ARTICLE AD BOX

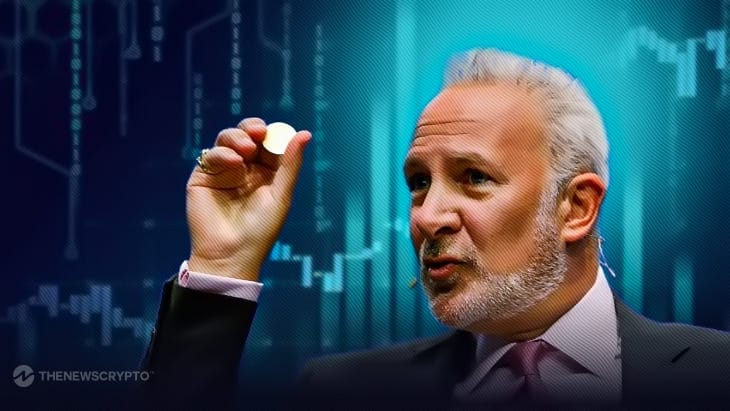

- Bitcoin naysayer Peter Schiff has forecasted a massive Bitcoin price collapse.

- His argument has been repeatedly disproven by the powerful undercurrent of Bitcoin bulls.

With global tensions on the rise and the Israel-Iran confrontation escalating once again, the price of Bitcoin is under heavy selling pressure and is falling below $62,000. The price of bitcoin has slightly rebounded since then and is now trading at roughly $64,058.

Notably, Bitcoin naysayer Peter Schiff has forecasted a massive Bitcoin price collapse, and Microstrategy, the biggest corporate Bitcoin holder in the world, is facing a mind-boggling $2.7 billion in losses. With the $60,000 mark serving as crucial support, Peter Schiff delivered a stern warning about the cryptocurrency’s price.

Possible Financial Effects for MicroStrategy

If Bitcoin breaks $60,000 for good, Schiff said, a strong triple-top structure might develop. A study he conducted indicated that a breach of this kind may set off a negative spiral, with a predicted downside goal of $20,000 as the endpoint.

Schiff highlighted not just the larger implications for Bitcoin but also the possible financial effects for MicroStrategy ($MSTR), a well-known corporation with substantial Bitcoin investments. Schiff predicts that MicroStrategy’s 214,000 Bitcoin assets, bought at an average price of $34,000, will incur an enormous unrealized loss of $2.7 billion in the event that Bitcoin drops below $20,000.

Schiff has already forecasted Bitcoin’s demise on several occasions; he is a gold bug. Nevertheless, his argument has been repeatedly disproven by the powerful undercurrent of Bitcoin bulls.

However, Michael Saylor, executive chairman of MicroStrategy, has maintained his composure despite the recent upheaval, and he has even gone so far as to say that Bitcoin benefits from instability.

When the Russia-Ukraine special military operation began in February 2022, Bitcoin and the wider cryptocurrency market encountered a comparable geopolitical scenario. The market, nevertheless, recovered even more strongly following the first volatility.

Highlighted Crypto News Today:

Custodia Bank CEO Criticizes Federal Reserve’s Innovation Limitations

.png)

8 months ago

3

8 months ago

3

English (US)

English (US)