ARTICLE AD BOX

One important economic indicator that affects everyone—individuals, companies, and politicians alike—is inflation, especially in the housing sector. For a long time, traditional measures of inflation have been used, such as the Consumer Price Index (CPI) and the Personal Consumption Expenditure Price Index (PCE). But these approaches often fail to capture the subtleties of housing inflation. To address this difficulty, Truflation and Pennsylvania State University have initiated a ground-breaking research partnership to provide substitute measurements that offer a more all-encompassing comprehension of housing inflation in the US.

Understanding Shelter Inflation

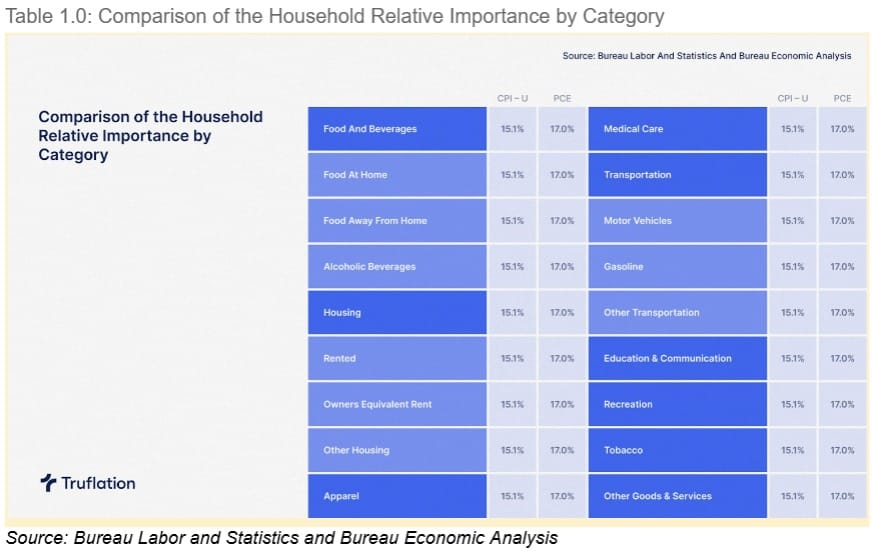

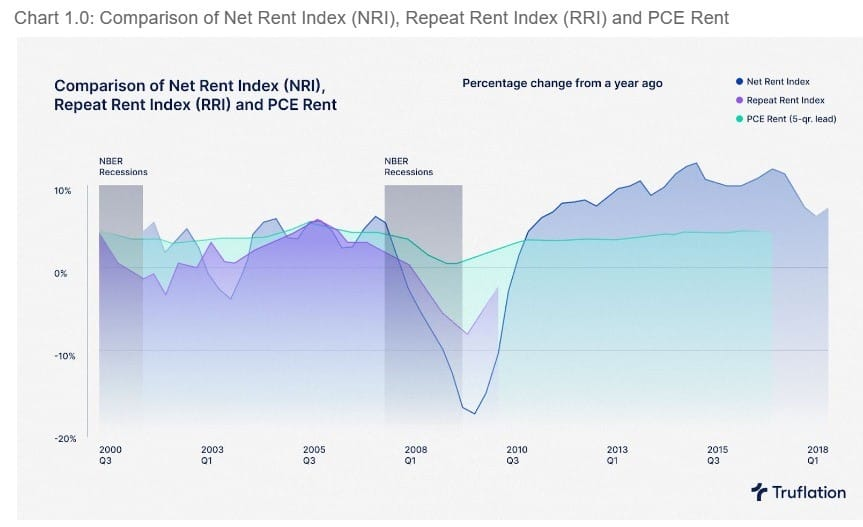

A large amount of household spending is attributed to shelter, which includes housing prices, and is reflected in the Consumer Price Index (CPI) and Personal Consumption Expenditure Price Index (PCE) indexes. In spite of this, the current techniques for calculating housing inflation have shown to be inconsistent and limited. Over the last several years, the CPI has consistently shown rising housing costs, whereas Truflation’s housing index has shown a slower rate of expansion. The discrepancy prompts inquiries on the precision of conventional measurements in representing the actual dynamics of housing inflation.

READ THE WHOLE REPORT (FREE) HERE

Proposed Substitute Metrics

The collaborative research presents two novel inflation indexes—the Truflation Index and the ACY Inflation Index, developed by Ambrose and Yoshida at Pennsylvania State University—in response to the drawbacks of conventional measures. These alternative metrics take into account a wider variety of elements, such as mortgage payments, property services, and household maintenance expenses, in an effort to produce a more accurate and nuanced representation of housing inflation. The alternative indexes provide a more comprehensive understanding of the inflationary pressures on the housing market by including these extra elements.

Data and Methodology

The approach used by Truflation to calculate housing inflation is based on in-depth statistical modeling and data analysis. Utilizing information from nationally reported expenditures, household budget allocations, and Truflation’s Personal Inflation Calculator, the researchers adjust their inflation indexes to take into account changing consumer spending trends and macroeconomic situations. Every year, the weighting of each component is revised to guarantee accuracy and relevance in tracking changes in housing inflation.

READ THE FULL REPORT HERE FOR FREE

Significance and Applications

For various stakeholders, an accurate assessment of the inflation in housing is essential. To ensure fair taxes and social support, federal authorities modify tax rates and entitlement programs based on inflation statistics, such as the CPI. Businesses utilize CPI data to guide pay negotiations, pricing tactics, and leasing agreements that include inflation-adjustment provisions. Inflation measures are used by financial analysts and economists to guide investment choices and policy recommendations by conducting trend analysis and economic forecasting.

The partnership between Truflation and Pennsylvania State University is a major advancement in the field of housing inflation assessment. Through the introduction of new metrics that tackle the shortcomings of conventional indices, the research provides significant understanding of the intricate dynamics of the housing market. Going forward, these substitute measures hold the potential to improve decision-making for people, companies, and legislators, resulting in a more knowledgeable and robust economy.

Click this link to see the full research report: https://subscribepage.io/GelN0g

.png)

4 months ago

1

4 months ago

1

English (US)

English (US)