ARTICLE AD BOX

Ondo Finance (ONDO) has been experiencing heavy selling pressure and heightened volatility, as the broader crypto market continues its downward trend. Since the start of March, ONDO has lost over 40% of its value, reflecting the overall risk-off sentiment in the market. With fear dominating price action, analysts are warning of further declines as investors remain hesitant to re-enter long positions.

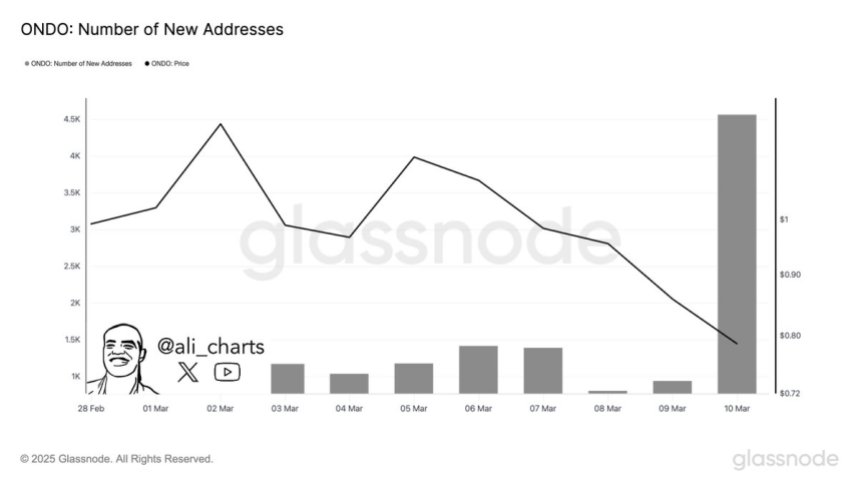

Despite the ongoing downtrend, on-chain data from Glassnode reveals a notable shift in network activity. In the past 24 hours, new ONDO addresses surged by 390%. This spike in new addresses suggests that interest in Ondo Finance is growing, even as price action remains weak. Historically, increased network activity can be a precursor to stronger adoption, potentially setting up the price for a recovery in the long run.

With market sentiment still leaning bearish, the coming days will be crucial for ONDO’s short-term price trajectory. Investors are closely watching whether the rising network activity translates into renewed demand or if selling pressure will continue to weigh on price action.

ONDO Leads The RWA Market Despite Volatility

Over the past year, Ondo Finance has established itself as one of the leading crypto projects, securing its position as the real-world assets (RWA) market leader. The project has gained significant traction by offering tokenized financial products, bridging traditional finance with blockchain technology.

Recently, they took a major step forward by unveiling Ondo Chain, a permissioned Layer-1 blockchain designed for institutional finance. This innovation aims to bring regulated institutions into the digital asset space, enhancing efficiency and security while ensuring compliance with financial regulations.

Top analyst Ali Martinez shared insights on X, revealing that new ONDO addresses surged 390% in just 24 hours, increasing from 935 to 4,559. This spike in network activity could indicate a shift in investor sentiment, suggesting that ONDO may be primed for strong performance once the market stabilizes. Historically, increasing network adoption has been a bullish signal, often preceding price recoveries.

Despite the current market downturn, fundamentals remain strong. The project continues to expand, attracting institutional interest and reinforcing its role as a key player in the growing RWA sector.

With institutional finance embracing blockchain solutions and network activity on the rise, ONDO remains a strong contender for future growth. If market conditions turn favorable, the project could emerge as one of the top performers in the next bull cycle, driven by its continued innovation and expanding ecosystem.

Bulls Monitor Key Support

ONDO is currently trading at $0.83, having erased all gains from the post-election rally that began in November 2024. After months of steady growth, ONDO has been caught in the broader market downturn, facing selling pressure and uncertainty as investors reassess risk.

For bulls to regain control, ONDO must hold above the $0.75 support level to establish a strong foundation for recovery. Consolidation at these levels could help stabilize price action, but with the market still trending downward, this process may take longer than expected. If buyers fail to hold $0.75, ONDO could face further downside risks, extending its correction.

However, if ONDO holds above the $0.80 level, bulls must aim for a push toward $0.95, a key resistance level that could signal the start of a recovery phase. With new address growth surging, indicating increased network activity, ONDO could be well-positioned for a rebound once market sentiment improves. For now, traders are watching whether ONDO can defend its support levels or if continued weakness will send it lower in the short term.

Featured image from Dall-E, chart from TradingView

.png)

4 hours ago

2

4 hours ago

2

English (US)

English (US)