ARTICLE AD BOX

Retail investors are showing remarkable confidence by buying the dip despite a significant sell-off by a prominent crypto whale. The recent transactions have stirred up the Bitcoin and crypto markets, particularly influencing the market’s short-term trajectory.

Early Thursday in Asian trading hours, Bitcoin’s price plummeted to $57,800, marking a two-month low. Despite this drop, the price recovered up to $59,000 by the time of writing.

Crypto Whale Sold $323 Million Worth of Bitcoin

Amidst the Bitcoin volatility, a crypto whale wallet, 3G98j, deposited an eye-watering 1,800 BTC, valued at $106.08 million, into Binance. Typically, such large deposits to a crypto exchange suggest a potential sale. In the past week alone, this crypto whale has transferred a total of 5,281 BTC—worth around $323 million at an average price of $61,196—to the same platform.

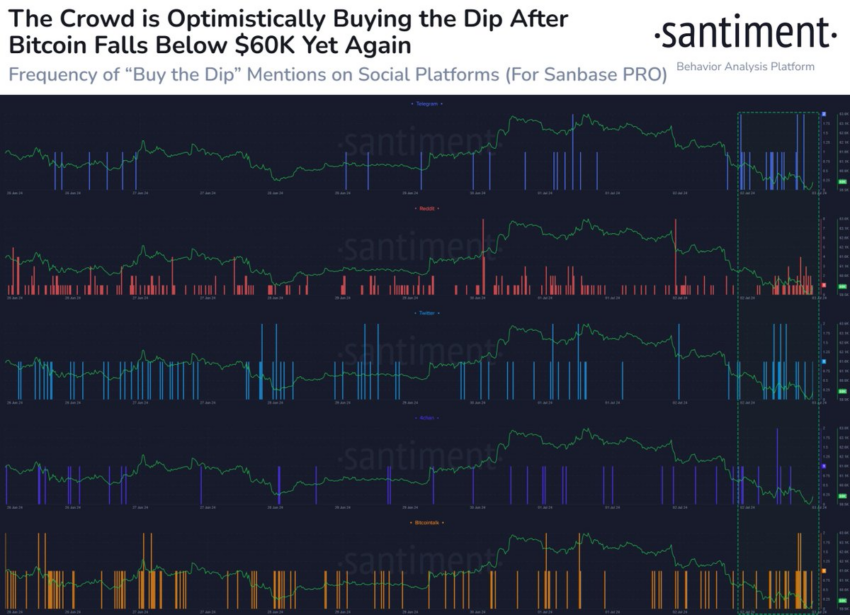

Despite these considerable sell-offs, the reaction from retail investors has been notably bullish. According to data from Santiment, a behavior analytics platform, the retail sector is aggressively purchasing Bitcoin under the $60,000 mark.

“The crowd is showing signs of seeing this as a buy-the-dip opportunity. Ideally, we wait for their enthusiasm to settle down. The time to buy is when they are impatient and skeptical,” Santiment explained.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Frequency of “Buy the Dip” Mentions on Social Platforms. Source: Santiment

Frequency of “Buy the Dip” Mentions on Social Platforms. Source: SantimentCold Blooded Shiller, a pseudonymous crypto analyst on X (formerly Twitter), echoes this sentiment. He provided a nuanced take on the current market conditions, noting novice traders’ challenges.

“Conditions remain significantly weighted on the downside, and the momentum is all there. Adapting to the side with the momentum is incredibly important, but that doesn’t make it a necessity to trade,” he advised.

Furthermore, Cold Blooded Shiller elaborated on the risks and strategies in current market conditions. He emphasized the need for patience and strategic disengagement, suggesting that many’s best course of action might be to avoid active trading.

“For many of you, sitting on the sidelines and doing other things is the biggest alpha I can bestow upon you,” Cold Blooded Shiller stated.

Moreover, he highlighted the psychological aspect of trading under such volatile conditions. He advised retail traders to let things settle down and reduce their emotions when timing the market, reinforcing the need for strategic patience until the market shows signs of a positive momentum shift.

Read more: Cryptocurrency Trading Courses Tailored for Beginners

The contrast between the crypto whale’s actions and retail investors’ enthusiasm paints a complex picture of the Bitcoin market. While large holders appear to be cashing out, the broader investor base remains optimistic, seeing the lower prices as an attractive entry point.

The post Retail Investors Buy the Dip While Crypto Whale Sells $323 Million in Bitcoin (BTC) appeared first on BeInCrypto.

.png)

4 months ago

1

4 months ago

1

English (US)

English (US)