ARTICLE AD BOX

- BlackRock’s $56.41 billion crypto portfolio overwhelmingly favors Bitcoin and Ethereum, making up over 99% of its holdings.

- CEO Larry Fink’s focus on Bitcoin and Ethereum highlights limited institutional interest in altcoins, reflecting concentrated investor sentiment.

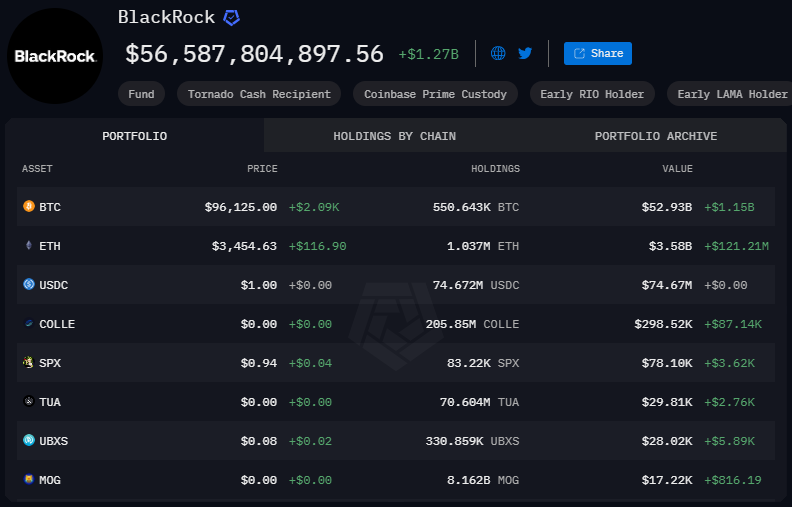

BlackRock, the world’s largest asset manager, has doubled down on its belief that only Bitcoin and Ethereum are worth the cryptocurrency gamble. As of January 2, 2024, the firm’s staggering $56.41 billion crypto portfolio is overwhelmingly dominated by those two assets, which account for over 99% of its holdings, according to Arkham Intel.

Source: ARKHAM INTELLIGENCE

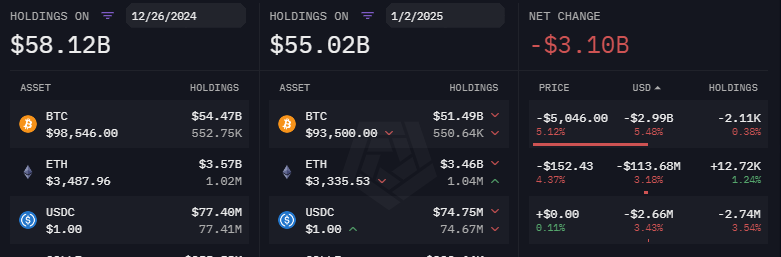

Source: ARKHAM INTELLIGENCELeading the charge, BlackRock holds 550,643 BTC, valued at $52.93 billion, with Bitcoin currently trading at $96,125. Ethereum follows with 1.037 million ETH, collectively worth $3.58 billion at $3,454 per token. Bitcoin recently saw a modest 2.79% rise, adding $1.53 billion to its value, while Ethereum posted a 2.59% gain, increasing by $89.61 million.

Notably, BlackRock’s CEO Larry Fink has characterized Ethereum as “not a currency but rather an asset,” reflecting the firm’s strategic focus. BlackRock now ranks as the 12th largest Ethereum holder globally, with 993,591 ETH, representing 0.12% of the asset’s total supply.

BlackRock’s Crypto Ambitions Could Surpass Gold

BlackRock’s journey into the cryptocurrency world hasn’t been straight. Initially skeptical, the firm launched its Bitcoin ETF after gaining SEC approval, a significant milestone spurred by Grayscale’s legal victory against the SEC. The ETF’s remarkable performance helped push Bitcoin’s price past $100,000 earlier this year, with assets under management surpassing $50 billion in just 11 months.

The ETF’s rapid growth sparked speculation that BlackRock’s crypto investments might one day eclipse gold ETFs. Nate Geraci, CEO of ETF Store, projected that the firm’s Bitcoin ETF could surpass SPDR Gold Shares, the leading gold ETF, by 2025, provided Bitcoin maintains its upward momentum.

BlackRock’s focus on Bitcoin and Ethereum mirrors investor sentiment, with Robert Mitchnick of the firm previously stating there is “very little interest” in other cryptocurrencies among their clients. That view underscores the limitations faced by altcoins in gaining institutional traction.

Alternative Tokens and Emerging Trends

Despite its heavy concentration in the top two cryptocurrencies, BlackRock’s portfolio includes exploratory holdings in stablecoins like USDC ($77.40 million) and lesser-known tokens such as COLLE, SPX, and MOG, though those make up a fraction of the total.

Source: ARKHAM INTELLIGENCE

Source: ARKHAM INTELLIGENCEMeanwhile, competitors like Franklin Templeton and VanEck have ventured into blockchain projects, including Solana, which Franklin Templeton regards as one of the most promising blockchain innovations. Similarly, WisdomTree and others have filed ETF applications for XRP, as CNF earlier reported.

While Solana and XRP gain traction, analysts like Eric Balchunas of Bloomberg believe futures-based ETFs could pave the way for spot ETFs, creating a broader path for altcoin adoption.

BlackRock’s Ethereum-focused ETF marked another turning point for the asset manager. Approved by the SEC earlier this year, the fund elevated Ethereum’s profile as a blockchain platform for decentralized applications and smart contracts, alongside its standing as an asset of institutional interest.

.png)

2 days ago

4

2 days ago

4

English (US)

English (US)