ARTICLE AD BOX

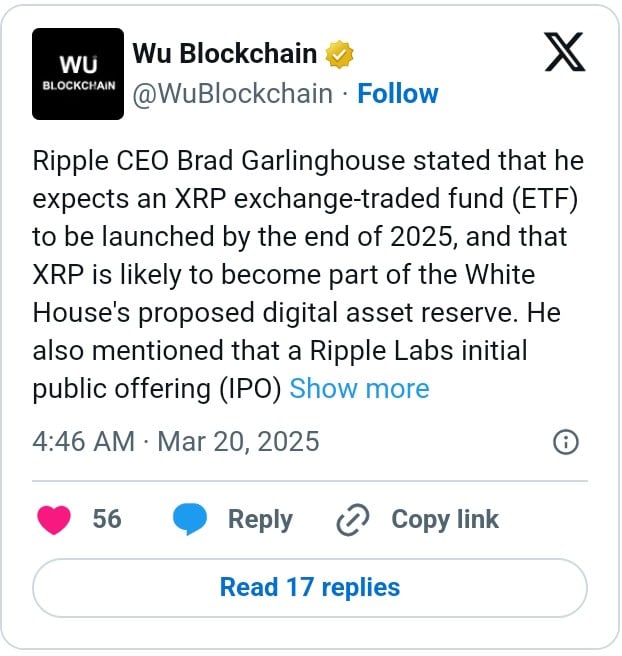

- Following reports that the US Securities and Exchange Commission (SEC) has walked away from its lawsuit against Ripple Labs, Brad Garlinghouse has hinted that XRP ETF could be launched before the end of the year.

- Garlinghouse also confirmed a possible launch of an Initial Public Offering (IPO); however, he clarified that this is not a high priority.

Ripple CEO Brad Garlinghouse has hinted that the spot XRP Exchange Traded Fund (ETF) applications could be approved and officially launched before the end of 2025.

Speaking in an interview with Bloomberg, Garlinghouse confirmed the tall list of applications pending with the US Securities and Exchange Commission (SEC). Fascinatingly, his comment did not end with the ETF as he also disclosed the possibility of the company launching an Initial Public Offering (IPO).

I have immense confidence in the ETFs. Something is possible; it isn’t a huge priority.

Meanwhile, the Ripple boss had clarified in a 2024 interview with Thinking Crypto podcast host Tony Edward, that “an IPO has not been a high priority for the company.” According to him, most companies who pursue IPO do so to raise capital. However, finance is not an issue with Ripple, considering its current position.

In that discussion, the Ripple boss explained that the company has, over the years, invested in various projects while making key acquisitions. Additionally, he cited its multi-year legal battle with the SEC as another reason it could not pursue an IPO yet.

We have a hostile SEC and regulatory environment in the U.S. Second, we don’t need to raise capital, so the idea of going public has been on the back burner.

Prior to that, Wall Street expert Linda P. Jones had hinted that Ripple’s IPO could be launched around June 2024, as indicated in our previous discussion. However, this prediction “failed to see the light of the day.”

Reviewing his most recent discussion with Bloomberg’s Sonali Basak, Garlinghouse excitedly confirmed that US President Donald Trump had issued an order to establish a crypto stockpile that would include assets like XRP. As outlined in our recent blog post, MicroStrategy’s Michael Saylor believes that this could be a bullish catalyst for the asset.

SEC Drops Ripple Lawsuit, XRP Reacts

Amidst the expected launch of XRP ETF, the US Securities and Exchange Commission (SEC) has officially dropped its lawsuit against Ripple. As featured in our recent coverage, Garlinghouse confirmed the decision at the Digital Assets Summit in New York on Wednesday, claiming that this has been a painful journey. According to him, Ripple would be on the right side of the law and the right side of history.

Reacting to this exciting development, XRP broke out above a crucial resistance level to hit $2.52 after recording 7% gains on the daily price chart. At the time of writing, XRP had marginally declined to $2.4; however, its daily trading volume had increased by a staggering 243% as $10.3 billion changed hands.

Subjecting the asset to further technical analysis, a renowned market expert called Dark Defender pointed out that the sudden strong green candlestick confirms a breakout and a significant increase in buying pressure. Per his analysis, the price is geared toward the $3.40 and $3.78 levels before targeting the $5 price point.

.png)

15 hours ago

1

15 hours ago

1

English (US)

English (US)