ARTICLE AD BOX

The post Monthly Bitcoin ETF Tracker: Analysing Market Performance appeared first on Coinpedia Fintech News

Bitcoin ETFs are making waves right now, with the US SEC recently greenlighting around 11 Bitcoin Spot ETFs, including those from BlockRock, Fidelity and Invesco.

In this report, we delve into a comprehensive analysis of how Bitcoin ETFs have performed this month, using top-notch data sources. Our focus is not just on spot ETFs but also extends to Bitcoin Futures ETFs. Join us as we explore the performance trends, offering a detailed look at the current state of Bitcoin ETFs in the market.

This monthly report aims to provide a clear and straightforward understanding of the latest developments in the world of Bitcoin Exchange-Traded Funds.

1. Bitcoin Futures ETF In-Depth Analysis

At the time of writing this report, ProShares Bitcoin Strategy ETF, VanECk Bitcoin Strategy ETF, Valkyrie Bitcoin and Ether Strategy ETF, Global X Blockchain & Bitcoin Strategy ETF, and Ark/21 Shares are the top players in the Bitcoin Futures ETF market, on the basis of Asset Under Management.

| Bitcoin Futures ETF | AUM |

| ProShares Bitcoin Strategy ETF | $2.28B |

| VanEck Bitcoin Strategy ETF | $58.30M |

| Valkyrie Bitcoin and Ether Strategy ETF | $38.20M |

| Global X Blockchain & Bitcoin Strategy ETF | $26.10M |

| Ark/21 Shares | $8.01M |

ProShares Bitcoin Strategy ETF leads in Bitcoin futures with a substantial $2.28 billion in Asset Under Management (AUM). In comparison, VanEck Bitcoin Strategy ETF follows with $58.30 million, trailed by Valkyrie Bitcoin and Ether Strategy ETF at $38.20 million, Global X Blockchain & Bitcoin Strategy ETF at $26.10 million, and ARK/21 Shares with $8.01 million AUM.

Let’s analyse these top players deeply using various parameters.

1.1. Bitcoin Futures ETF: A Basic Data Overview

| Bitcoin Futures ETF | Price | Volume | 1 Month Average Volume | AUM | Shares |

| ProShares Bitcoin Strategy ETF | $19.39 | 26,299,600 | 28,165,564 | $2.28B | 93.3M |

| VanEck Bitcoin Strategy ETF | $36.79 | 51,400 | 51,295 | $58.30M | 1.3M |

| Valkyrie Bitcoin and Ether Strategy ETF | $13.13 | 117,400 | 141,276 | 38.20M | 2.8M |

| Global X Blockchain & Bitcoin Strategy ETF | $43.88 | 3,400 | 17,100 | $26.10M | 0.3M |

| Ark/21 Shares | $39.66 | 7,400 | 33,200 | $8.01M | 0.3M |

1.2. Bitcoin Futures ETF Monthly Average Volume Analysis

Bitcoin Futures ETF Monthly Average Volume Analysis

Bitcoin Futures ETF Monthly Average Volume Analysis| Bitcoin Futures ETF | 1 Month Average Volume |

| ProShares Bitcoin Strategy ETF | 28,165,564 |

| VanEck Bitcoin Strategy ETF | 51,295 |

| Valkyrie Bitcoin and Ether Strategy ETF | 141,276 |

| Global X Blockchain & Bitcoin Strategy ETF | 17,100 |

| Ark/21 Shares | 33,200 |

Among the top five Bitcoin Futures ETF with high AUM, ProShares Bitcoin Strategy ETF leads with a robust 1-month average volume of 28,165,564. It is followed by Valkyrie Bitcoin and Ether Strategy ETF (141, 276), VanEck Bitcoin Strategy ETF (51,295), Ark/21 Shares (33,200), and Global X Blockchain & Bitcoin Strategy ETF (17,100). Higher average volumes signal increased market activity, reflecting strong investor interest in these ETFs.

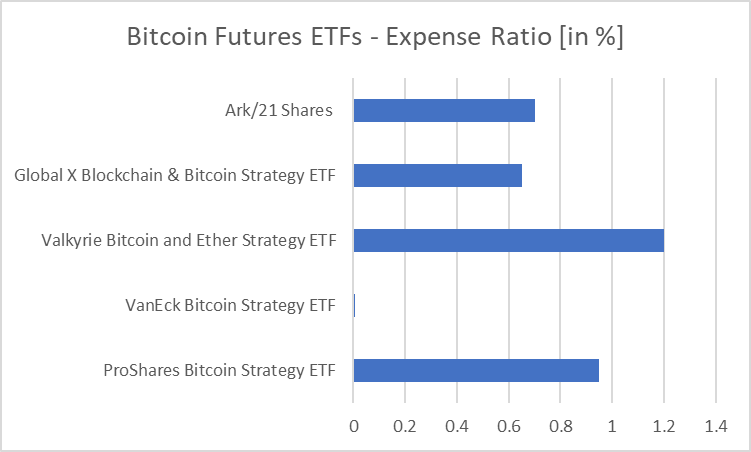

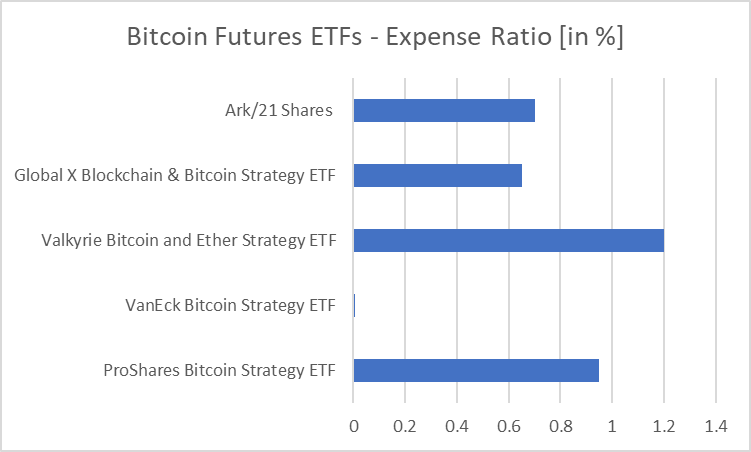

1.3. Bitcoin Futures ETF Expense Ratio Analysis

Bitcoin Futures ETF Expense Ratio Analysis

Bitcoin Futures ETF Expense Ratio Analysis| Bitcoin Futures ETF | Expense Ratio |

| ProShares Bitcoin Strategy ETF | 0.95% |

| VanEck Bitcoin Strategy ETF | 0.76% |

| Valkyrie Bitcoin and Ether Strategy ETF | 1.20% |

| Global X Blockchain & Bitcoin Strategy ETF | 0.65% |

| Ark/21 Shares | 0.70% |

Examining the expense ratios of top Bitcoin Futures ETFs by AUM reveals varied cost structures. Valkyrie Bitcoin and Ether Strategy ETF carries the highest expense ratio at 1.20%, potentially impacting investor returns, Meanwhile, Global X Blockchain & Bitcoin Strategy ETF boasts a competitive 0.65% ratio. Considering these expense ratios, alongside performance metrics, can help investors develop cost efficient investment strategies.

1.4. Bitcoin Futures ETF Performance Analysis

Bitcoin Futures ETF Performance Analysis

Bitcoin Futures ETF Performance Analysis| Bitcoin Futures ETF | 1 Month Return |

| ProShares Bitcoin Strategy ETF | -2.51% |

| VanEck Bitcoin Strategy ETF | -1.81% |

| Valkyrie Bitcoin and Ether Strategy ETF | +5.34% |

| Global X Blockchain & Bitcoin Strategy ETF | -11.38% |

| Ark/21 Shares | -2.26% |

Recent performance highlights disparities among top Bitcoin Futures ETFs by AUM. Valkyrie Bitcoin and Ether Strategy ETF outshines others with a positive 1-month return of +5.34%, suggesting relative strength in its underlying assets. Conversely, Global X Blockchain & Bitcoin Strategy ETF faces a notable -11.38% return, indicating a period of underperformance. Investors should evaluate these returns in conjunction with other metrics for a comprehensive assessment.

1.5. Bitcoin Futures ETF One Month Net Fund Flow Analysis

Bitcoin Futures ETF One Month Net Fund Flow Analysis

Bitcoin Futures ETF One Month Net Fund Flow Analysis| Bitcoin Futures ETF | One Month Net Fund Flow |

| ProShares Bitcoin Strategy ETF | +352.37M |

| VanEck Bitcoin Strategy ETF | -17.75M |

| Valkyrie Bitcoin and Ether Strategy ETF | +3.59M |

| Global X Blockchain & Bitcoin Strategy ETF | -2.75M |

| Ark/21 Shares | +6.44M |

Analysing One-Month Net Fund Flow in top Bitcoin Futures ETFs reveals diverse investor activity. ProShares Bitcoin Strategy ETF leads with a substantial inflow of +352.37M, signalling strong investor interest. Valkyrie Bitcoin and Ether Strategy, and Ark/21 Shares also saw positive flow at +3.59M, and +6.44M, respectively. However, VanEck Bitcoin Strategy ETF, and Global X Blockchain & Bitcoin Strategy ETF experienced negative flows of -17.75M, and -2.75M, respectively. Analysing One-Month Net Fund Flow is crucial for Bitcoin Futures ETF analysis as it measures investor sentiment and fund popularity. Positive flows suggest strong interest, while negative flows may indicate potential concerns or shifts in market sentiment.

1.6. Bitcoin Futures ETF Technical Analysis

| Bitcoin Futures ETF | Price | RSI (30 Days) | 20 Day Moving Average | MACD (15 Days) | Williams % Range (20 Days) |

| ProShares Bitcoin Strategy ETF | $19.39 | 52 | $21.30 | -1.22 | 85.49 |

| VanEck Bitcoin Strategy ETF | $36.79 | 52 | $39.91 | -2.04 | 88.01 |

| Valkyrie Bitcoin and Ether Strategy ETF | $13.13 | 55 | $13.85 | -0.19 | 72.20 |

| Global X Blockchain & Bitcoin Strategy ETF | $43.88 | 49 | $52.69 | -7.25 | 90.58 |

| Ark/21 Shares | $39.66 | 54 | $43.58 | -2.43 | 85.33 |

Analysing the technical indicators for the top five Bitcoin Futures ETFs by AUM reveals insightful trends.

Starting with the ProShares Bitcoin Strategy ETF, it presents a neutral stance with an RSI of 52. However, the 20-day moving average at $21.30 is above the current price of $19.39, accompanied by a negative MACD of -1.22 and a high Willams % Range of 85.49. These factors collectively suggest a potential bearish trend.

The VanEck Bitcoin Strategy ETF follows a similar pattern, indicating a neutral RSI of 52. The 20-day moving average is at $39.91, slightly higher than the current price of $36.79, with a negative MACD of -2.04 and a William % Range of 88.01, pointing towards a potential bearish momentum.

Contrarily, the Valkyrie Bitcoin and Ether Strategy ETF show a relatively stronger position with an RSI of 55 and a 20-day moving average at $13.85, which is above the current price of $13.13. The MACD is slightly negative at -0.19 and the Williams % Range at 72.20 suggests a more balanced market sentiment.

The Global X Blockchain & Bitcoin Strategy ETF exhibits a bearish scenario with an RSI of 49. The 20-day moving average is at $52.69, considerably higher than the current price of $43.88. A negative MACD of -7.25 and a higher Willams % Range of 90.58 indicate a potential oversold condition and a bearish trend.

Finally, Ark/21 Shares present a neutral-to-bullish stance with an RSI of 54. The 20-day moving average is at $43.58, slightly above the current price of $38.66. The negative MACD of -2.43 and Williams % Range of 85.33 suggests caution, indicating a possible corrective phase.

2. Bitcoin Spot ETF In-Depth Analysis

At the time of writing this report, Grayscale Bitcoin Trust, iShare Bitcoin Trust, Wise Origin Bitcoin Trust by Fidelity, Bitwise Bitcoin ETP, and Ark/21 Shares Bitcoin Trust are the top players in the Bitcoin Spot ETF market on the basis of Asset Under Management.

| Bitcoin Spot ETF | AUM |

| Grayscale Bitcoin Trust | $22.94B |

| iShare Bitcoin Trust | $1.40B |

| Wise Origin Bitcoin Trust by Fidelity | $1.26B |

| Bitwise Bitcoin ETP | $425.40M |

| Ark/21 Shares Bitcoin Trust | $379.60M |

Grayscale Bitcoin Trust leads Bitcoin spot ETFs with a substantial $22.94 billion in Asset Under Management (AUM). Following behind are iShare Bitcoin Trust at $1.40 billion, Wise Origin Bitcoin Trust by Fidelity with $1.26 billion, Bitwise Bitcoin ETP at $425.40 million, and Ark/21 Shares Bitcoin Trust at $379.60 million AUM.

Let’s analyse these top players using various parameters.

2.1. Bitcoin Spot ETF: A Basic Data Overview

| Bitcoin Spot ETF | Price | Volume | AUM | Shares |

| Grayscale Bitcoin Trust | $35.82 | 30,142,100 | $22.94B | 634.2M |

| iShare Bitcoin Trust | $22.95 | 17,222,000 | $1.40B | 50.2M |

| Wise Origin Bitcoin Trust by Fidelity | $35.18 | 11,640,300 | $1.26B | 28.4M |

| Bitwise Bitcoin ETP | $21.97 | 2,279,900 | $425.40M | 16.1M |

| Ark/21 Shares Bitcoin Trust | $40.21 | 3,238,200 | $379.60M | 7.6M |

2.2. Bitcoin Spot ETF Average Volume Analysis

| Bitcoin Spot ETF | 10 Day Average Volume |

| Grayscale Bitcoin Trust | 18.17M |

| iShare Bitcoin Trust | 9.58M |

| Wise Origin Bitcoin Trust by Fidelity | 6.26M |

| Bitwise Bitcoin ETF | 1.63M |

| Ark/21 Shares Bitcoin Trust | 1.51M |

Examining the 10-day Average Volume of prominent Bitcoin Spot ETFs by AUM, Grayscale Bitcoin Trust leads with 18.17M, indicating robust market activity. iShare follows with 9.58M, while Wise Origin Bitcoin Trust by Fidelity, Bitwise Bitcoin ETF, and Ark/21 Shares Bitcoin Trust report 6.26M, 1.63M, and 1.51M, respectively. Higher average volumes generally signify increased liquidity and investor interest. Investors seeking active markets may find Grayscale Bitcoin Trust and iShare more favourable due to their higher volumes, allowing for smoother transactions.

2.3. Bitcoin Spot ETF Expense Ratio Analysis

| Bitcoin Spot ETF | Fees | Expense Ratio |

| Grayscale Bitcoin Trust | 1.50% | 1.50% |

| iShare Bitcoin Trust | 0.25% | 0.25% |

| Wise Origin Bitcoin Trust by Fidelity | 0.25% | 0.25% |

| Bitwise Bitcoin ETP | 0.20% | 0.20% |

| Ark/21 Shares Bitcoin Trust | 0.21% | 0.21% |

Among the top Bitcoin Spot ETFs by AUM, Grayscale Bitcoin Trust Charges the highest fee at 1.50%, followed by iShare and Wise Origin Bitcoin Trust by Fidelity, both with a 0.25% fee. Bitwise Bitcoin ETP offers a relatively lower fee of 0.20%, making it an attractive option for cost-conscious investors.

Notably, iShare presents a temporary 0.12% discount for the first $5 billion in assets during the initial 12 months post-launch. Additionally, Arl/21 Shares maintains zero fees for the first six months or until reaching $1 billion in assets, further enhancing investor incentives.

It is important to consider fee structure to optimise investment returns.

2.4. Bitcoin Spot ETF Performance Analysis

| Bitcoin Spot ETF | One Month Return |

| Grayscale Bitcoin Trust | +7.15% |

| iShare Bitcoin Trust | -10.63% |

| Wise Origin Bitcoin Trust by Fidelity | -10.74% |

| Bitwise Bitcoin ETP | -11.00% |

| Ark/21 Shares Bitcoin Trust | -10.76% |

Analysing the One-Month Return of top Bitcoin Spot ETFs by AUM reveals varied performance. Grayscale Bitcoin Trust led with a positive return of +7.15%, showcasing strength. However, iShare, Wise Origin Bitcoin Trust, Bitwise Bitcoin ETO, and Ark/21 Shares Bitcoin Trust experienced negative returns of -10.63%, -10.74%, -11.00%, and -10.76%, respectively. The negative trend may be attributed to market fluctuations. Diversification and risk management remain crucial in navigating the volatility associated with ETF investments.

2.5. Bitcoin Spot ETF Net Fund Flow Analysis

| Bitcoin Spot ETF | Net Fund Flow |

| Grayscale Bitcoin Trust | -2.12 |

| iShare Bitcoin Trust | +1.30 |

| Wise Origin Bitcoin Trust by Fidelity | +1.29 |

| Bitwise Bitcoin ETF | +0.39 |

| Ark/21 Shares Bitcoin Trust | +0.06 |

Analysing One-Month Net Fund Flow among top Bitcoin Spot ETFs reveals dynamic investor activity, Grayscale Bitcoin Trust experienced the largest outflow at -2.12B, while iShare, Wise Origin Bitcoin Trust, Bitwise Bitcoin ETF, and Ark/21 Shares reported positive flows of +1.32B, +1.29B, +369.75M, and +60.42M respectively. The goal of the analysis is to understand investor sentiment, fund popularity, and potential market trends. Positive flows indicate investor confidence, while negative flows may signal concerns or changing preferences.

.png)

1 year ago

17

1 year ago

17

English (US)

English (US)