offering any further explanation.

MicroStrategy remains the largest Bitcoin holder globally, with over 417,107 BTC in its treasury, valued at more than $48 billion at current prices as of Monday. Yesterday, the firm declared buying an additional 10,107 BTC with an investment value of $1.1 billion, as detailed in our last news piece.

Interestingly, some market watchers are optimistic about Bitcoin’s future, partly due to the so-called “Inverse Cramer” phenomenon. CNBC host Jim Cramer has historically been perceived as an unintentional contrarian indicator, with his picks often performing opposite to his predictions over time. This inspired the creation of a short-lived “Inverse Cramer ETF” in 2022, which was discontinued in early 2024.

Last year, in January 2024, during the approval of spot Bitcoin ETF, Cramer suggested that the Bitcoin price had peaked while advising users to sell the asset. However, over the past year, BTC has appreciated by 147% and is currently trading at $102,400 levels.

Where’s BTC Price Heading Next?

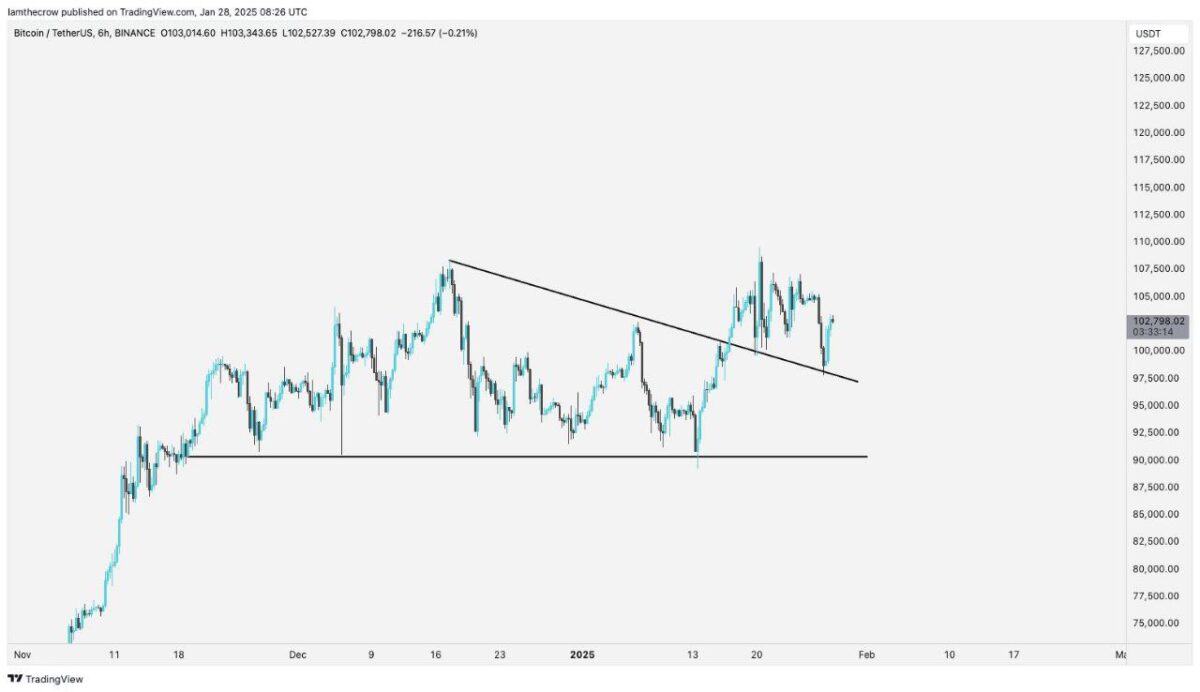

For a while, the BTC price has been consolidating in the range of $101K-$106K. On Monday, Bitcoin took a dive under $100K staying there for a few hours, before recovering back, as mentioned previously in our report.

Bitcoin’s price has surged past the $103,000 mark despite recent market volatility triggered by the rise of DeepSeek, a China-based AI model. The surge follows a market sell-off spurred by investor concerns over DeepSeek’s growing influence, which has led to its rapid rise in popularity, even surpassing OpenAI’s ChatGPT, as highlighted in our previous article.

As shown in the below image, the BTC price has bounced back from the falling wedge pattern. As long as Bitcoin continues to hold above this support, it can rally higher, hitting fresh all-time highs. Popular crypto analyst Crypto Diplomat noted: “I have a strong feeling that $BTC will achieve a new all-time high this week.”

Source: Crypto Diplomat

Source: Crypto Diplomat.png)

1 day ago

1

1 day ago

1

English (US)

English (US)