ARTICLE AD BOX

- Polkadot faces challenges with low risk-adjusted returns, evident from its negative Sharpe Ratio, deterring investor interest.

- Decreasing participation in the futures market indicates waning investor confidence and potential further price drops.

- Polkadot risks further decline if it doesn’t stabilize or improve its market appeal, with a critical support at $6.3.

Polkadot (DOT) has found itself grappling with a significant challenge – attracting and retaining investor interest. As the digital asset seeks to recover from recent price declines, the lack of attractive risk-adjusted returns and dwindling participation in the futures market have emerged as formidable obstacles.

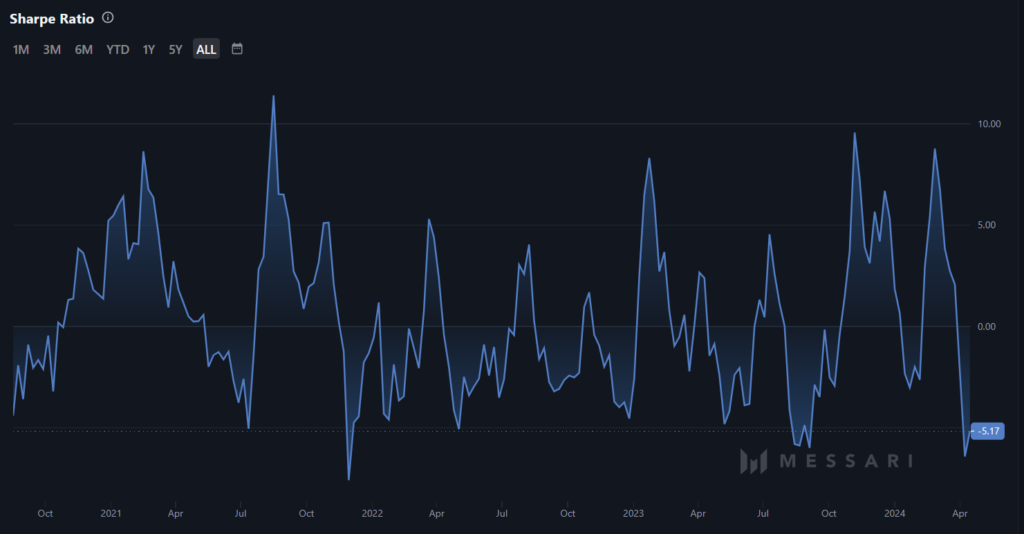

One of the key indicators highlighting Polkadot’s struggle to attract investors is the Sharpe Ratio, a metric that measures the risk-adjusted return of an investment or portfolio.

Currently, Polkadot’s Sharpe Ratio stands at a concerning -5.17, indicating a lack of solid risk-adjusted returns. This negative figure serves as a deterrent for potential investors, who often seek investments with favorable risk-return profiles.

The Sharpe Ratio’s seven-month low underscores the challenges Polkadot faces in its quest for price recovery. A negative Sharpe Ratio suggests that the asset’s performance has been unsatisfactory when compared to the risks involved, making it less appealing to investors seeking efficient investment strategies.

What’s next for Polkadot?

Beyond attracting new investors, retaining the interest of current DOT holders is equally crucial for Polkadot’s recovery prospects. However, data suggests that the project is also losing ground on this front, with traders pulling their money out of the futures market. This exodus of capital from the futures market signals a potential decline in investor confidence and a heightened risk of further price erosion.

The combination of an unattractive risk-adjusted return profile and dwindling interest in the futures market has created a formidable barrier for Polkadot’s price recovery. Currently trading at $6.6, the digital asset has already undergone a significant correction after invalidating a falling wedge pattern, leaving it vulnerable to additional downside pressure.

Market analysts warn that if the critical support level of $6.3 is breached, Polkadot’s price could plummet further, potentially reaching $5.7 – a four-month low that could establish a new market bottom for 2024. However, given the established support at $6.3, a bounce-back from this level is also a possibility, potentially propelling DOT beyond the $7.00 mark and reigniting the bullish momentum.

As Polkadot navigates these challenging market conditions, the project’s ability to regain investor confidence and attract fresh capital will be crucial in determining its future trajectory.

Polkadot, whether by enhancing risk-adjusted returns or reinvigorating interest in the futures market, confronts a formidable challenge in reestablishing itself as a compelling investment opportunity amidst the fiercely competitive cryptocurrency landscape.

.png)

8 months ago

2

8 months ago

2

English (US)

English (US)