ARTICLE AD BOX

Renzo, one of the key players in the liquid staking space, has announced a $17 million raise in a two-series fundraiser.

The collection comes as it looks to expand its reach in the growing restaking arena even as it runs atop Ethereum’s EigenLayer.

Renzo Raises $17 Million from Galaxy and Digital Nova

Renzo has successfully raised $17 million through a two-series fundraiser. The first round was led by Galaxy Ventures, while Brevan Howard Digital Nova Fund spearheaded the second. These funds will be allocated towards expanding Renzo’s restaking services, which will now include the integration of ERC-20 tokens into its protocol.

The project’s whitepaper describes Renzo as a “liquid derivative platform” built on top of the EigenLayer protocol. Specifically, it acts as an interface to the EigenLayer, effectively securing AVSs while offering a higher yield than Ethereum.

“For every liquid staking token or ETH deposited on Renzo, it mints an equivalent amount of Renzo’s liquid restaking token, ezETH, in return,” reads an excerpt in the whitepaper.

Read More: Ethereum Restaking: What Is It And How Does It Work?

As noted above, the $17 million raise will help Renzo integrate ERC-20 tokens into its protocol, a new trend in restaking. EigenLayer recently shared plans to start accepting its native EIGEN token, an ERC-20, toward securing its own AVS, EigenDA.

“Soon be able to deposit your EIGEN tokens onto EigenLayer! If you have already restaked ETH and delegated to an EigenDA operator, staking your EIGEN on the web app automatically delegates to the same operator,” blockchain infrastructure provider Luganodes reported.

Notably, native ETH restaking is the brainchild of the EigenLayer and now expands into other assets, including EIGEN, to secure EigenDA. ERC-20s entering the restaking arena set the stage for other liquid restaking tokens to join alongside ezETH.

Restaking Battleground is Shaping Up

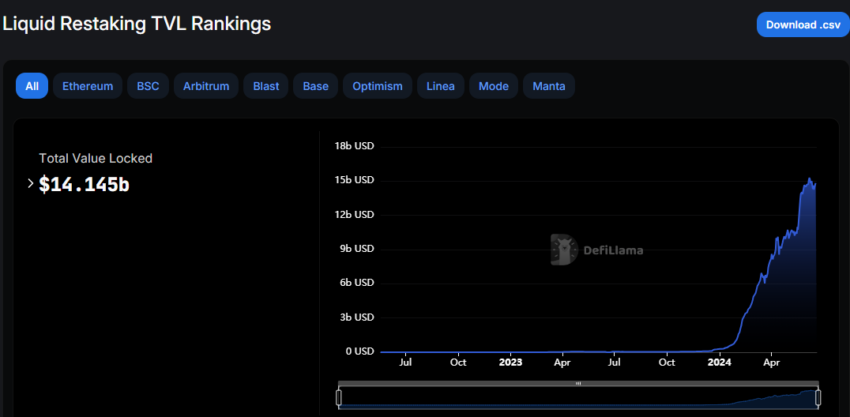

According to DefiLlama data, the liquid restaking space has a total value locked (TVL) of $14.145 billion. Growth intensified in 2024, with the TVL metric measuring the overall activity and popularity of a DeFi project.

Renzo is the second largest liquid restaking protocol, with a TVL of $3.614 billion, only second to Ether.fi with $6.1 billion. The data shows that Renzo’s TVL is up 13% in a month.

Read more: 9 Best Places To Stake Ethereum in 2024

Liquid Restaking TVL, Source: DefiLlama

Liquid Restaking TVL, Source: DefiLlamaWith Renzo’s plans to expand its services atop the EigenLayer, restaking battlegrounds are forming. Recently, sector competitor Symbiotic debuted with $5.8 million in seed funding from Paradigm and Cyber Fund.

The protocol aims to provide flexible, permissionless restaking options, and its debut marked a significant challenge for EigenLayer. EigenLayer only accepts ETH, EIGEN, and a few ETH derivatives. In contrast, Symbiotic accepts any crypto asset based on Ethereum’s ERC-20 token standard. Symbiotic is backed by Lido DAO supporter Paradigm, adding to its competitive edge.

Now, with Renzo’s recent funding, the EigenLayer protocol could gain the fortification needed to withstand the intense competition.

The post Renzo Secures $17 Million Investment, Restaking Battle Heats Up appeared first on BeInCrypto.

.png)

4 months ago

9

4 months ago

9

English (US)

English (US)