ARTICLE AD BOX

Morgan Stanley announced on Friday that it will soon allow its financial advisors to offer Bitcoin ETFs to certain clients, making it the first major Wall Street bank to do so.

Starting Wednesday, the firm’s 15,000 financial advisors can offer eligible clients shares of two Bitcoin exchange-traded funds: BlackRock’s iShares Bitcoin Trust and Fidelity’s Wise Origin Bitcoin Fund.

Morgan Stanley Allows Bitcoin ETF Pitches to Clients

This move by Morgan Stanley, one of the largest wealth management firms globally, signifies an important step in the adoption of Bitcoin by mainstream finance. In January, the US Securities and Exchange Commission (SEC) approved applications for 11 spot Bitcoin ETFs. This made the largest cryptocurrency more accessible, affordable, and easier to trade.

“This move is in response to client demand and our desire to keep pace with the evolving digital asset marketplace,” CNBC reported, referring to a source familiar with the bank’s policies.

Initially, major Wall Street wealth management businesses were cautious, not allowing their advisors to pitch the new ETFs. Goldman Sachs, JPMorgan, Bank of America, and Wells Fargo still follow this policy.

Read more: Crypto ETN vs. Crypto ETF: What Is the Difference?

Morgan Stanley’s decision was driven by high client demand. However, the bank remains cautious in its approach. Only clients with a net worth of at least $1.5 million, a high risk tolerance, and an interest in speculative investments are eligible for Bitcoin ETF solicitations. These investments are limited to taxable brokerage accounts, not retirement accounts.

The bank will monitor clients’ crypto holdings to ensure they do not have excessive exposure to this volatile asset class. Currently, the only approved crypto investments at Morgan Stanley are the Bitcoin ETFs from BlackRock and Fidelity.

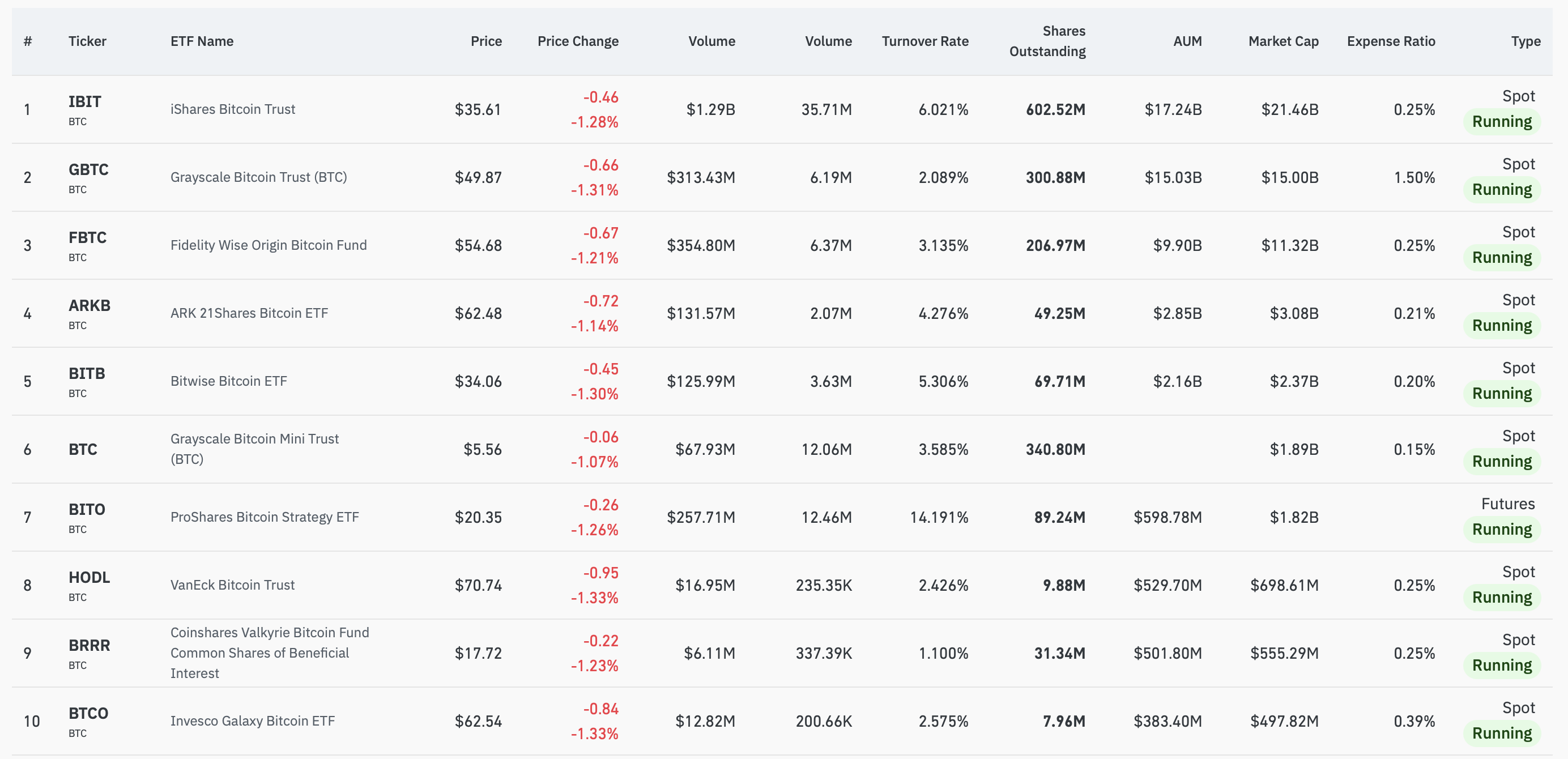

BlackRock’s IBIT has amassed nearly $18 billion in assets since its inception, while Fidelity’s FBTC has gathered $11 billion. Collectively, US Bitcoin ETFs’ assets under management surpass $49 billion.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Top 10 Bitcoin ETFs in US. Source: Coinglass

Top 10 Bitcoin ETFs in US. Source: CoinglassEarlier this year, Morgan Stanley phased out private funds from Galaxy and FS NYDIG, which had been available since 2021. The bank is also observing the market for newly approved Ethereum ETFs and has not yet decided whether it will offer access to those.

The post Morgan Stanley’s Wealth Advisors to Offer Bitcoin ETFs appeared first on BeInCrypto.

.png)

3 months ago

1

3 months ago

1

English (US)

English (US)