ARTICLE AD BOX

- Pi Network (Pi) has been observed to be trading sideways as analysts predict a decline to $0.5 and a subsequent fall to $0.4.

- The asset has also broken its direct correlation with Bitcoin, moving in the opposite direction while the other holds strong.

Pi Network (Pi) has been struggling since reaching an all-time high price of $2.9. Our market data shows that Pi has currently declined by 6% in the last 24 hours, extending its weekly and monthly losses to 8% and 24%.

From its current price of $0.578, Pi’s overall Return on Investment (ROI) seems to have declined by 33%. However, trading activities keep improving as the daily trading volume records an impressive surge of 44% to $107 million. This has earned it a spot in our top crypto picks for the week, as highlighted in our earlier news brief.

Pi Technical Analysis

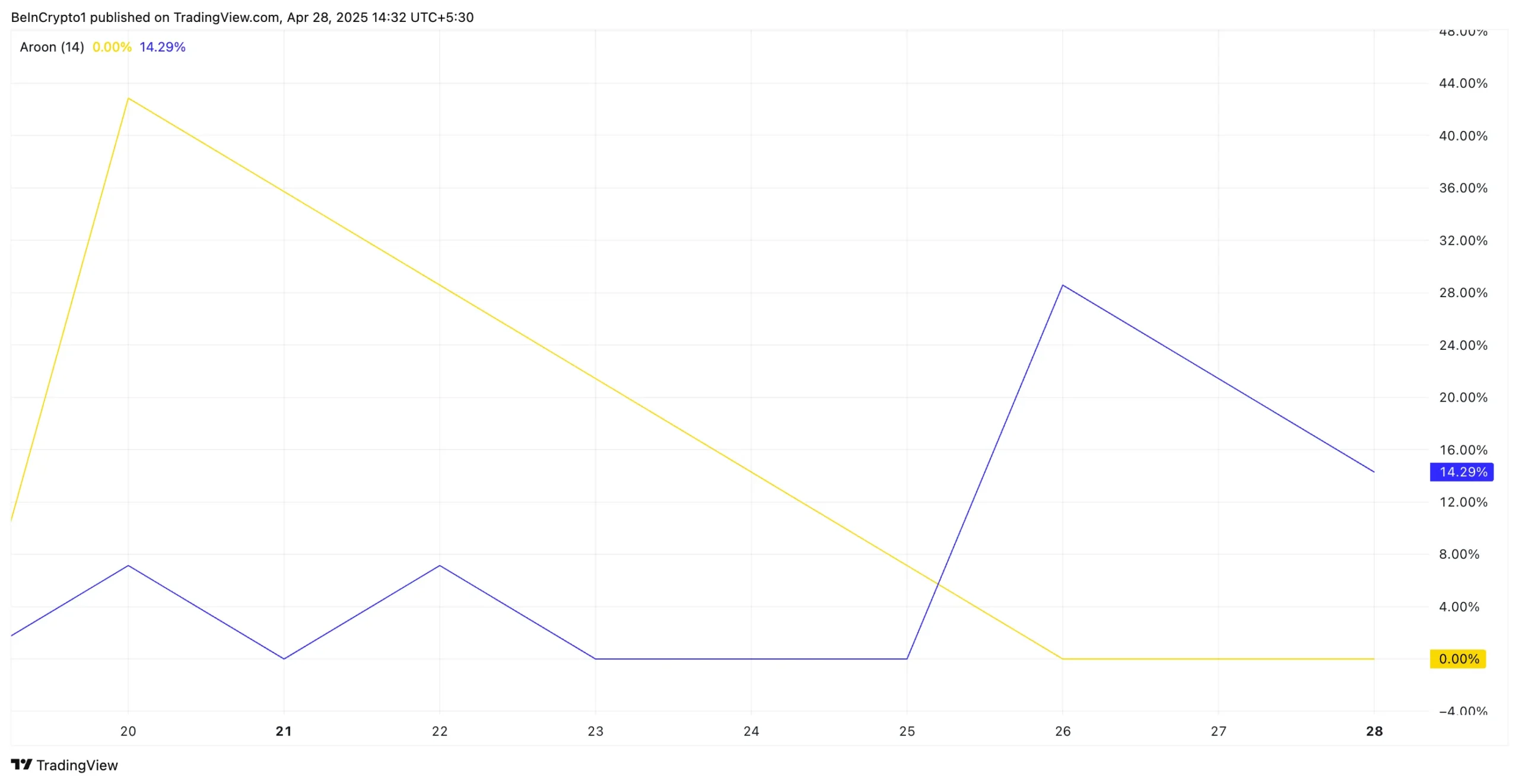

Looking at some key technical indicators, we found that the Pi price has been in stagnation for some time, with its Aroon indicator confirming this. As indicated in the chart below, Pi’s Aroon Up Line, which is yellow, is currently trending around 0%, while Aaroon Down Line, which is blue, has fallen to 14.29%.

Source: TradingView

Source: TradingViewAccording to analysts’ interpretation, the 0% shows that the asset is yet to reach a new high, while the 14.29% also shows that Pi has not recorded any serious downturn recently. Meanwhile, the Average True Range (ATR) discloses that there has been a decrease in market volatility with a shift towards consolidation.

Commenting on its price performance, the COO at Bitget Wallet, Alvin Kan, highlighted that Pi’s previous surge was triggered by anticipation. However, the recent supply of the token and the transition to a long-term project have significantly subdued the price.

Pi Network’s initial surge was largely driven by anticipation and years of community mining, but the follow-through has been more muted. As early users began realizing gains, increased token supply met limited exchange listings and a still-developing ecosystem. Without strong utility or broader liquidity, investor demand naturally tapered off. Like many new tokens, Pi is now facing the challenge of transitioning from early hype to long-term value delivery.

Above this, one thing that has come to our notice is the inverse relationship between Pi and Bitcoin. With a correlation of -0.11, the asset has consistently moved in the opposite direction whenever the price of Bitcoin surges.

Source: TradingView

Source: TradingViewCurrently, $0.5192 has been said to be its next crucial support level. Breaking below this point could see Pi falling to $0.4.

Speaking on the overall growth, Kan disclosed that the mobile mining and referral method helped it in its initial stage to amass a huge user base. However, this certainly creates a pocket of scepticism around its sustainability.

While the project clarifies that it doesn’t follow a multi-level structure, concerns persist over the perceived lack of transparency and real-world use cases. To move past the debate, the focus will need to shift toward building credible utility and expanding access. If that happens, sentiment could recover—but trust takes time.

As recently discussed in our blog post, Pi could stage a bullish reversal to $3 as rumours of a Binance listing intensify. Fascinatingly, the project has also made good progress in terms of compliance, setting it up for groundbreaking developments, as also indicated in our previous article.

.png)

4 hours ago

1

4 hours ago

1

English (US)

English (US)